It’s Friday in the Wall Street Daily Nation. And longtime readers know what that means…

I’m selecting a handful of graphics to put important economic and investing news into perspective.

This week, I’m dishing on non-stop government spending, the importance of emerging markets and the next sovereign debt crisis.

So say “goodbye” to long-winded commentary. Instead, say “hi” to easy-to-understand pictures and some quick-hit observations.

Certainties: Death, Taxes… And More Government Spending

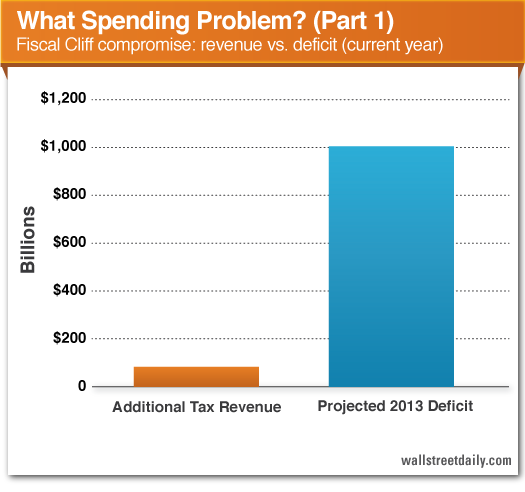

Finally! Congress reached a compromise to avert the dreaded Fiscal Cliff.

Don’t worry about all the details contained in the 154-page bill, though. This graphic tells us all we need to know.

As you can see, all the new taxes don’t go very far towards covering up Washington’s spending problem for the coming year.

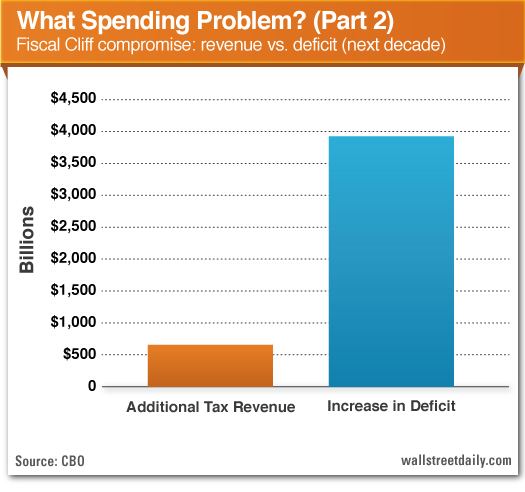

Lest you think I’m manipulating statistics to try to hide a delayed benefit, here’s another chart from the non-partisan CBO. It shows the impact of the compromise over the next decade.

I still see a (spending) problem somewhere -- do you?

Definitive Proof That Emerging Markets Matter

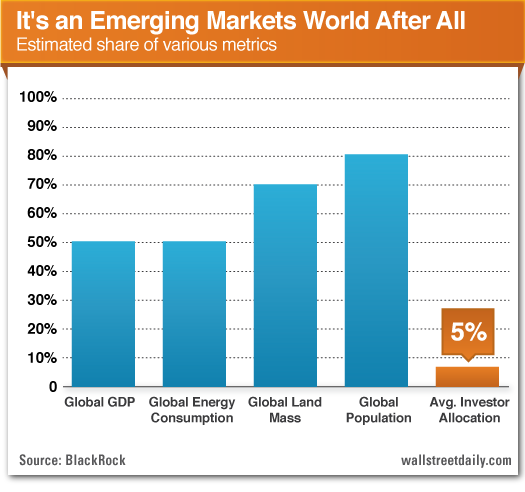

Do you doubt the significance of emerging markets? Here’s proof that they’re a really, really big deal.

And yet, according to BlackRock, investors only allocate 5% of their capital on average to emerging markets.

Call me crazy, but I bet that allocation goes up in the future – and rightfully so.

If you want to get a head start, a little birdy mentioned something about South Korea. (Details are here.)

Cry For Argentina!

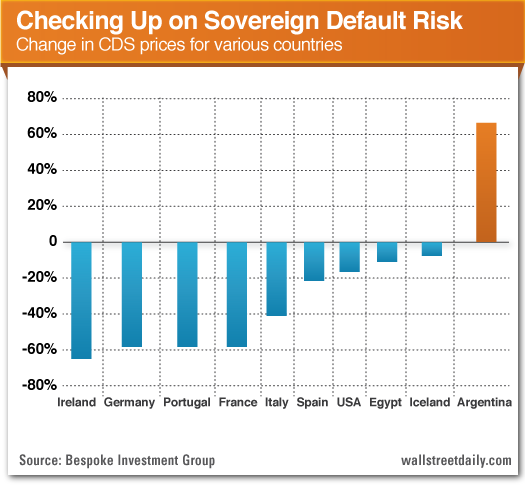

The United States narrowly averted a fiscal crisis. For now, at least. But not all countries promise to be so lucky. Particularly Argentina.

Argentina is the only country that witnessed an increase in the cost to insure against a default last year, as represented by credit default swap (CDS) prices.

That’s not the only troubling statistic, either.

Since 1800, Argentina has reneged on its debt seven times. (Fun fact: That’s one more time than Greece over the same period.)

So that makes Argentina a serial defaulter and debt restructurer.

Misery loves company, Argentina. Greece is waiting.

That’s it for today. But before you sign off, do us a favor. Let us know what you think about this weekly column -- or any of our recent work at Wall Street Daily -- by sending an email to feedback@wallstreetdaily.com.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Spendaholics, Sovereign Debt And Proof That Emerging Markets Matter

Published 01/04/2013, 11:20 AM

Updated 05/14/2017, 06:45 AM

Spendaholics, Sovereign Debt And Proof That Emerging Markets Matter

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.