Research Highlights

- The SPY has been trading below its previous peak resistance level from March for more than two weeks and has begun to retest this level.

- If the SPY can clear this level on moderately strong volume, we believe the U.S. stock market may enter another “melt-up” phase.

- If not, then we may see more of a sideways/melt-down phase headed into the U.S. Presidential Elections.

The SPDR S&P 500 (NYSE:SPY) ETF has been trading below $339.50, the previous peak resistance level, for more than two weeks and has begun to retest this level. I believe these levels are critical in determining the future trending capacity of the SPY and the U.S. stock market. If the SPY can clear this level on moderately strong volume, we believe the U.S. stock market may enter another “melt-up” phase. If not, then we may see more of a sideways/melt-down phase headed into the Presidential Elections.

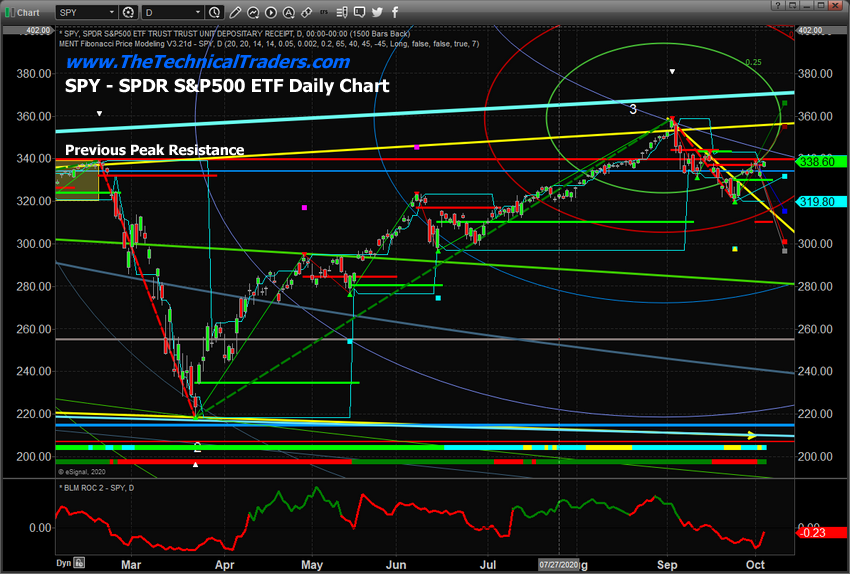

SPY Price Resistance At $339.50

This daily SPY chart below highlights our Adaptive Fibonacci Price Modeling system and shows the previous peak resistance level as a SOLID RED LINE. We believe the current setup suggests this resistance level may act as a solid ceiling in price over the next few weeks. If price can break through this resistance level for a few trading sessions, then we will likely see it continue marching up (until the next news bomb hits).

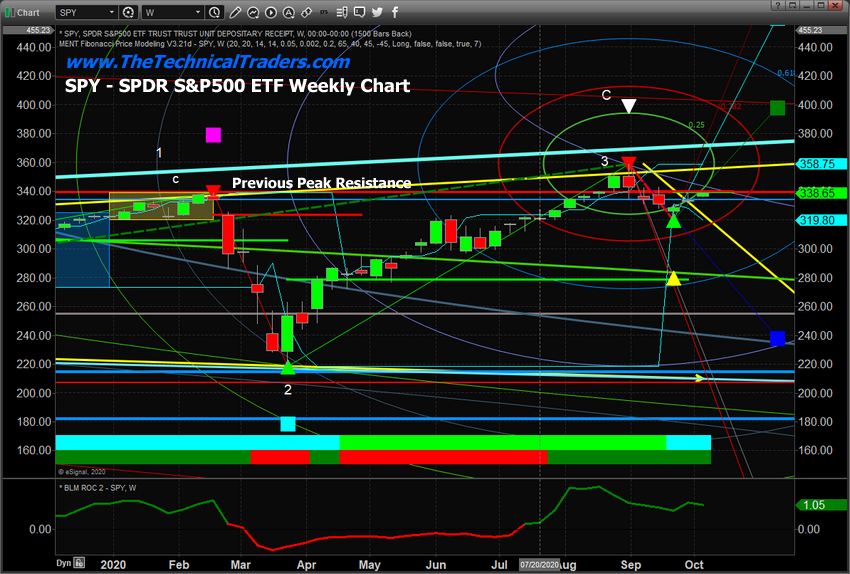

Below, we look at the weekly SPY chart to see the bigger picture with a longer-term chart. We can easily spot the resistance near the $339.50 previous peak level and how the current price is retesting this critical price level. We believe the markets are simply waffling sideways before the U.S. Presidential Eections.

Watch for the $339.50 level to be accepted or rejected.Traders should stay very cautious and look for sectors that present greater opportunities and defined trends. The major indexes are going to continue to trade in a sideways pattern as Washington and the Senate are stuck in paralysis before the elections. There are still opportunities to profit from some of these moves, just be cautious of the volatility at play in the markets.