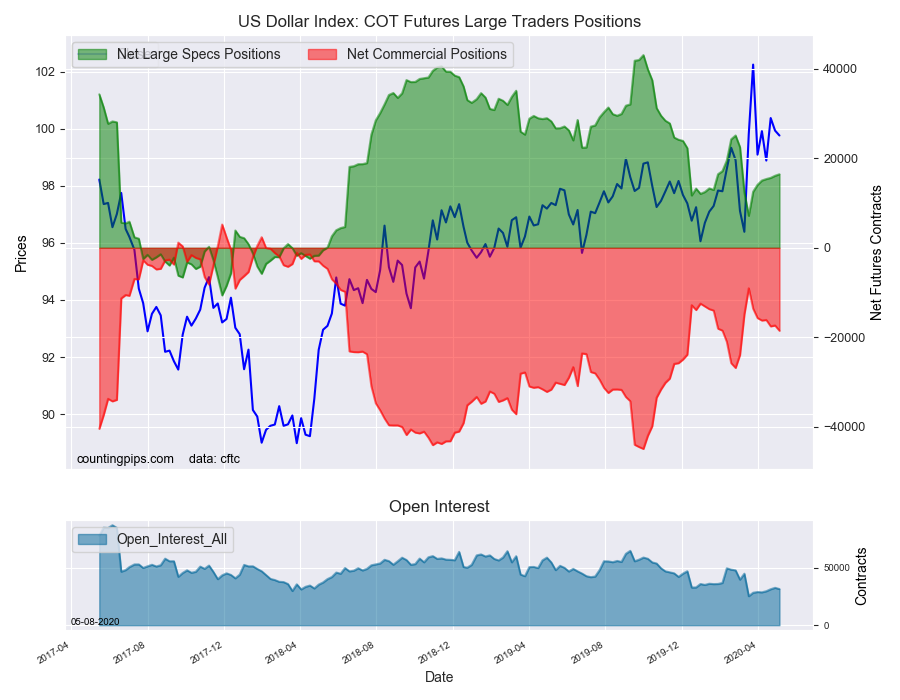

US Dollar Index Speculator Positions

Large currency speculators once again raised their bullish net positions in the US Dollar Index futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 16,425 contracts in the data reported through Tuesday, May 5th. This was a weekly gain of 337 contracts from the previous week which had a total of 16,088 net contracts.

This week’s net position change was the result of the gross bullish position (longs) sliding by -1,556 contracts (to a weekly total of 24,713 contracts) compared to the gross bearish position (shorts) which saw a larger decline of -1,893 contracts on the week (to a total of 8,288 contracts).

The US Dollar Index speculative positions continued their upward trend as bullish bets have now risen for seven weeks in a row. This steady uptrend has pushed the bullish net position to the highest level in nine weeks at over +16,000 contracts. These recent gains have nudged the current standing just above the 2020 weekly average of +16,009 contracts (through May 5th).

Individual Currencies Data this week:

In the other major currency contracts data, the biggest movements we saw in the speculators' category this week was the gain in the Australian dollar while British pound and the Japanese yen had the largest declines.

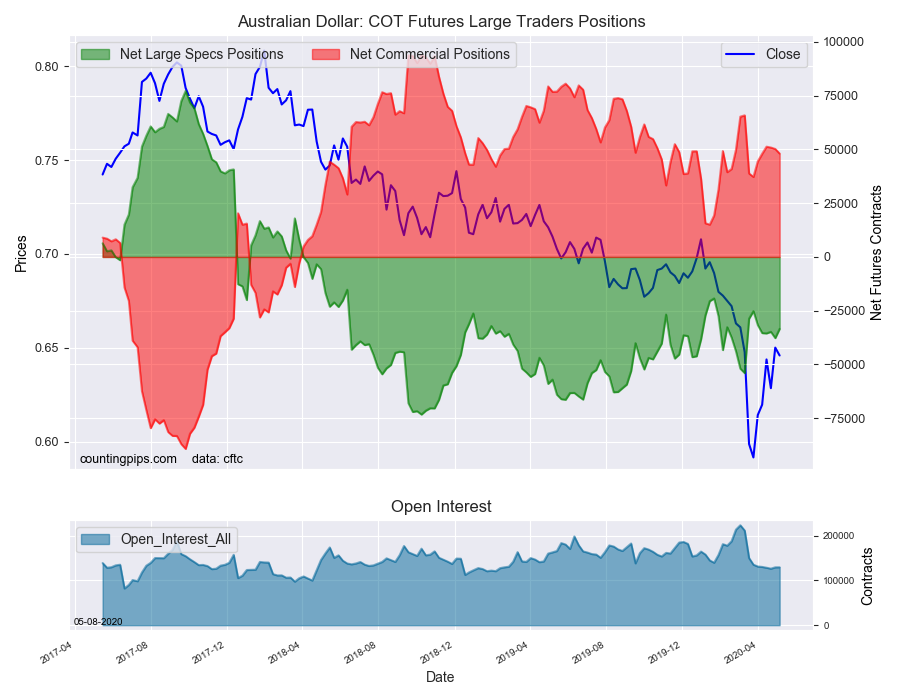

Australian dollar speculative positions rose by over +4,000 contracts this week. Previously, the AUD had fallen in four out of the prior five weeks and dropped to the most bearish level in seven weeks at a total of -37,741 contracts. The AUD standing has now remained in bearish territory for a total of 110 consecutive weeks, dating back to April of 2018.

British pound sterling positions dropped for the ninth consecutive week this week and fell further into bearish territory. The GBP speculator bets have now decreased by -47,167 contracts in just the last nine weeks and these declines have pushed the speculator overall standing to the lowest level (-12,005 contracts) in twenty-two weeks, dating back to December 10th of 2019.

Japanese yen positions fell this week for the first time in five weeks this week. The yen had risen by +14,044 contracts in those previous four weeks before this week’s slight turnaround. The current standing for the yen speculator position remains bullish for the ninth straight week and has now been above the +20,000 net contract level for five weeks.

Overall, the major currencies that saw improving speculator positions this week were the US dollar index (337 weekly change in contracts), Swiss franc (2,215 contracts) and the Australian dollar (4,286 contracts).

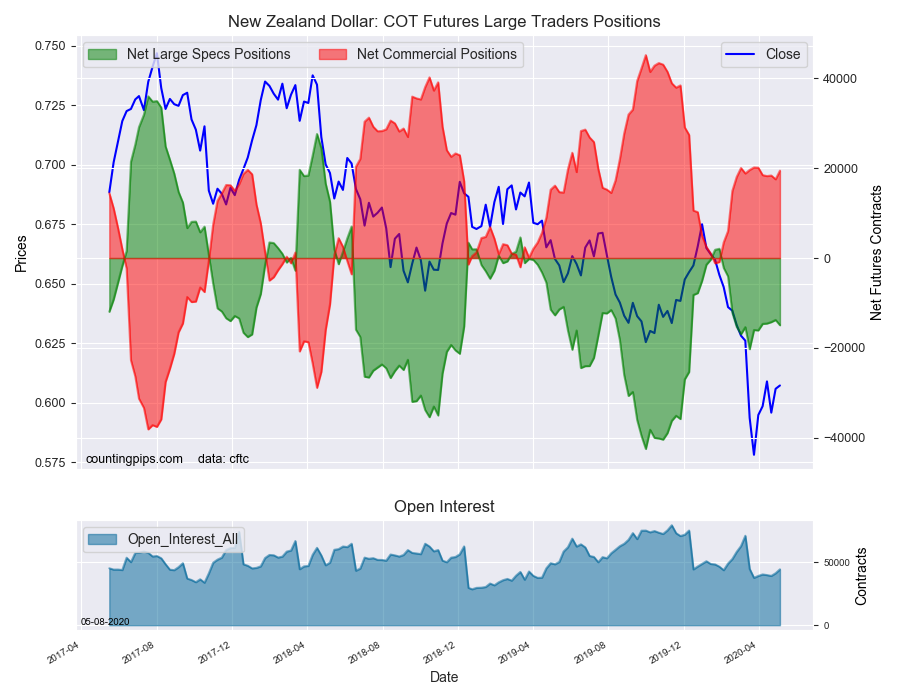

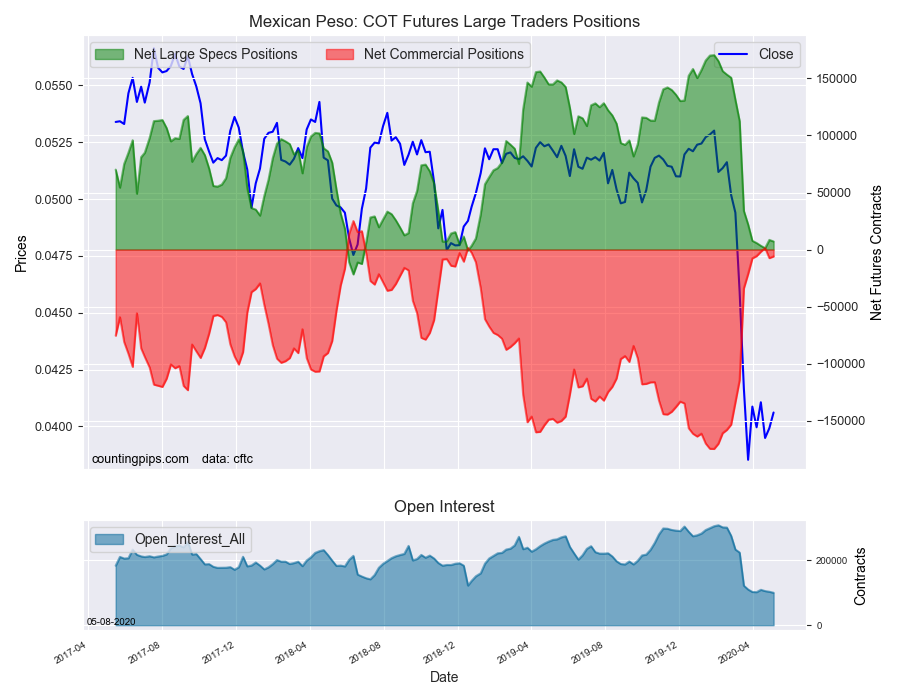

The currencies whose speculative bets declined this week were the euro (-3,382 weekly change in contracts), British pound sterling (-5,324 contracts), Japanese yen (-5,112 contracts), Canadian dollar (-3,008 contracts), New Zealand dollar (-1,174 contracts) and the Mexican peso (-1,372 contracts).

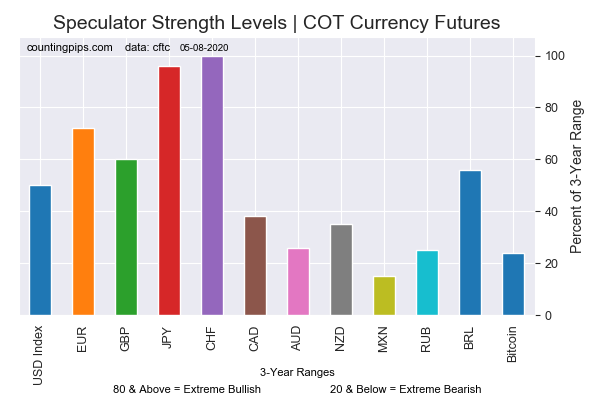

Chart: Current Strength of Each Currency compared to their 3-Year Range

The above chart depicts each currency’s current speculator strength level compared to data of the past 3 years. A score of 0 percent would mean speculator bets are currently at the lowest level of the past three years. A 100 percent score would be at the highest level while a 50 percent score would mean speculator bets are right in the middle of the data (a neutral score). We use above 80 percent (extreme bullish) and below 20 percent (extreme bearish) as extreme score measurements.

Please see the data table and individual currency charts below.

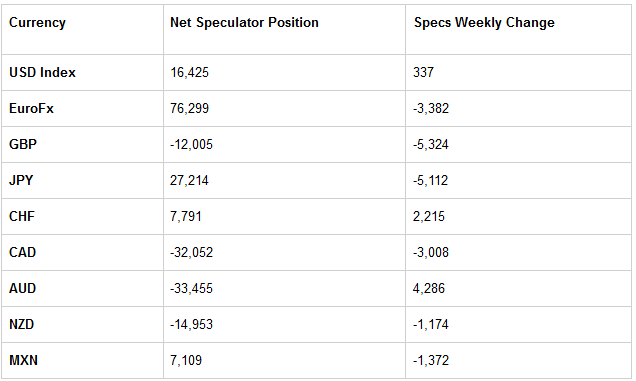

Table of Large Speculator Levels & Weekly Changes:

This latest COT data is through Tuesday and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the dollar will gain versus the euro.

Weekly Charts: Large Trader Weekly Positions vs Price

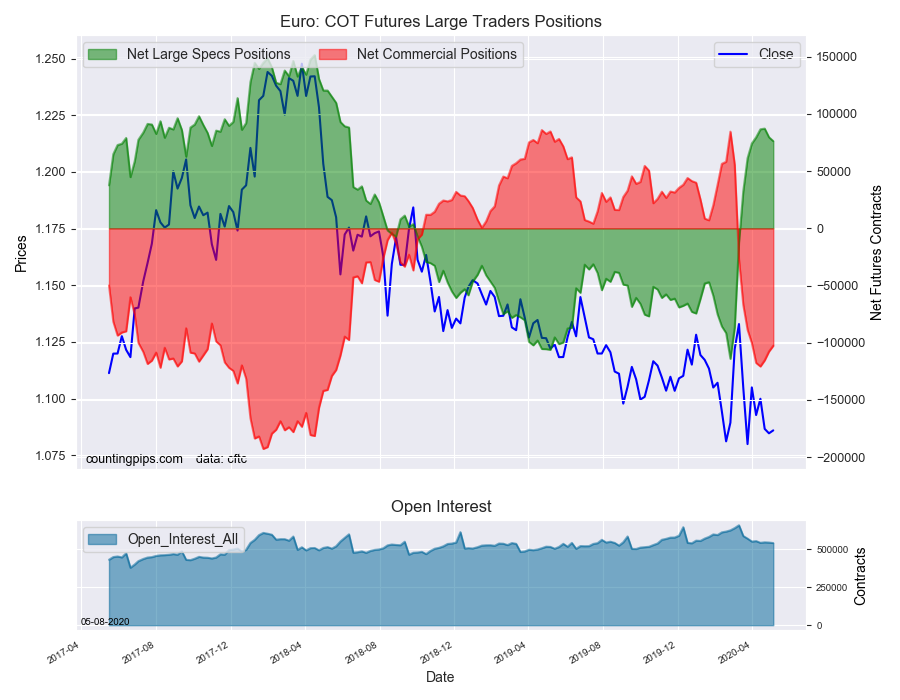

EuroFX:

The Euro large speculator standing this week came in at a net position of 76,299 contracts in the data reported through Tuesday. This was a weekly lowering of -3,382 contracts from the previous week which had a total of 79,681 net contracts.

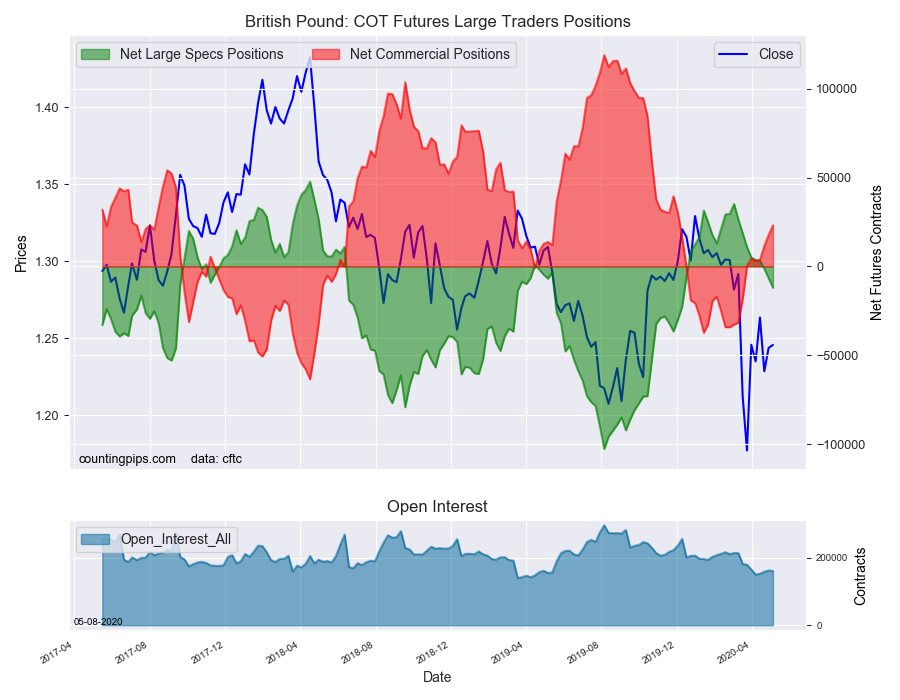

British Pound Sterling:

The large British pound sterling speculator level resulted in a net position of -12,005 contracts in the data reported this week. This was a weekly lowering of -5,324 contracts from the previous week which had a total of -6,681 net contracts.

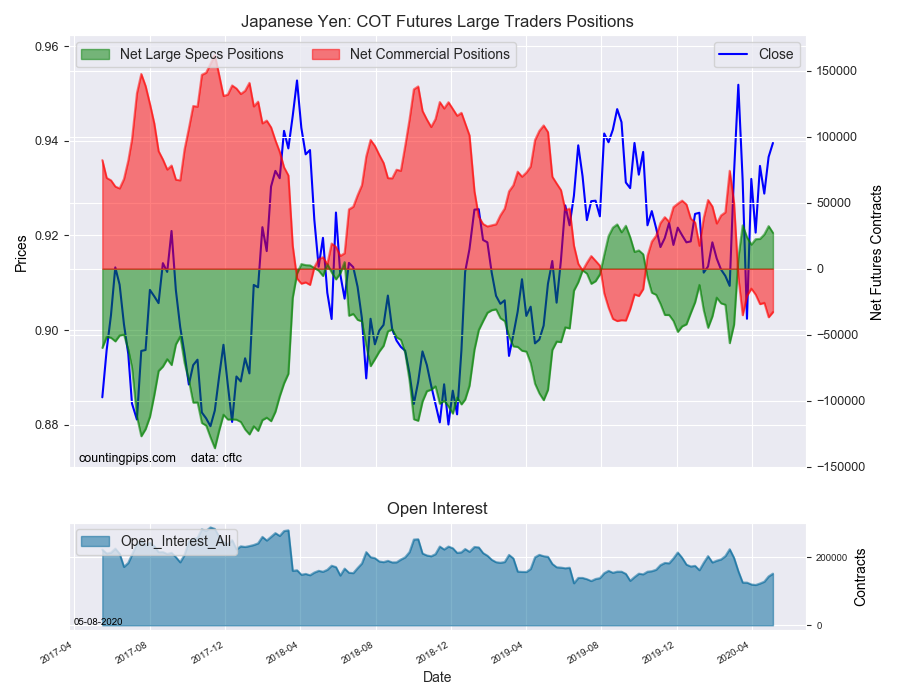

Japanese Yen:

Large Japanese yen speculators was a net position of 27,214 contracts in this week’s data. This was a weekly lowering of -5,112 contracts from the previous week which had a total of 32,326 net contracts.

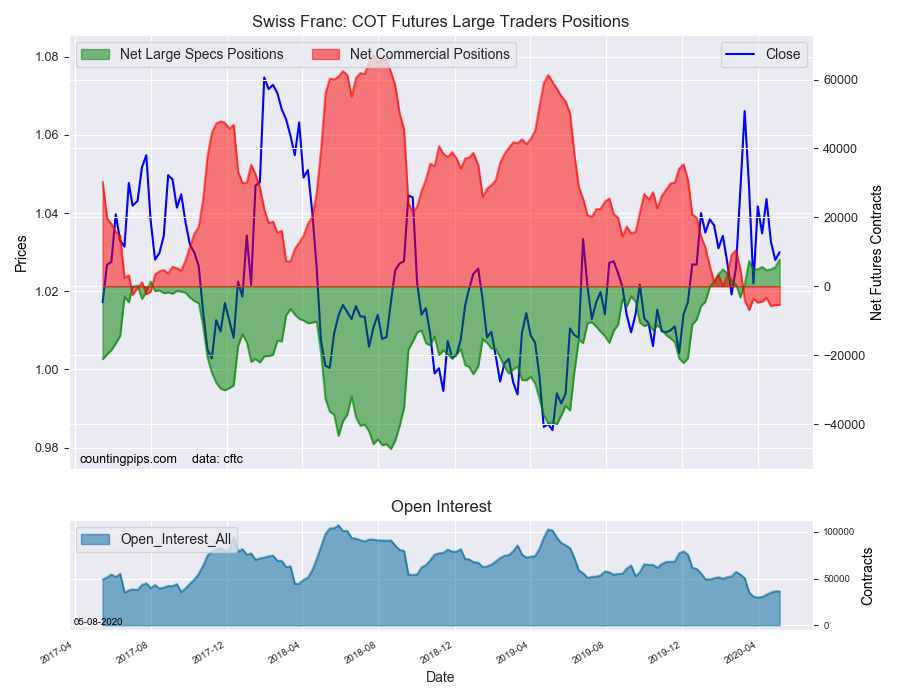

Swiss Franc:

The Swiss franc speculator standing this week equaled a net position of 7,791 contracts in the data through Tuesday. This was a weekly gain of 2,215 contracts from the previous week which had a total of 5,576 net contracts.

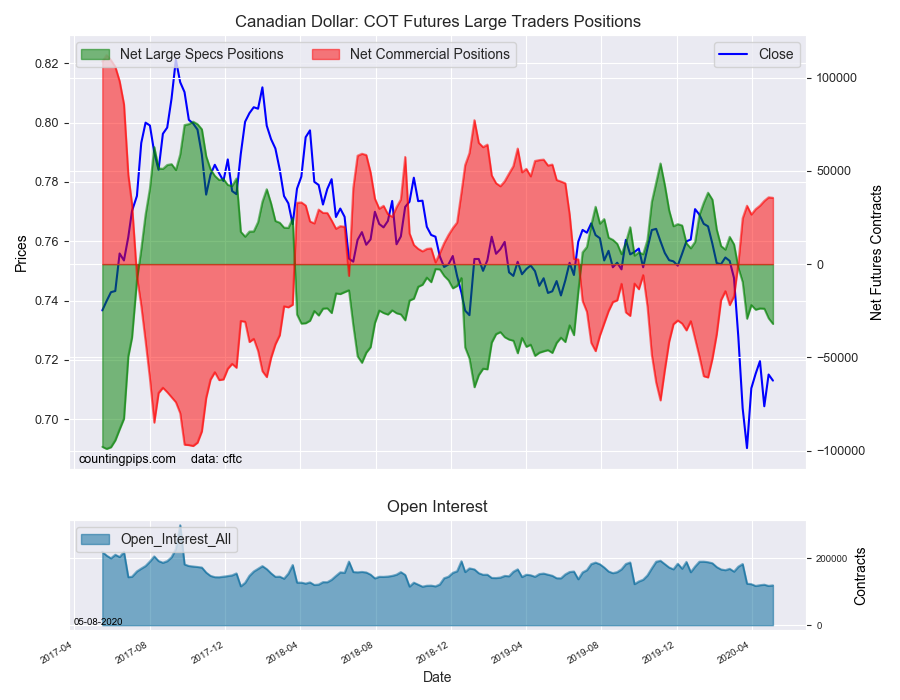

Canadian Dollar:

Canadian dollar speculators recorded a net position of -32,052 contracts this week. This was a lowering of -3,008 contracts from the previous week which had a total of -29,044 net contracts.

Australian Dollar:

The large speculator positions in Australian dollar futures came in at a net position of -33,455 contracts this week in the data ending Tuesday. This was a weekly boost of 4,286 contracts from the previous week which had a total of -37,741 net contracts.

New Zealand Dollar:

The New Zealand dollar speculative standing resulted in a net position of -14,953 contracts this week in the latest COT data. This was a weekly fall of -1,174 contracts from the previous week which had a total of -13,779 net contracts.

Mexican Peso:

Mexican peso speculators came in at a net position of 7,109 contracts this week. This was a weekly fall of -1,372 contracts from the previous week which had a total of 8,481 net contracts.