Splunk Inc. (NASDAQ:SPLK) has been ranked number one in worldwide IT Operations Analytics (ITOA), as well as Event and Log Management software market shares for 2016 by International Data Corporation (IDC), the world's leading IT analyst firm.

Citing the reports of IDC, the company revealed that the two aforementioned IT markets have witnessed the highest growth rates within the overall IT market. While ITOA registered an increase of 32.9%, Event and Log Management grew 23.5%.

Reportedly, this was the third consecutive year when Splunk gained the top spot in the rapidly growing ITOA software market, outplaying established players such as International Business Machines (NYSE:IBM) , Microsoft (NASDAQ:MSFT) , VMware, Hewlett Packard Enterprise, CA Technologies and BMC – all of which are vying to grab a bigger share of this fastest-growing IT market.

Splunk’s market share in ITOA touched 32.2% in 2016, per IDC. According to IDC report author Tim Grieser, “Splunk supports prepackaged content and visualization for a variety of use cases including IT operations and APM. This is making Splunk-based analytics available to an increasing variety of IT and business users.”

In the IT Event and Log Management Market Shares report, Splunk’s “rapid growth is based on core capabilities for big data capture, indexing, management, search and visualization that extend across a wide variety of machine-generated data sources including metrics and logs”, cited Tim Grieser. With a market share of 21.2%, this was for the second consecutive year that the company is maintaining its market leader position.

Splunk provides a software platform, which collects and indexes log and data from any defined source and enables users to search, monitor, analyze, and visualize the high volumes of machine-generated data gathered from the websites, applications, sensors, devices, etc, that comprise technology infrastructure, security systems and business applications—giving the insights to drive operational performance and business results.

Over the years, Splunk has evolved from a basic IT Search tool into a platform for applications that center around IT information. We believe the market for IT products that provide operational intelligence, specifically machine data, presents a substantial opportunity for organizations as data grows in volume and diversity.

Competitively, Splunk appears quite dominant in its machine data analytics niche. And the company's market opportunity is growing as its software, traditionally used for IT operational intelligence, gets adopted for security, fraud-detection, app analytics and other use cases.

Notably, Splunk has maintained a long history of topping analyst estimates. The company's latest quarterly total revenues for the first quarter fiscal 2018 (Q1 FY18) increased 30% y-o-y, outperforming market consensus estimates.

Since going public in 2012, Splunk has shown a knack for steadily raising full-year guidance over the course of a fiscal year. The company's fiscal second quarter 2018 (ending Jul 31, 2017) sales guidance of $267–269 million is only in-line with the Zacks Consensus Estimate of $268.7 million.

Zacks Rank & Share Price Movement

Currently, Splunk carries a Zacks Rank #3 (Hold).

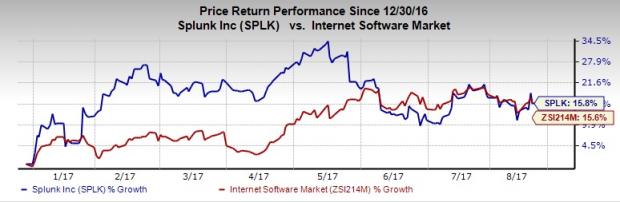

Shares of Splunk have generated a return of 15.8% on a year-to-date basis, compared with the industry’s gain of 15.6%.

Stock to Consider

A better-ranked technology stock in this industry is AppFolio, Inc. (NASDAQ:APPF) , sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank Stocks here.

Long-term earnings growth rate of AppFolio is pegged at 30%.

4 Surprising Tech Stocks to Keep an Eye on

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

International Business Machines Corporation (IBM): Free Stock Analysis Report

Splunk Inc. (SPLK): Free Stock Analysis Report

AppFolio, Inc. (APPF): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Original post

Zacks Investment Research