Falling stock markets on Wednesday set the tone for the Canadian dollar, which suffered its third straight day in negative territory and below 74.5 cents. This trend could continue if comments from U.S. Federal Reserve (Fed) members are to be believed. In the minutes of the most recent Fed meeting, it was mentioned that current stock market levels were bordering on overvalued. The committee also discussed strategies to reduce the size of the central bank’s balance sheet, estimated at $4.5 trillion, and the impact it could have on the bond market. An unregimented liquidation of the portfolio, accumulated since the recession of 2008, could drive up long-term interest rates.

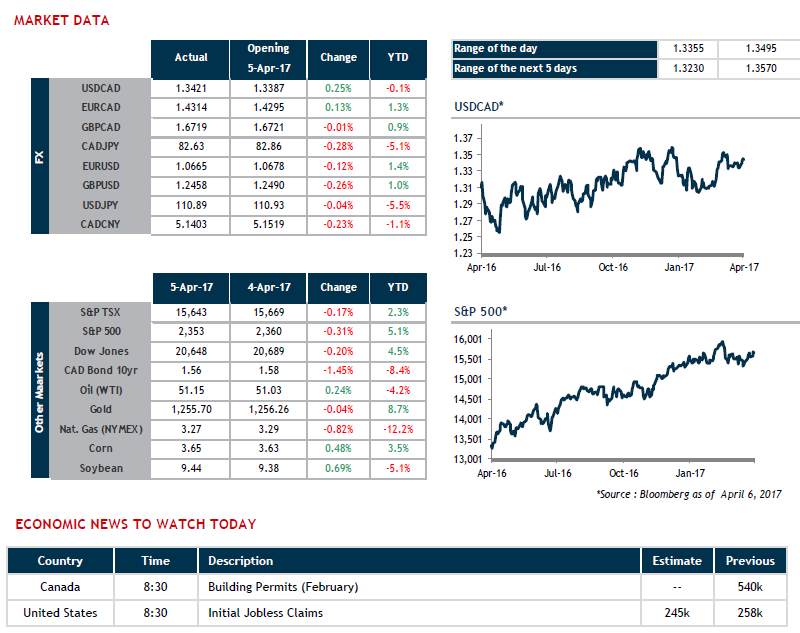

While we await tomorrow’s jobs data, the economic calendar is relatively sparse today, although we will be keeping an eye on February Building Permits, indicating the trend in the Canadian real estate market. The tweets will no doubt come fast and furious later on as the summit between Donald Trump and Xi Jinping gets underway today in Palm Beach, Florida.