On 2/5, the SPX made a low at 1737.92, and 22 trading days later, on 3/7, the SPX made a high of 1883.57. That is a jaw-dropping gain of 8.4%.

The SPX closed lower for the second day in a row as it pulled back from a new high made during last Friday’s jobs report. While the S&P closed down only -0.50%, growth in China and the Russian annexation of Crimea remained front and center on traders’ minds.

What Happened

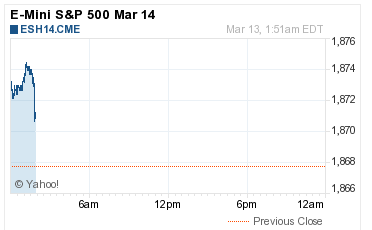

After the S&P opened modestly lower, the index arbitrage sell programs helped push the future down to a 9:10 AM (CT) low at 1871.50. The premium level between the ESH14 and the S&P cash was constantly trading -1.00 under fair value. This helped set up several decent-sized sell programs, but as soon as the lows were made the futures traded up to 1882.25, the day’s high. After that, it got hit by several late-day sell programs that pushed the futures back down, making several new lows right into the 3:00 and 3:15 closes.

S&P from -5.8% to +1.6%

The S&P has gone a long way from its Feb. 3 low for the year. The S&P had fallen 5.8% in late January to that low in early February, but since then it has rallied a full 7.4% in 22 trading days. So far the S&P is up 0.4% in March.

Trade less, trade better

Despite the overall uptrend of the past few weeks, the intraday price action has been anything but predictable. As we saw yesterday, not only is investor sentiment mixed, but the buy and sell programs add momentum and exaggerate what might have been smaller rallies and dips a decade ago. How do you trade consistently in such an environment? Fewer trades, letting the market tell you clearly what it’s doing before you jump in.

Warren Buffett likes to tell MBA students if they had a punch card, with 20 investments total they could make in a lifetime, they’d choose those investments so carefully that they would end up richer and probably have a few holes left unpunched. It’s a good time to choose your trades carefully and let someone else get chopped up.

The Asian major markets closed modestly lower (Nikkei -2.59%) and in Europe 11 out of 12 markets are trading modestly lower. Today’s economic calendar has the MBA purchase applications, quarterly services survey, EIA petroleum status report, 10-year note auction and Treasury budget. The S&P started showing some wear and tear last Friday and has not tested 1885 again since that brief high after the positive jobs report.

Our view

The S&P is overbought and overextended and facing a wave of bad economic news out of China and the Ukraine. No one really knows what Putin and the Russians will do next. At 6:00 the total range in Globex is only 7 handles from 1866.50 down to 1859 on big volume of 175,000 contracts. That’s a lot for overnight.

As we’ve pointed out before, a lot of the selling happens in Globex before the market opens. That is a recent pattern we have seen too many times to ignore.

Yesterday we said sell the early rally and buy weakness, which was right, but after the S&P sold off after making the highs it kind of set the tone for the overnight session and what we are seeing this morning. Is there more room on the downside? Sure, but we don’t think this is going to last, nor do we think this is the beginning of a prolonged selloff.

If the S&P gaps sharply lower, we lean to buying it and then selling the rallies. We said in Monday’s report that Friday’s weakness could last all the way into the Pit Bull’s Thursday/Friday low the week before the March expiration, and according to the S&P cash study it looks like it should be an up expiration.

- In Asia, 10 of 11 markets closed lower: Shanghai Comp. -0.17%, Hang Seng -1.65%, Nikkei -2.59 %

- In Europe 11 of 12 markets are trading lower: DAX -1.47%, FTSE -1.07%

- Morning headline: “S&P 500 futures plagued by Ukraine and China”

- Total volume: 1.6Mil ESH14 and 14k SPH14 contracts traded

- S&P fair value: 1866.88 (futures 5.63 lower at 1861.25 as of 6:54 AM CT)

- Economic calendar: MBA purchase applications, quarterly services survey, EIA petroleum status report, 10-year note auction and Treasury budget.

- E-mini S&P 5001870.50+2.75 - +0.15%

- Crude98.55-0.22 - -0.22%

- Shanghai Composite0.00N/A - N/A

- Hang Seng21951.881+49.932 - +0.23%

- Nikkei 22514879.74+49.351 - +0.33%

- DAX9188.69-119.10 - -1.28%

- FTSE 1006620.90-64.62 - -0.97%

- Euro1.3939