“Your success in investing will depend, in part, on your character and guts, and in part on your ability to realize at the height of ebullience and the depth of despair alike, that this too shall pass.” – John Bogle

We saw markets begin to give up Monday’s oversold gains early before the selling accelerated very quickly in the afternoon.

Several stocks hit buy points but then failed, as has been the norm this summer so cash remains a great place to be.

Why put money at risk when it is too dangerous to do so.

Enjoy the summer and wait for clearer markets.

That said, more weakness looks due but perhaps not for a few more days.

Gold and Silver diverged this afternoon as gold moved higher on market weakness but silver continued lower.

I’ve told subscribers that silver seemed to be taking the lead lately so I’m not expecting this gold strength to continue.

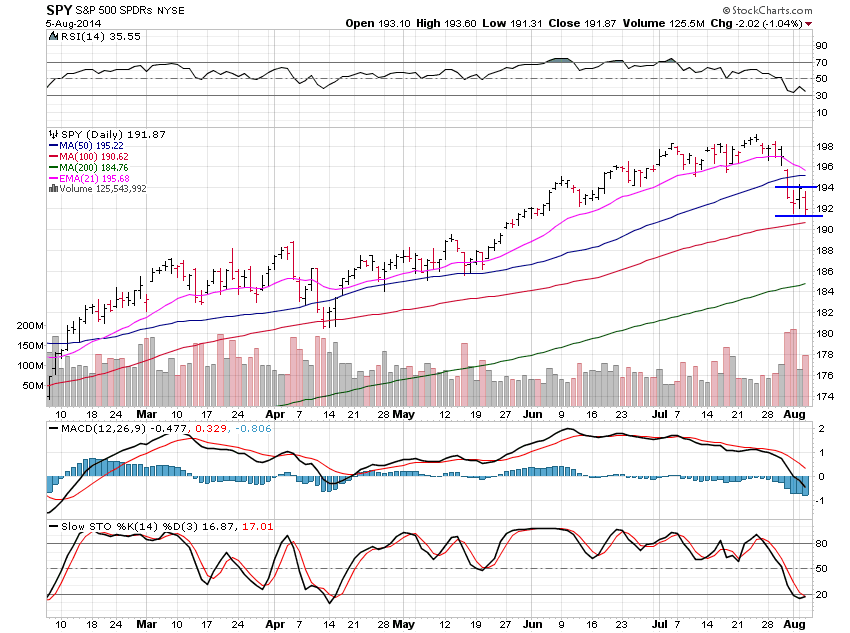

SPDR S&P 500 (ARCA:SPY) is still building a bear flag and needs a few more days from what I see before we can see more release to the downside.

Tuesday’s weakness was strong and swift but a few more days of chop between $191.50 and $194 or so would be best.

The next move lower should take us to 188.

I did get short today using some SPY puts but I was making a smoothy and missed the initial swift move in the first minute so I ended up taking a small loss on the trade.