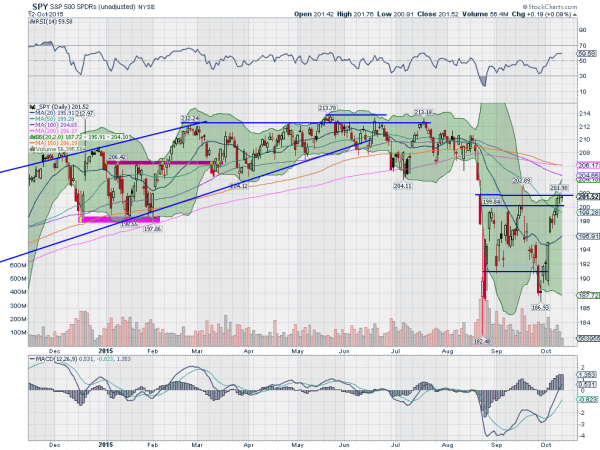

The SPDR S&P 500 (N:SPY) moved above 200 last week and the world breathed a collective sigh of relief. It was a well deserved sigh of relief, no doubt. The SPY had managed one close above that level since August 20th and that lasted just a few hours.

It has been above 200 for 3 days in a row, consolidating the move higher off of the double bottom. This has been a strong move, adding 7.5% to the SPY. And it looks promising for more upside in the near term. But one thing is nagging about it. The failure to close over the open from August 21st.

The second of 3 red candles lower started the day at 201.73 before closing the gap above and then falling hard to close at the low. On the chart above it looked like a lone bump above the consolidation range until the move higher last Thursday. Now it looks like resistance. The last resistance before the SPY can get back in the long sideways consolidation range that lasted from February until the August plunge.

Get excited about the prospects. The momentum is bullish and the Bollinger Bands® giving room to the upside. But lets get that next hurdle, over 201.75 to be able to push higher to the 204.40 to 212.60 range.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.