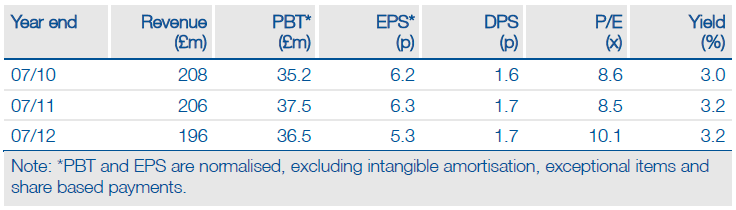

Final results reflected the significant shift in the business during FY12, with the acquisition of Centrebet in Australia, sale of the Turkish-facing website business and new taxes in regulating markets. There is much greater clarity for FY13, with 80% of revenues now coming from regulated or taxed markets, the Australian business fully integrated and growing strongly and European cost cutting sufficient to “produce a profit at budgeted revenue levels”. The market is awaiting further news on the approach from William Hill and GVC and as a connected party under Takeover Panel rules, we are unable to publish estimates.

Strong FY12 Performance In Australia

Normalised FY12 operating profit was £32.2m (FY11: 38.1m), with £31.8m coming from Australia (FY11: £8.9m) and only £0.4m from the rest (Europe and emerging markets, less PLC costs), versus £29.2m in FY11. Australian net gaming revenue (NGR) grew by 31% on a like-for-like basis and Centrebet was fully integrated onto the Sportingbet platform by June, generating synergies of £15m (original estimate £9.8m). European profits were affected by new taxes, the sale of the Turkish website business, economic pressures and the temporary closure of the Spanish website.

Greater Clarity For FY13

Sportingbet’s business mix has been transformed during FY12 and 80% of revenues now come from regulated and/or taxed countries. Medium term, the Australian experience is that an initial reduction in profitability in regulating markets from new taxes is more than offset by new growth opportunities in the medium term. Meanwhile, management reports that “the group has had a solid start to the year in line with our expectations… while the economic outlook remains challenging our robust position across a variety of attractive territories gives us confidence in the outlook for the current financial year”.

Bid Situation: Awaiting Developments

On 1 October, Sportingbet confirmed that it had received an indicative offer from William Hill and GVC Holdings of 52.5p (45p in cash from William Hill and 7.5p of shares in GVC). The Sportingbet board responded that “this indicative offer significantly undervalues the business and its future prospects”. William Hill and GVC have until 16 October to announce a firm intention to make an offer or announce that they do not intend to make an offer (unless the deadline is extended by the Panel).

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Sportingbet Update

Transformed

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.