- Dollar slips further ahead of crucial US jobs report

- Pound marginally higher as Labour crush the Tories in UK election

- Equities set to end week on a high note, Bitcoin keeps slumping

Stakes are high as markets brace for soft NFP

After a bit of a wobble last week, stock markets around the world are back in bullish mode following the weak ISM surveys for both manufacturing and services that bolstered expectations that the Federal Reserve will start cutting rates in September.

A strong US economy has been a major factor in preventing the Fed from making pre-emptive rate cuts despite some progress lately with inflation resuming its decline. But a weaker economic backdrop would make policymakers more confident that inflationary pressures would not flare up again if they lower interest rates.

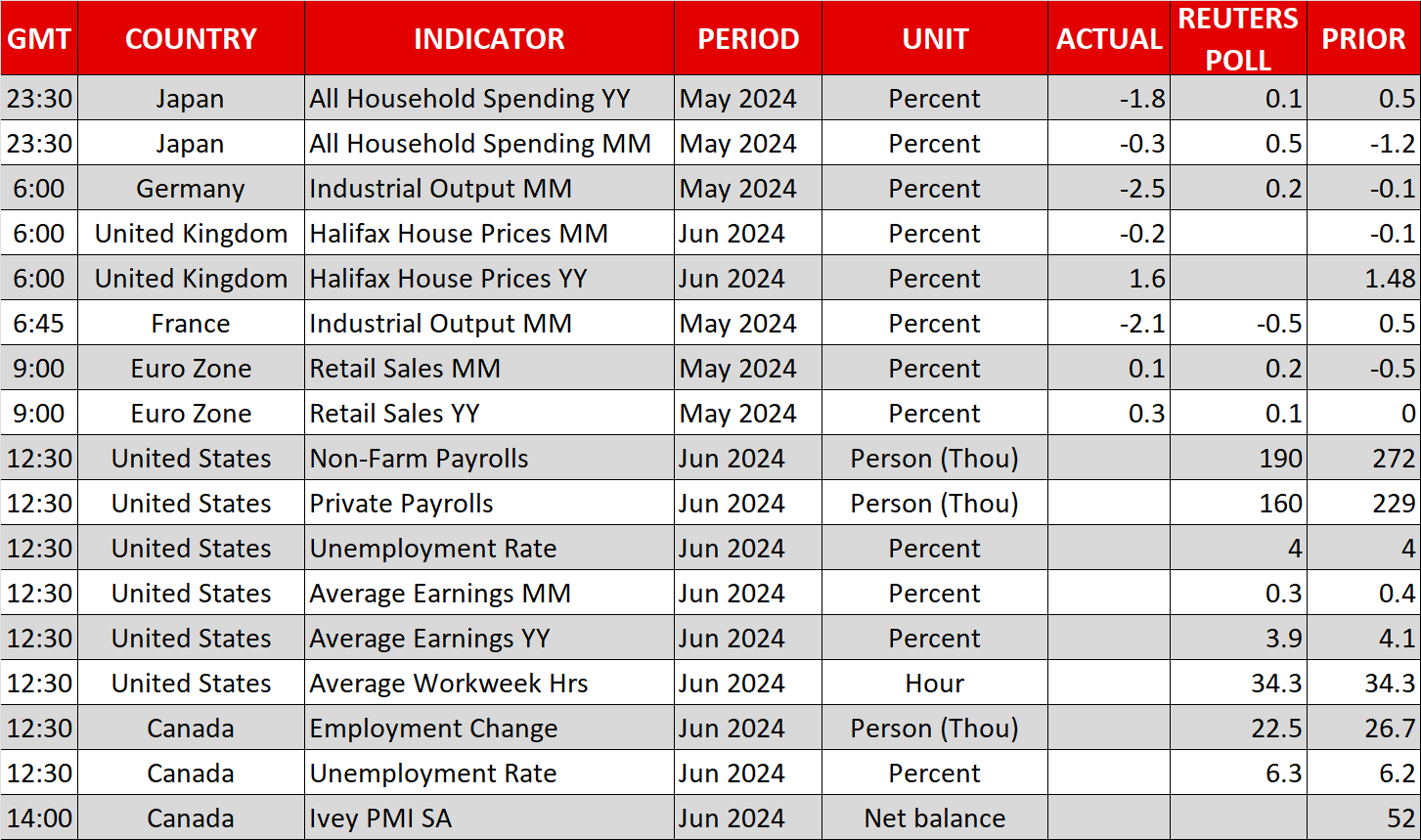

More specifically, it is the still-tight labour market that’s kept the Fed nervous about cutting rates too soon as it’s encouraged consumers to continue spending. But some signs are emerging of a cooldown in the jobs market as the unemployment rate ticked up to 4.0% in May despite the beat in the headline payrolls print. Nonfarm payrolls are expected to have risen by 190k in June versus 272k in the prior month.

As long as the actual figure does not exceed 200k and there’s no positive surprises in the jobless rate or average earnings either, markets would likely cheer the data.

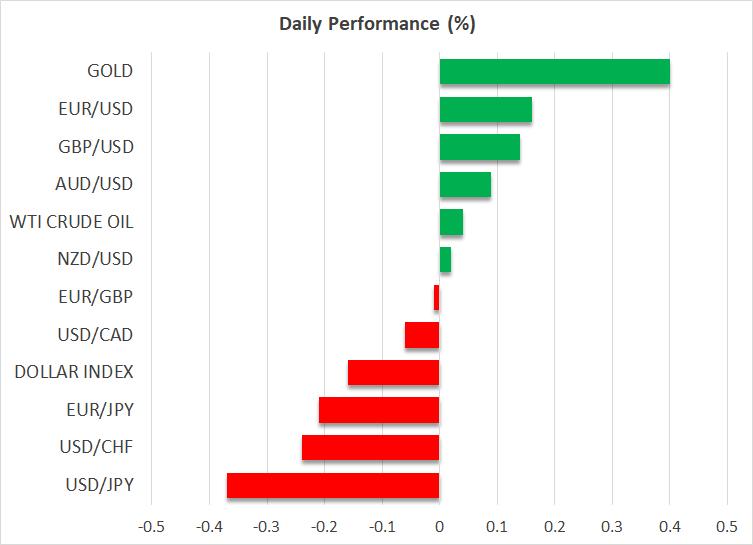

Dollar Nosedives

Nevertheless, with the US dollar trading at three-week lows against a basket of currencies, there is a risk that investors have positioned themselves not to be disappointed by today’s jobs numbers. A shock hot report could easily roil markets just as traders started to feel more hopeful of two Fed rate cuts this year, assigning an 80% probability of the first arriving in September.

Treasury yields have also pulled back, although the downside is limited given the concerns about even bigger budget deficits should Donald Trump win November’s presidential election.

Pound Holds Firm as Labour Win by a Landslide

Talking of elections, there were no surprises in the UK’s general election, with Labour winning a strong majority of over 160 seats, and Rishi Sunak’s Conservative party losing more than 250 seats in parliament.

There was little reaction in the pound, however, as the opinion polls proved accurate so a Labour government has already been fully priced in by the markets. Cable is headed for weekly gains of more than 1% and the euro is enjoying a similarly positive week.

France also goes to the polls on Sunday for the second round of legislative elections. With centrist and left-wing parties agreeing to withdraw their candidates in constituencies where there is a three-way runoff with the National Rally, there’s been relief at the diminished prospect of a far-right government.

Stocks Set for Strong Weekly Gains, Bitcoin Can’t Join in the Fun

The reduced political risks combined with expectations of an imminent dovish pivot by the Fed have lifted equity markets in Europe and America.

US futures point to slight gains when trading resumes today after the July 4th holiday and major European indices are up too.

Gold has also been edging higher this week on the back of the dollar sell-off, but there’s been no let-up in Bitcoin’s slide. Liquidation fears are driving the panic selling, while worries that a Trump presidency would be less crypto-friendly than the Biden administration are also weighing on crypto markets.