US Dollar Index Speculator Positions

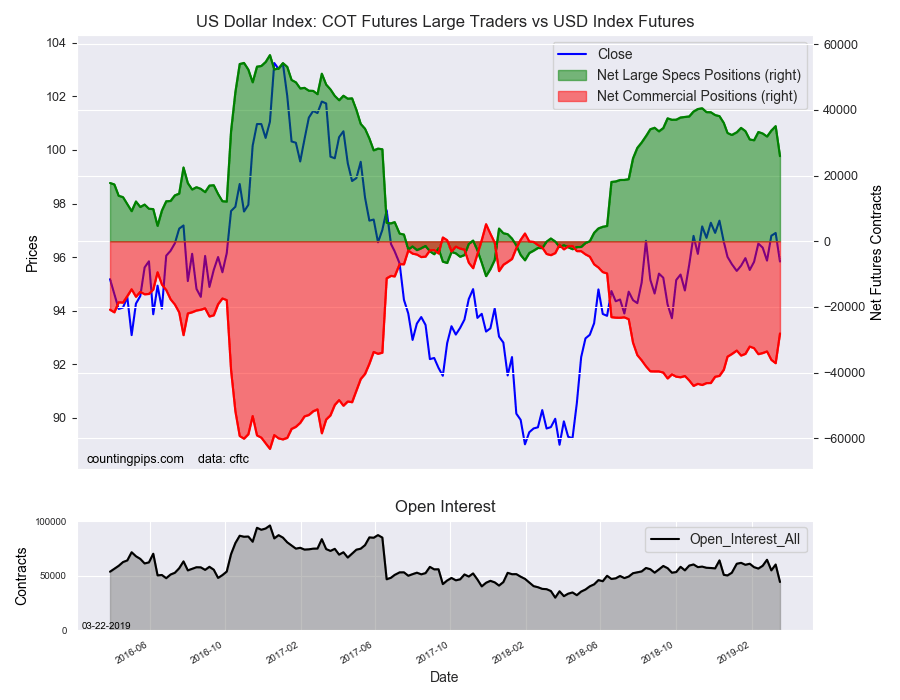

Large currency speculators sharply reduced their bullish net positions in the US Dollar Index futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 25,935 contracts in the data reported through Tuesday, March 19th. This was a weekly lowering of -9,139 contracts from the previous week which had a total of 35,074 net contracts.

This week’s net position was the result of the gross bullish position (the longs) tumbling by -6,423 contracts to a weekly total of 38,607 contracts combined with the gross bearish position (the shorts) total of 12,672 contracts which saw an increase by 2,716 contracts for the week.

The net speculative position had advanced for two straight weeks before this week’s decline which marks the largest weekly fall since June 20th of 2017 when the net position plunged by -22,405 contracts. Despite the speculator bet reductions, the dollar index level remains in a bullish position although under the +30,000 net contract level for the first time in thirty-three weeks.

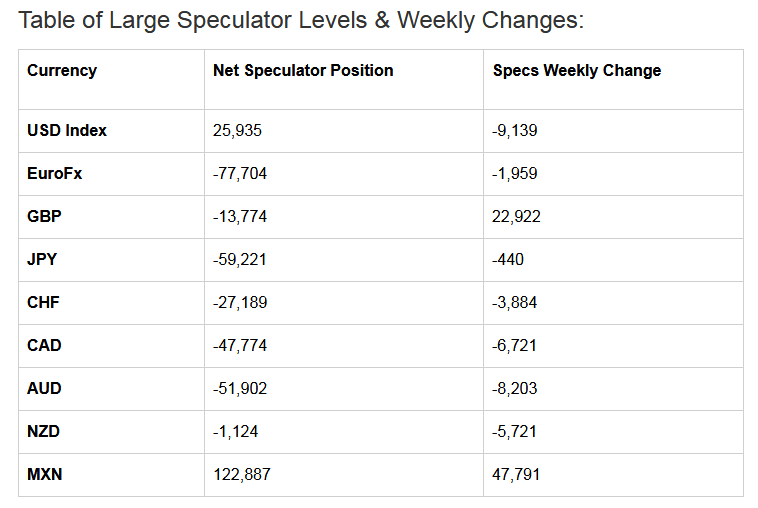

Individual Currencies Data this week:

In the other major currency contracts data, we saw two substantial changes (+ or – 10,000 contracts) in the speculators' category this week.

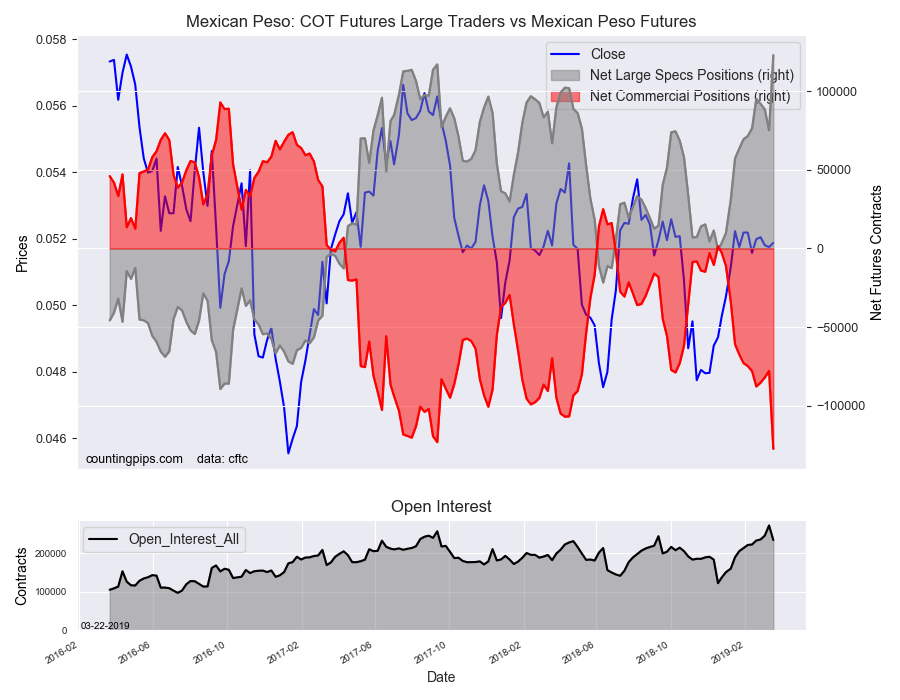

Mexican peso bets jumped dramatically this week by over +47,000 contracts. This weekly gain followed three weeks of declining net positions in MXN futures. The boost this week pushed the total net position for the peso above +122,000 contracts which is by far and away the most bullish level among all the currencies we cover. The last time the MXN position was above +100,000 contracts was April 17th of 2018.

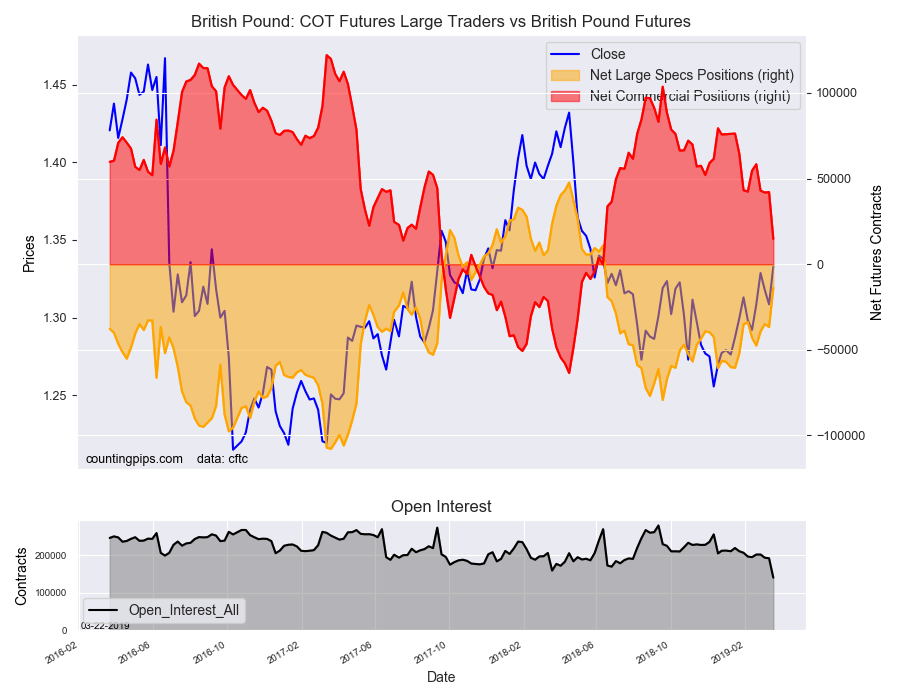

British pound sterling bets got a strong boost this week by over +22,000 net contracts. This weekly gain brought the overall bearish position in the GBP (-13,774 contracts) down to the lowest level since June 12th of 2018. Before this week’s gain, British pound speculator positions had been at -30,000 contracts or more for the previous thirty-six weeks in a row.

Overall, the major currencies that saw improving speculator positions this week were just the British pound sterling (22,922 weekly change in contracts) and the Mexican peso (47,791 contracts).

The currencies whose speculative bets declined this week were the US dollar index (-9,139 weekly change in contracts), euro (-1,959 contracts), Japanese yen (-440 contracts), Swiss franc (-3,884 contracts), Canadian dollar (-6,721 contracts), Australian dollar (-8,203 contracts) and the New Zealand dollar (-5,721 contracts).

See the table and individual currency charts below.

Weekly Charts: Large Trader Weekly Positions vs Price

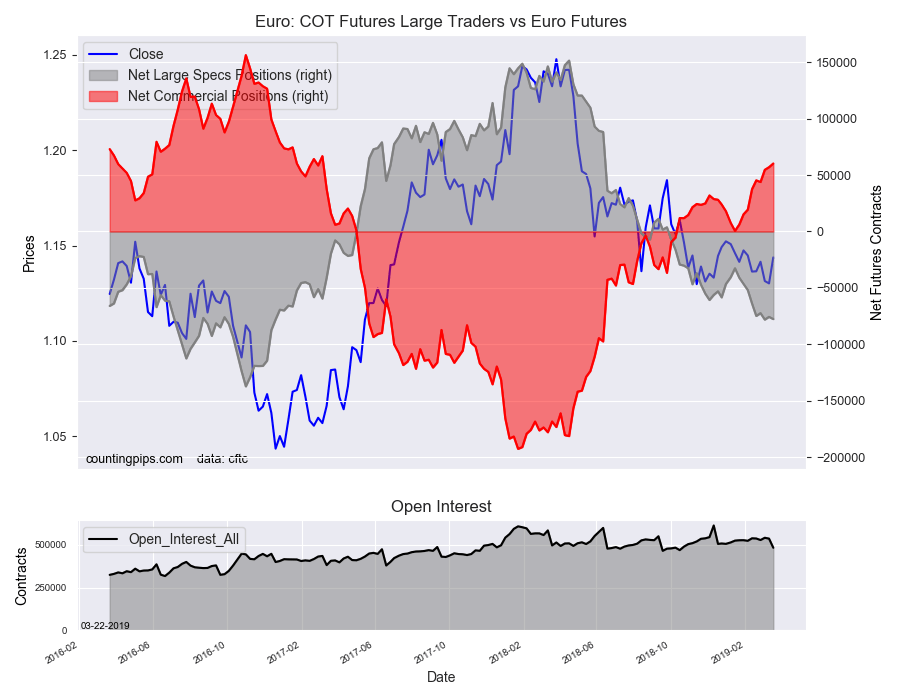

EuroFX:

The euro large speculator standing this week came in at a net position of -77,704 contracts in the data reported through Tuesday. This was a weekly reduction of -1,959 contracts from the previous week which had a total of -75,745 net contracts.

British Pound Sterling:

The large British pound sterling speculator level was a net position of -13,774 contracts in the data reported this week. This was a weekly boost of 22,922 contracts from the previous week which had a total of -36,696 net contracts.

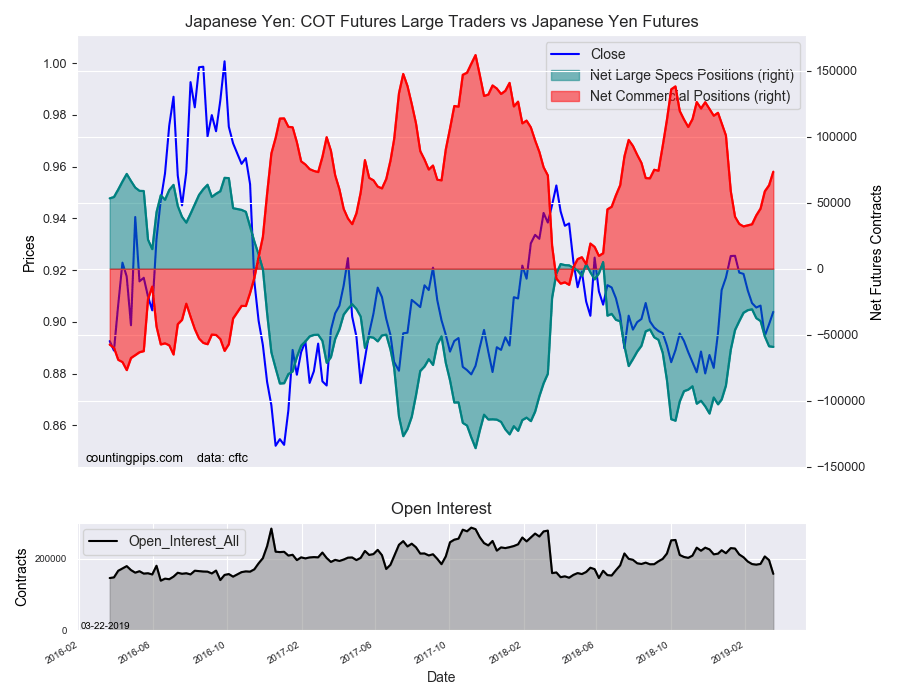

Japanese Yen:

Large Japanese yen speculators equaled a net position of -59,221 contracts in this week’s data. This was a weekly decline of -440 contracts from the previous week which had a total of -58,781 net contracts.

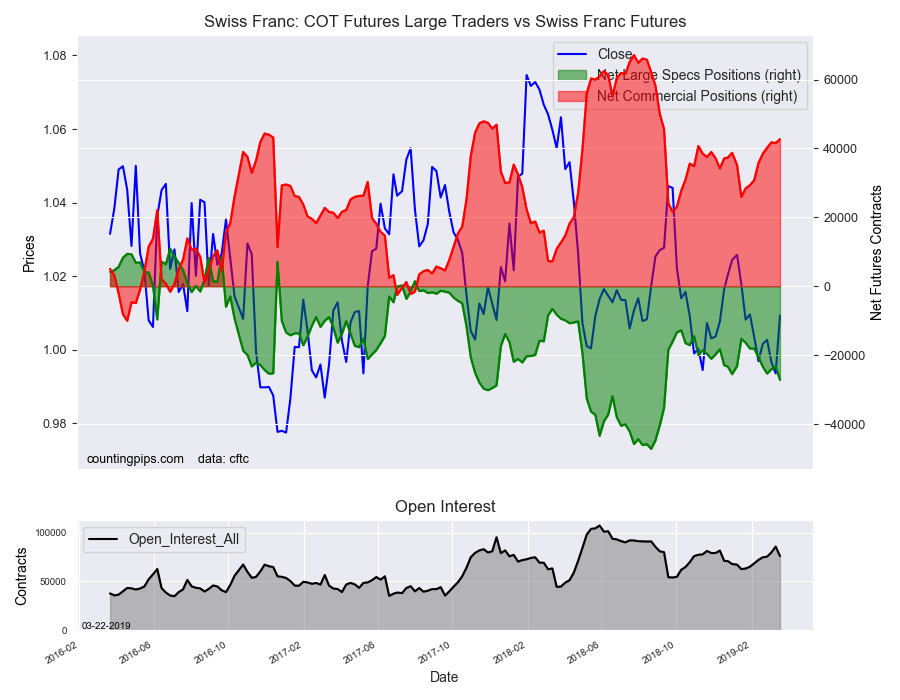

Swiss Franc:

The Swiss franc speculator standing this week totaled a net position of -27,189 contracts in the data through Tuesday. This was a weekly reduction of -3,884 contracts from the previous week which had a total of -23,305 net contracts.

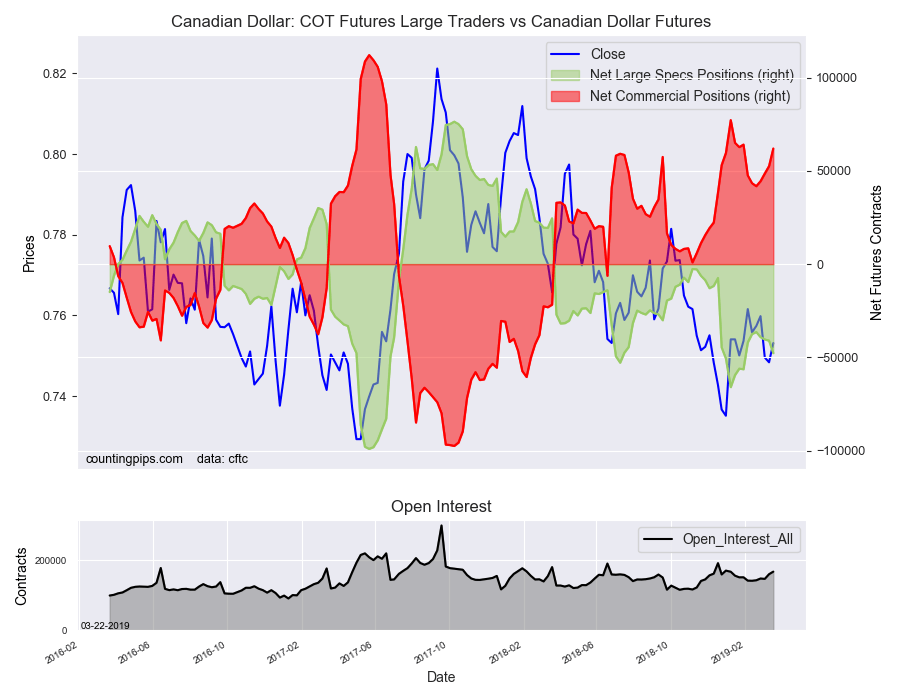

Canadian Dollar:

Canadian dollar speculators recorded a net position of -47,774 contracts this week. This was a reduction of -6,721 contracts from the previous week which had a total of -41,053 net contracts.

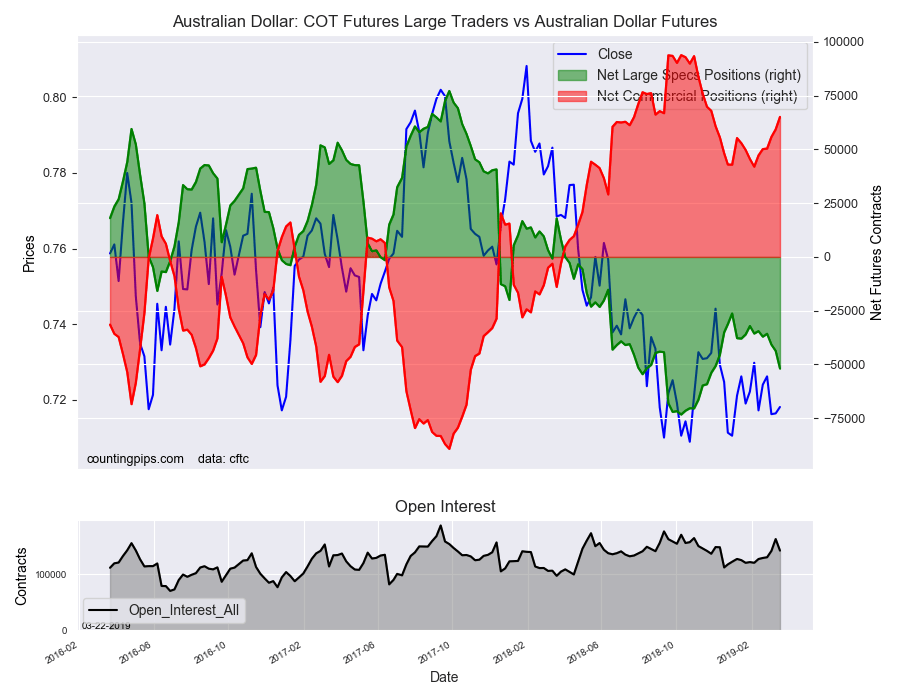

Australian Dollar:

The large speculator positions in Australian dollar futures recorded a net position of -51,902 contracts this week in the data ending Tuesday. This was a weekly decrease of -8,203 contracts from the previous week which had a total of -43,699 net contracts.

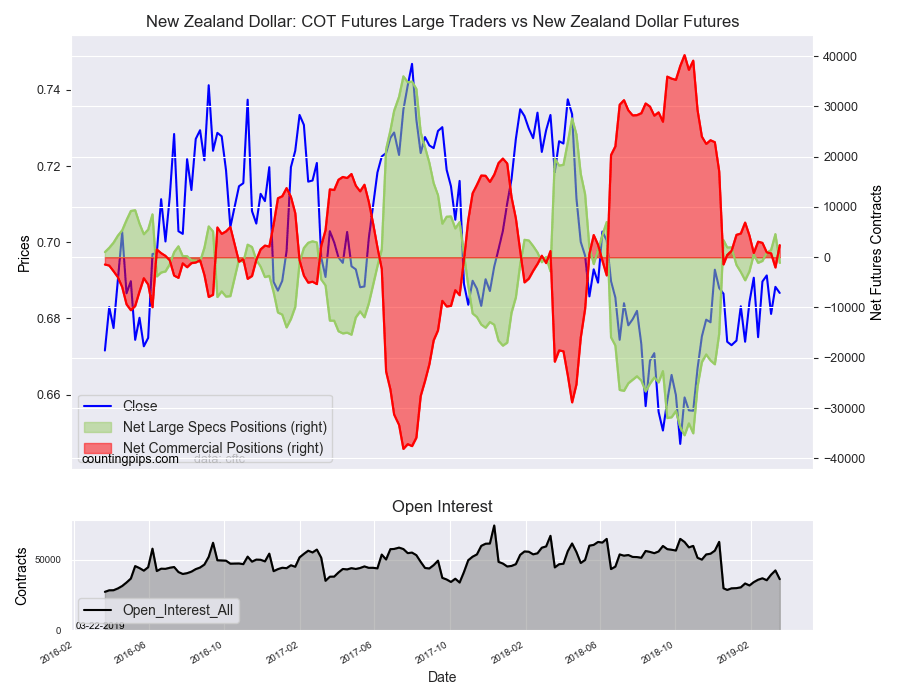

New Zealand Dollar:

The New Zealand dollar speculative standing came in at a net position of -1,124 contracts this week in the latest COT data. This was a weekly decline of -5,721 contracts from the previous week which had a total of 4,597 net contracts.

Mexican Peso:

Mexican peso speculators came in at a net position of 122,887 contracts this week. This was a weekly increase of 47,791 contracts from the previous week which had a total of 75,096 net contracts.

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).