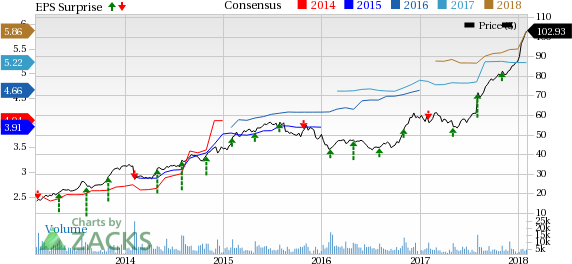

Spirit AeroSystems Holdings, Inc. (NYSE:SPR) recorded fourth-quarter 2017 adjusted earnings of $1.32 per share, which surpassed the Zacks Consensus Estimate of $1.22 by 8.2%.

Excluding a one-time impact of tax-reform worth 25 cents, the company reported GAAP earnings of $1.07, which improved 20.2% from the year-ago figure of 89 cents.

For 2017, the company posted adjusted earnings of $5.35 per share, which surpassed the Zacks Consensus Estimate of $5.22 by 2.5%.

Highlights of the Release

Total revenues of $1,714 million in the fourth quarter surpassed the Zacks Consensus Estimate of $1,650 million by 3.9%. Moreover, revenues rose 9.5% year over year.

Backlog at the end of fourth-quarter 2017 was $47 billion, higher than the prior-quarter figure of $45 billion.

For 2017, the company generated revenues of $6.98 billion, which surpassed the Zacks Consensus Estimate of $6.93 billion.

Segment Performance

Fuselage Systems: Revenues at the segment grew 12.2% to $918.7 million from the prior-year figure of $819.1 million. Higher production deliveries of the Boeing 737 program as well as increased defense work and non-recurring activities on certain Boeing programs drove the results.

Propulsion Systems: The segment recorded revenues of $415.5 million in the quarter, up 2.8% from $404 million a year ago. The upside was driven by higher production deliveries on the Boeing 737 program.

Wing Systems: Revenues at the segment increased 8.6% to $377.1 million from $347.2 million in the prior-year quarter due to higher production deliveries on the Boeing 737, 787, and A320 programs.

Financial Position

As of Dec 31, 2017, Spirit AeroSystems had $423.3 million in cash and cash equivalents compared with $697.7 as of Dec 31, 2016.

As of Dec 31, 2017, long-term debt (excluding current portion) was $1,119.9 million compared with $1,060 million at the end of 2016.

Cash flow from operating activities declined to $573.7 million at the end of 2017 from $716.9 million at the end of 2016.

Capital expenditure totaled $273 million in 2017 compared with $254 million in the prior-year.

Guidance

Spirit AeroSystems issued financial guidance for 2018. The company expects to generate earnings in the range of $6.25-$6.50 on revenues of $7.1-$7.2 billion.

Management also expects free cash flow to be in the range of $550-$600 million for 2018.

Zacks Rank

Spirit AeroSystems currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Peer Releases

Boeing Company (NYSE:BA) reported adjusted earnings of $4.80 per share for fourth-quarter 2017, beating the Zacks Consensus Estimate of $2.91 by 64.9%. Its fourth-quarter revenues amounted to $25.37 billion in the quarter beating the Zacks Consensus Estimate of $24.83 billion by 2.2%.

Lockheed Martin (NYSE:LMT) reported fourth-quarter 2017 adjusted earnings from continuing operations of $4.30 per share, which surpassed the Zacks Consensus Estimate of $4.06 by 5.9%. Its total revenues came in at $15.14 billion which exceeded the Zacks Consensus Estimate of $14.75 billion by 2.6%.

Rockwell Collins (NYSE:COL) reported results for first-quarter fiscal 2018 (ended Dec 31, 2017). The company’s adjusted earnings per share of $1.59 beat the Zacks Consensus Estimate of $1.53 by 3.9%. Its total sales were $2,011 million, which beat the Zacks Consensus Estimate of $1,988 million by 1.2%.

Breaking News: Cryptocurrencies Now Bigger than Visa

The total market cap of all cryptos recently surpassed $700 billion – more than a 3,800% increase in the previous 12 months. They’re now bigger than Morgan Stanley (NYSE:MS), Goldman Sachs (NYSE:GS) and even Visa! The new asset class may expand even more rapidly in 2018 as new investors continue pouring in and Wall Street becomes increasingly involved.

Zacks has just named 4 companies that enable investors to take advantage of the explosive growth of cryptocurrencies via the stock market.

Click here to access these stocks >>

Boeing Company (The) (BA): Free Stock Analysis Report

Lockheed Martin Corporation (LMT): Free Stock Analysis Report

Rockwell Collins, Inc. (COL): Free Stock Analysis Report

Spirit Aerosystems Holdings, Inc. (SPR): Free Stock Analysis Report

Original post

Zacks Investment Research