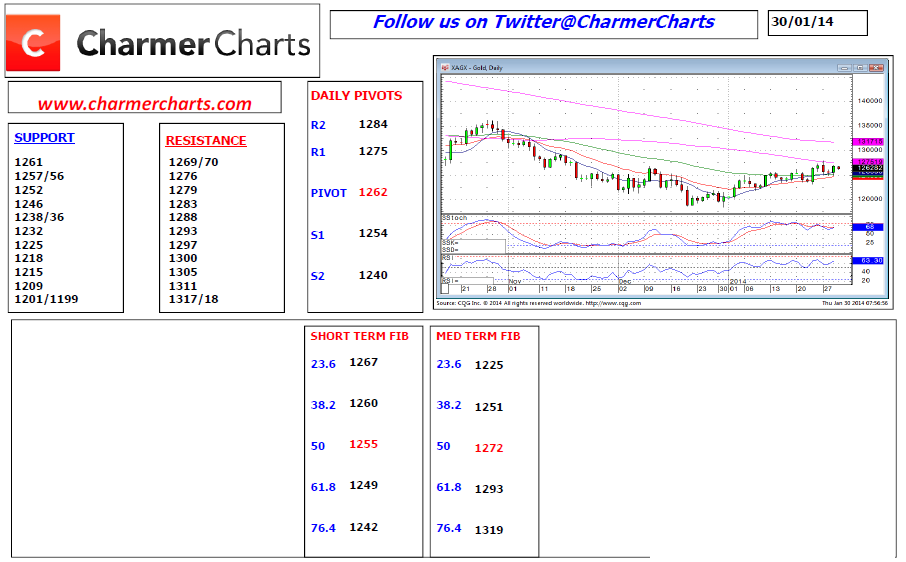

Gold remained strong as we anticipated yesterday and we ht 1269/70 target thus covering all long positions. Now we are seeing slight pullbacks overnight but unless we break the 1257/56 support we can reinstate small longs looking for another attempt at the 1269/70 resistance. We apply the same strategy of

covering all longs to this point.

Only a break of 1270 would put us back into a long position, and then we can trade higher and we would be looking at the key resistance between 1279 and 1283. Once more all longs shuould be covered to here.

Now failure to actually hold over 1255 makes us a little more cautious and we would then look to reinstate shorts as we would expect sellers to drive us lower to 1246 once more. Here we would again cover all short positions and we would attempt longs at this key support area because we know the stops are tight and a loss of 1244 sees any shorts reversed for sellers to be in control, once more looking for 1236 to 1232 with the possibility of further weakness to 1225. We are covering all shorts here and going long looking for this key support to hold.