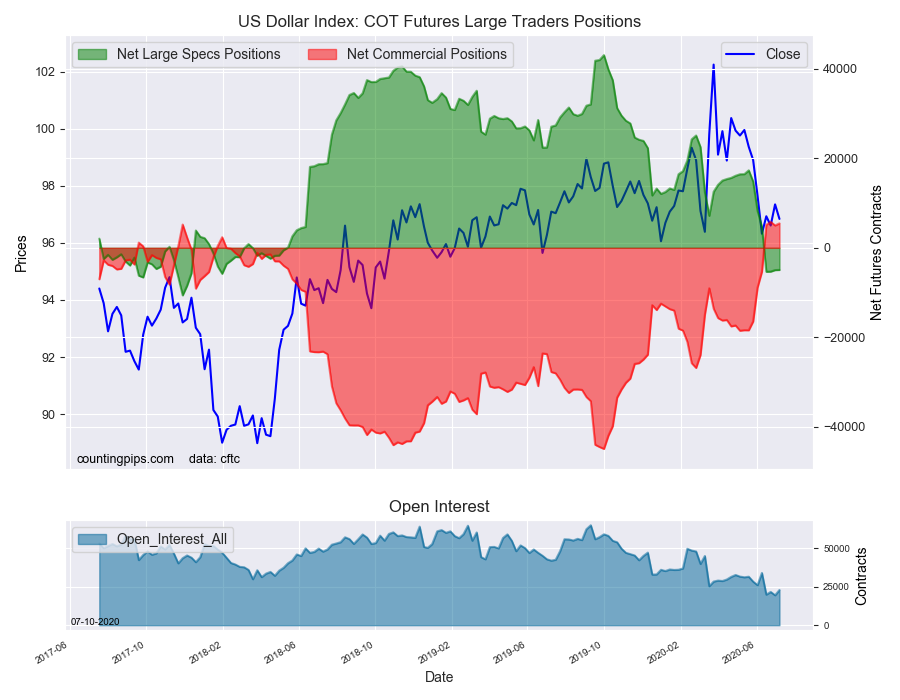

Speculators trim US Dollar Index bearish bets

Large currency speculators trimmed their bearish net positions in the US Dollar Index futures markets again this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of -4,939 contracts in the data reported through Tuesday July 7th. This was a weekly change of 36 contracts from the previous week which had a total of -4,975 net contracts.

This week’s net position was the result of the gross bullish position (longs) rising by 2,324 contracts (to a weekly total of 12,136 contracts) compared to the gross bearish position (shorts) which saw a larger advance by 2,288 contracts on the week (to a total of 17,075 contracts).

US Dollar Index speculators edged their bearish bets lower for the third straight week following a four-week surge in bearish bets. US Dollar Index net positions had previously dropped sharply from May 26th to June 16th by a total of -22,641 contracts over that period and fell into an overall bearish level for the first time in 110 weeks, dating back to May of 2018. These last three weeks have seen the dollar position improve a little but sentiment remains bearish at a total of -4,939 contracts.

Individual Currencies Data this week: Yen & Peso bets fall

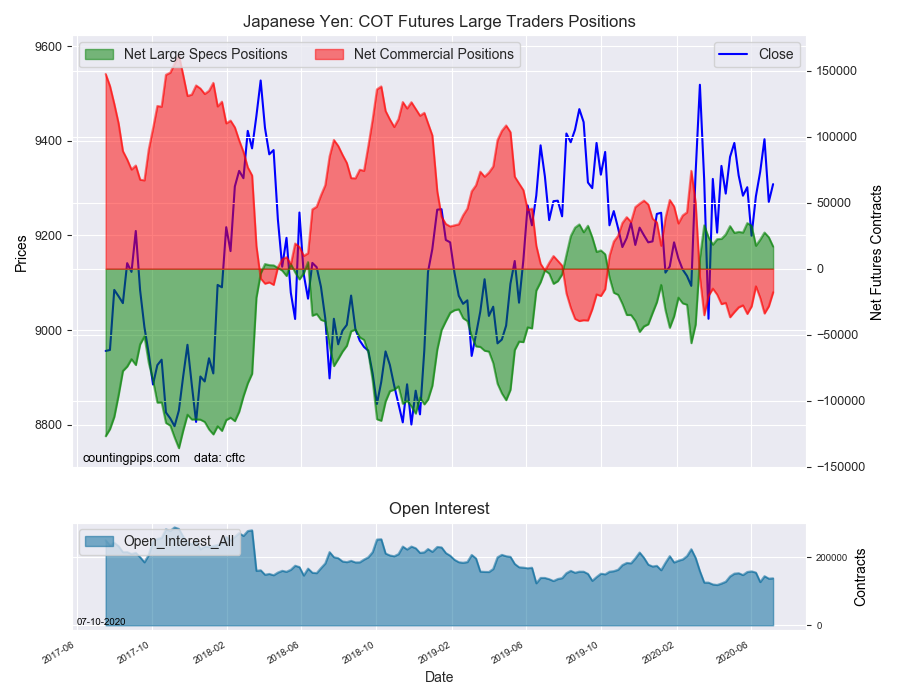

In the other major currency contracts data, the largest changes in the speculators category this week were for the Japanese yen and the Mexican peso.

Japanese yen bullish positions fell this week for a second straight week and for the fourth time in the past six weeks. These decreases have pushed the current standing (+16,812 contracts) to the lowest level since yen bets turned bullish (+8,157 contracts) on March 10th, a span of 18 weeks.

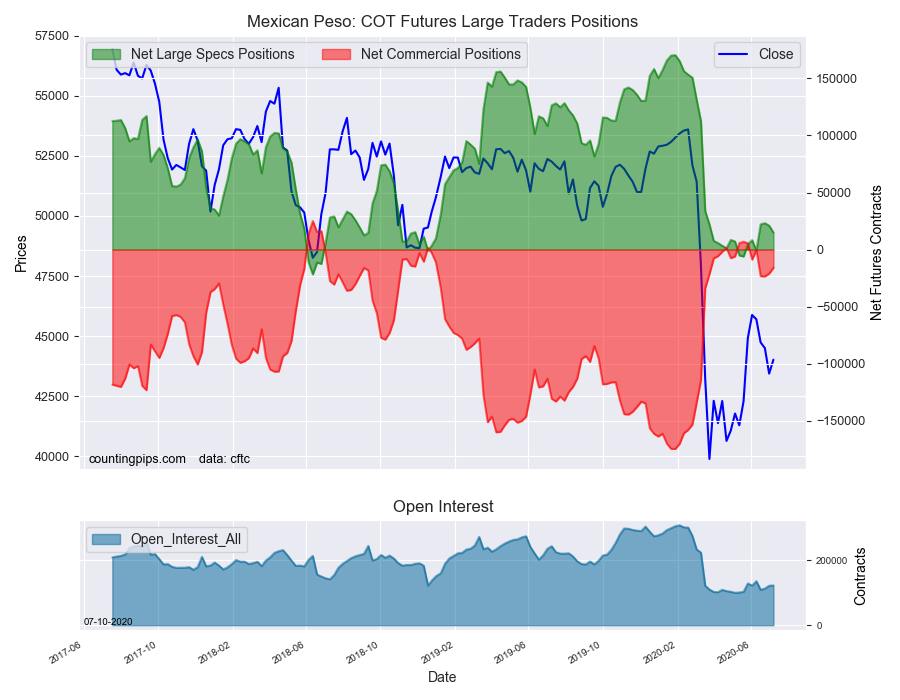

Mexican peso positions decreased for a second straight week and for the third time in the past four weeks. The peso speculator position has remained close to the neutral level (zero contracts) since the onset of the coronavirus in March. Peso positions had a strong bullish year in 2019 and into early 2020 with a record bullish level taking place on January 28th at a total of +170,366 contracts. Since the record, peso positions have dropped by a total of -155,386 contracts and are in a small bullish position this week.

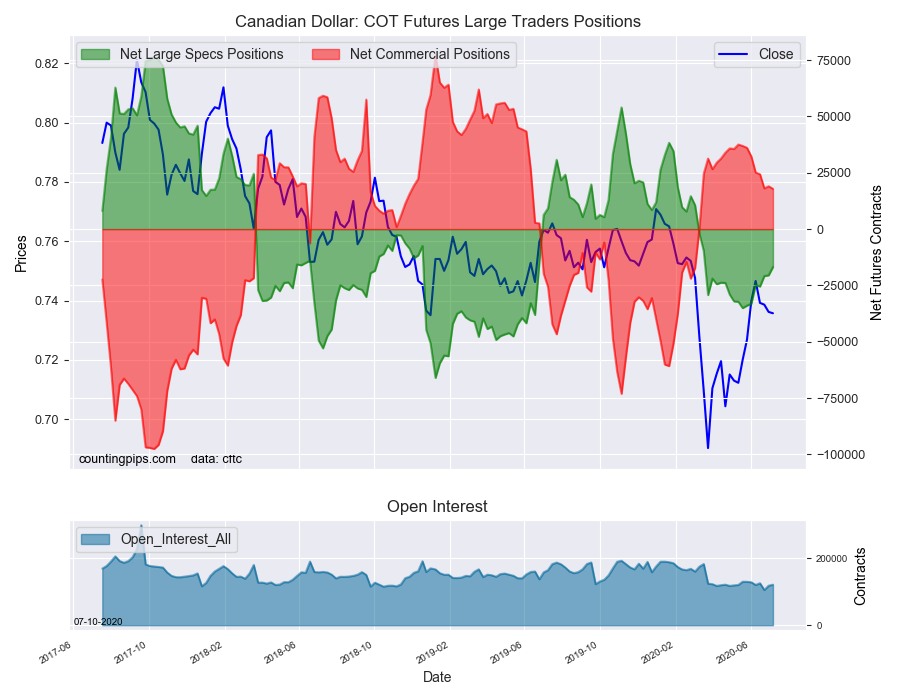

Overall, the major currencies that saw improving speculator positions this week were the US dollar index (36 weekly change in contracts), euro (4,642 weekly change in contracts), British pound sterling (4,582 contracts), Canadian dollar (3,701 contracts) and the Australian dollar (2,214 contracts).

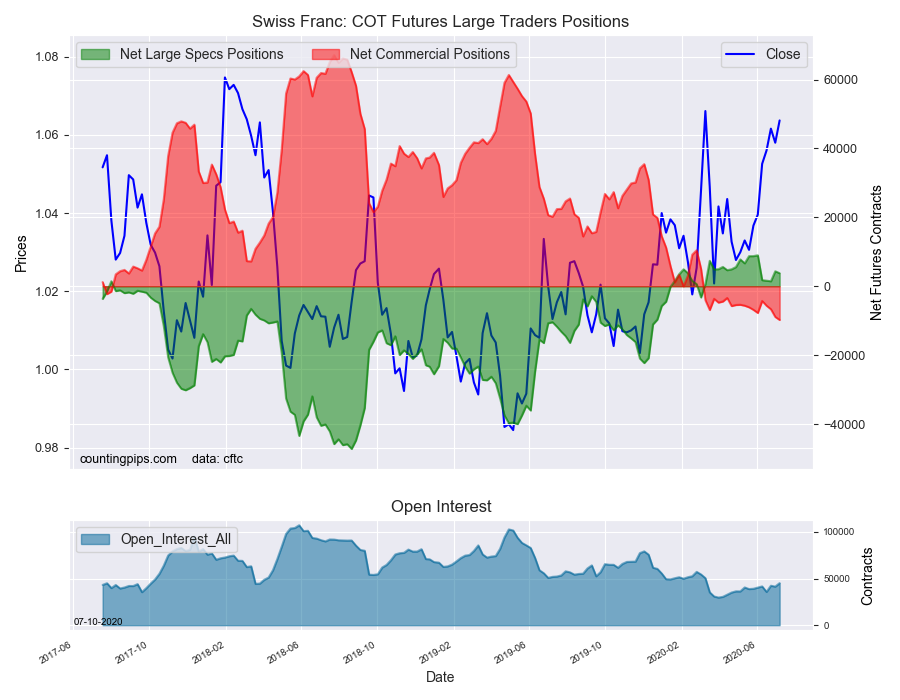

The currencies whose speculative bets declined this week were the Japanese yen (-7,049 contracts), Swiss franc (-560 contracts), New Zealand dollar (-673 contracts) and the Mexican peso (-5,976 contracts).

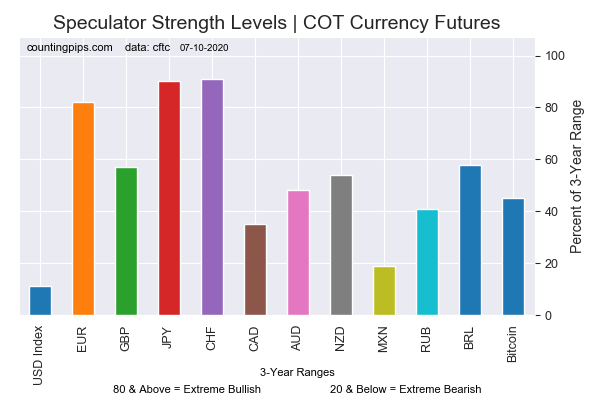

Chart: Current Strength of Each Currency compared to their 3-Year Range

The above chart depicts each currency’s current speculator strength level compared to data of the past 3 years. A score of 0 percent would mean speculator bets are currently at the lowest level of the past three years. A 100 percent score would be at the highest level while a 50 percent score would mean speculator bets are right in the middle of the data (a neutral score). We use above 80 percent (extreme bullish) and below 20 percent (extreme bearish) as extreme score measurements.

Please see the data table and individual currency charts below.

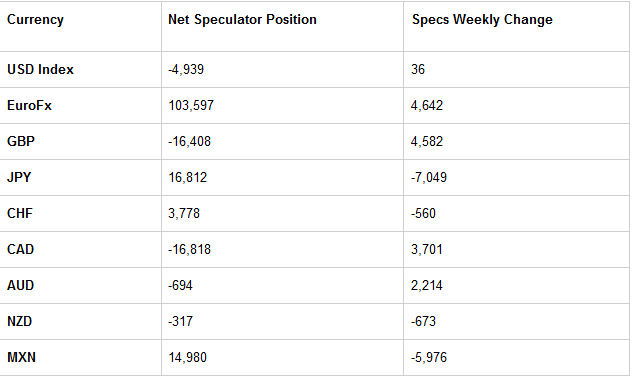

Table of Large Speculator Levels & Weekly Changes:

This latest COT data is through Tuesday and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the dollar will gain versus the euro.

Weekly Charts: Large Trader Weekly Positions vs Price

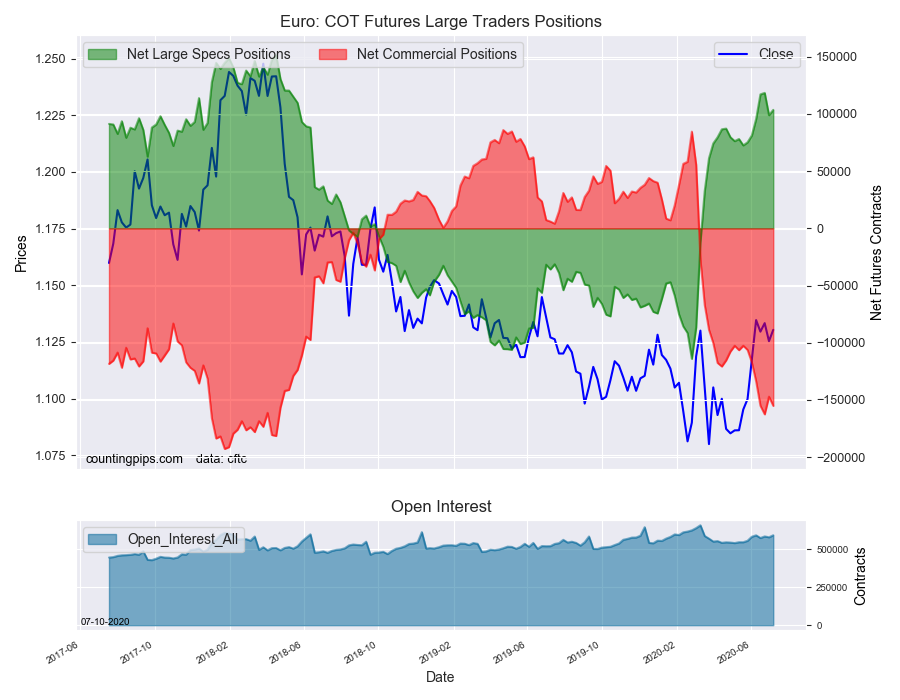

EuroFX:

The euro large speculator standing this week equaled a net position of 103,597 contracts in the data reported through Tuesday. This was a weekly increase of 4,642 contracts from the previous week which had a total of 98,955 net contracts.

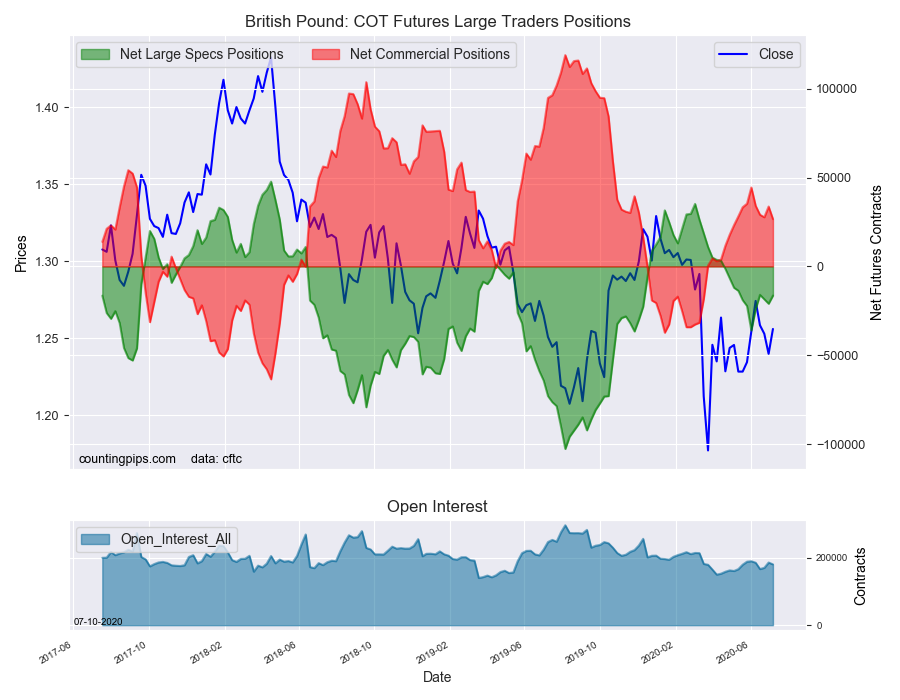

British Pound Sterling:

The large British pound sterling speculator level recorded a net position of -16,408 contracts in the data reported this week. This was a weekly advance of 4,582 contracts from the previous week which had a total of -20,990 net contracts.

Japanese Yen:

Large Japanese yen speculators came in at a net position of 16,812 contracts in this week’s data. This was a weekly lowering of -7,049 contracts from the previous week which had a total of 23,861 net contracts.

Swiss Franc:

The Swiss franc speculator standing this week reached a net position of 3,778 contracts in the data through Tuesday. This was a weekly reduction of -560 contracts from the previous week which had a total of 4,338 net contracts.

Canadian Dollar:

Canadian dollar speculators came in at a net position of -16,818 contracts this week. This was a rise of 3,701 contracts from the previous week which had a total of -20,519 net contracts.

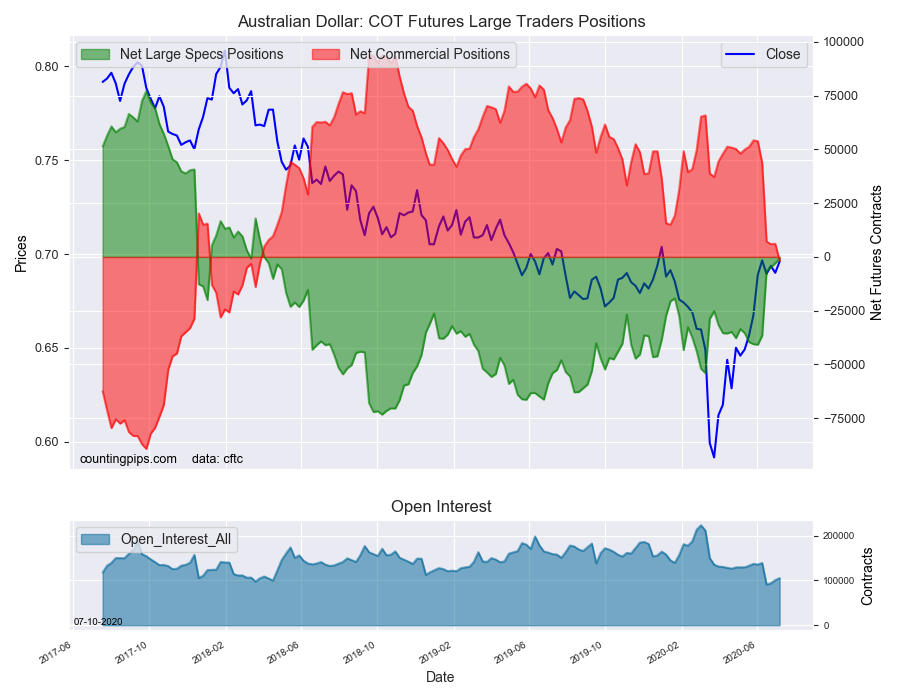

Australian Dollar:

The large speculator positions in Australian dollar futures recorded a net position of -694 contracts this week in the data ending Tuesday. This was a weekly rise of 2,214 contracts from the previous week which had a total of -2,908 net contracts.

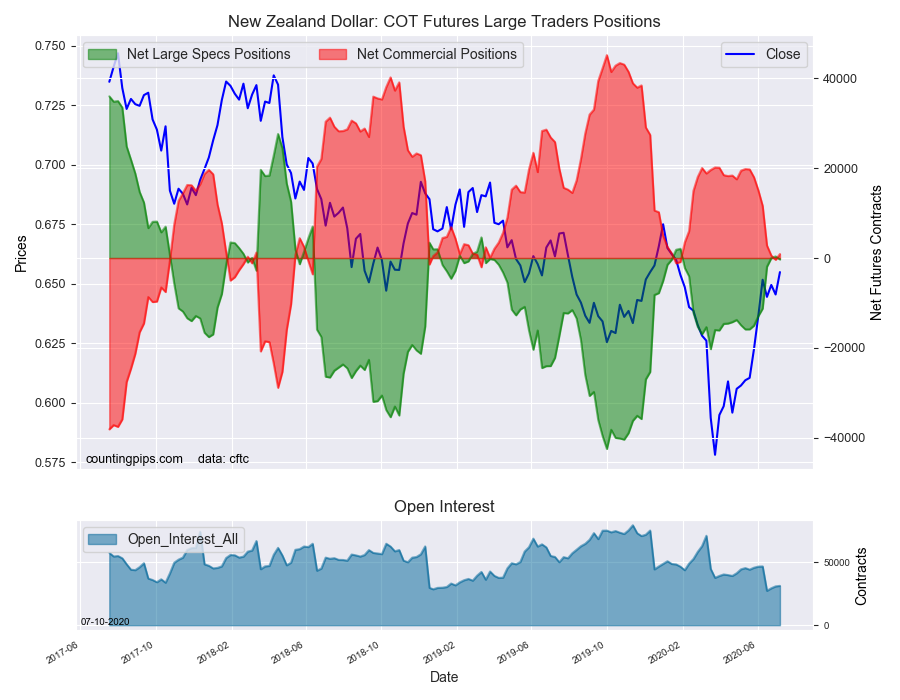

New Zealand Dollar:

The New Zealand dollar speculative standing recorded a net position of -317 contracts this week in the latest COT data. This was a weekly lowering of -673 contracts from the previous week which had a total of 356 net contracts.

Mexican Peso:

Mexican peso speculators equaled a net position of 14,980 contracts this week. This was a weekly lowering of -5,976 contracts from the previous week which had a total of 20,956 net contracts.