Software solutions giant Splunk Inc (NASDAQ:SPLK) late Tuesday posted better than expected third quarter earnings results and offered an upbeat forecast, sending its shares surging higher after hours.

The San Francisco-based company reported Q3 net income of $0.12 per share, which was $0.04 better than the average Wall Street consensus of $0.08. Revenues rose 40.3% from last year to $244.79 million, which easily beat analysts’ view for $230.27 million.

Splunk said that license revenues surged 34% from last year to $140 million, while it signed up nearly 500 new enterprise customers in the latest period.

Looking ahead, SPLK forecast Q4 revenues to range from $286 to $288 million, which would beat Wall Street’s $285.04 million estimate. Meanwhile, non-GAAP operating margin is expected to be between 8% and 9% for the fourth quarter.

The company commented via press release:

“Our market opportunity is tremendous,” said Doug Merritt, President and CEO. “Splunk provides the market leading platform that powers Operational Intelligence to enable customers to cost effectively get value from machine data. We want to make it easier to collect and analyze even larger volumes and varieties of data to help our customers gain more insights and value from Splunk solutions. Our passionate customers and their innovations with the Splunk platform are at the core of our success.”

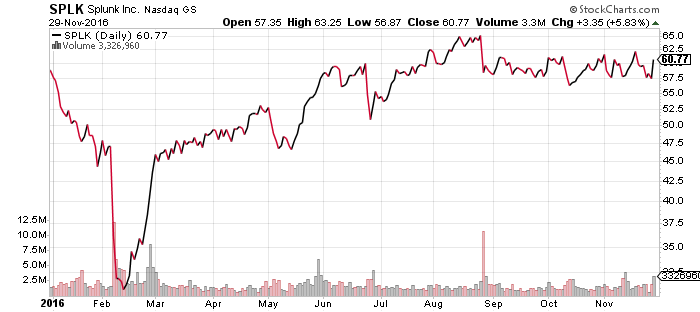

Splunk shares rose $3.42 (+5.96%) to $60.80 in after-hours trading Tuesday. Prior to today’s report, SPLK had fallen 2.43% year-to-date.