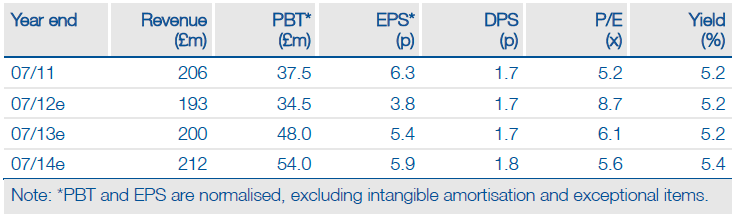

FY12 results are reported to be in line with expectations and we have marginally upgraded FY13 PBT as Australian synergies are coming through strongly. With the high-growth, regulated Australian business estimated to be worth 44-50p per share and Turkey disposal proceeds of c €126m still to come, the rating assigns nothing to the industry-leading European sport platform. Our SOTP is 36-66% above the current share price. European uncertainties remain but the cost base has been adjusted and the clouds are slowly lifting as more countries introduce licensing regimes, suggesting strong medium-term operating profit growth potential.

Strong performance in Australia

We expect Australian operating profit of £30m in FY12, up from £8.9m in FY11, due to strong underlying market growth and the successful acquisition and integration of Centrebet. Q4 like-for-like revenue increased by 24% and there remains the potential for new products (in-play and some poker) to be allowed in FY13.

FY13 PBT upgraded by £1.5m, new FY14 estimates

Centrebet integration synergies are reported to be ‘significantly’ ahead of expectations and we have increased our FY13 normalised PBT estimate by £1.5m to £48m, with Australia contributing £35m of operating profit. We assume overall breakeven from the non-Australian business (versus an £11m loss ex-Turkey in FY12e). We believe this is very achievable given the significant cost-cutting Sportingbet has already implemented, and despite additional burdens in regulated markets and economic pressures (particularly in Greece and Spain). Estimated FY13 EPS growth is more than 40%. Our tentative new FY14 estimate is for £37m of operating profit from Australia and £2m elsewhere, with PBT rising to £54m. Once markets settle down a 10% margin on £110m of non-Australian revenue would not seem overly ambitious.

Valuation: Low, whichever way you look at it

P/E and EV/EBITDA calculations are slightly complicated by the Turkish disposal proceeds (earn-out based, so included in the P&L, but finite). Depending on treatment we calculate a FY13e EV/EBITDA of only 4.3-4.4x, well below the peer group average despite Sportingbet’s European prospects slowly becoming clearer. We prefer a sum-of-the-parts approach and our estimated range has narrowed slightly to 45-55p per share (versus 42-55p published in June). Hoped-for newsflow in coming months about new Australian products or a US partnership would be very positive triggers.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Sportingbet Q4 Trading Update

Published 08/09/2012, 06:44 AM

Updated 07/09/2023, 06:31 AM

Sportingbet Q4 Trading Update

Well on course

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.