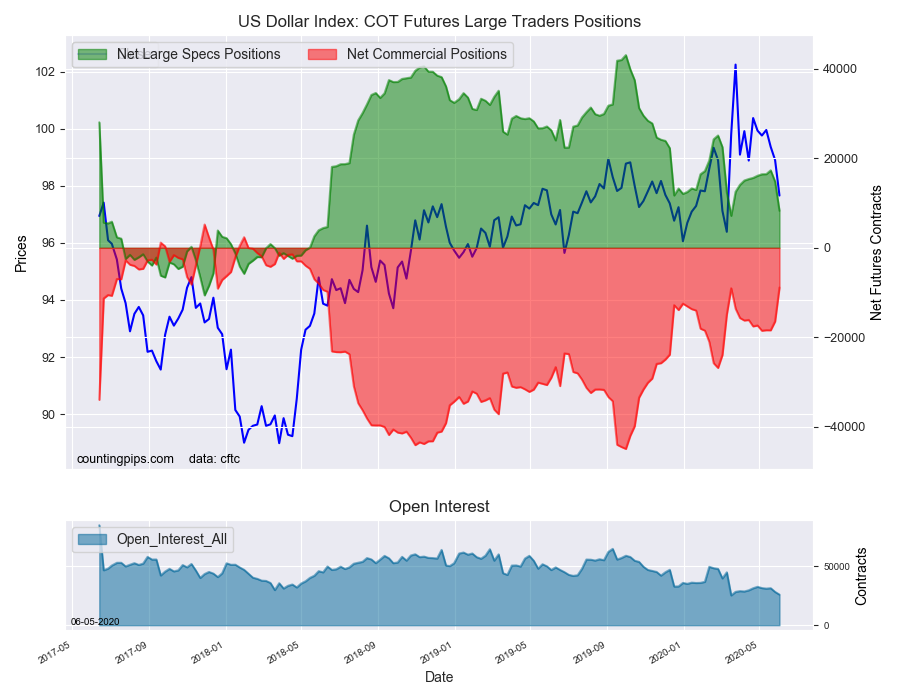

US Dollar Index Speculator Positions

Large currency speculators lowered their bullish net positions in the US Dollar Index futures markets for a second straight week this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 8,258 contracts in the data reported through Tuesday, June 2nd. This was a weekly decrease of -6,541 contracts from the previous week which had a total of 14,799 net contracts.

This week’s net position was the result of the gross bullish position (longs) decreasing by -3,162 contracts (to a weekly total of 17,877 contracts) compared to the gross bearish position (shorts) which saw a gain by 3,379 contracts on the week (to a total of 9,619 contracts).

Speculators reduced their US Dollar Index bullish bets for a second straight week and by the largest one-week decline in the past twelve weeks. Previously, the US Dollar Index bets had been steadily (although in small increments) climbing for nine straight weeks from March 24th to May 19th. These last two weeks of declines, however, have now cut the bullish position by -9,039 contracts and brought the overall standing to the least bullish level since March 17th. Overall, the USD Index bets have continued to be in bullish territory for 108 consecutive weeks, dating back to May 8th of 2018.

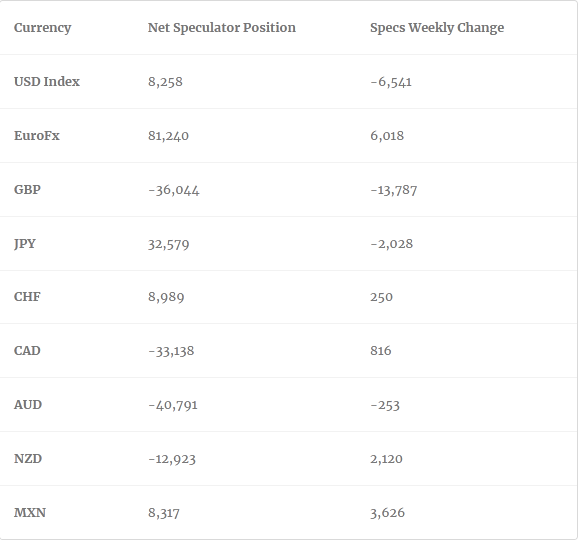

Individual Currencies Data this week:

In the other major currency contracts data, we saw only one substantial change (+ or – 10,000 contracts) in the speculators category this week and this took place in the British pound sterling.

The British pound sterling speculators raised their bearish bets for the thirteenth consecutive week this week. The GBP bets have fallen by -71,206 contracts over that time-frame. GBP bets were in bullish territory as recently as April 14th but speculators have now pushed the net position to the most bearish level of the past twenty-seven weeks, dating back to November 26th.

Euro speculator bets rose this week for a second straight week and for the third time in the past four weeks. Sentiment for the euro has pushed the current standing back over the +80,000 contract level for the first time since April 21st. The EUR/USD currency pair, meanwhile, finished this week with a third week of gains and hovered around the 1.13 exchange rate, a level not seen since March.

Overall, the major currencies that saw improving speculator positions this week were the euro (6,018 weekly change in contracts), Swiss franc (250 contracts), New Zealand dollar (2,120 contracts) and the Mexican peso (3,626 contracts).

The currencies whose speculative bets declined this week were the US dollar index (-6,541 weekly change in contracts), British pound sterling (-13,787 contracts), Japanese yen (-2,028 contracts), Canadian dollar (816 contracts) and the Australian dollar (-253 contracts).

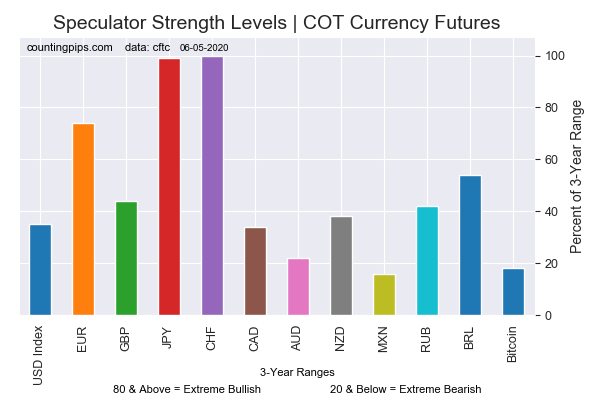

Chart: Current Strength of Each Currency compared to their 3-Year Range

The above chart depicts each currency’s current speculator strength level compared to data of the past 3 years. A score of 0 percent would mean speculator bets are currently at the lowest level of the past three years. A 100 percent score would be at the highest level while a 50 percent score would mean speculator bets are right in the middle of the data (a neutral score). We use above 80 percent (extreme bullish) and below 20 percent (extreme bearish) as extreme score measurements.

Please see the data table and individual currency charts below.

Table of Large Speculator Levels & Weekly Changes:

This latest COT data is through Tuesday and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the dollar will gain versus the euro.

Weekly Charts: Large Trader Weekly Positions vs Price

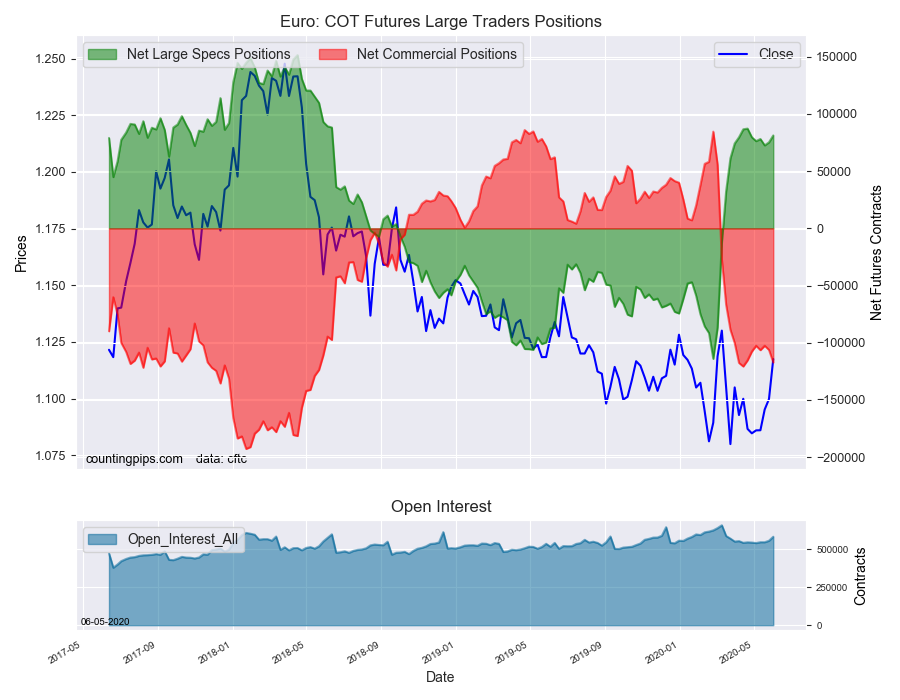

EuroFX:

The Euro large speculator standing this week reached a net position of 81,240 contracts in the data reported through Tuesday. This was a weekly increase of 6,018 contracts from the previous week which had a total of 75,222 net contracts.

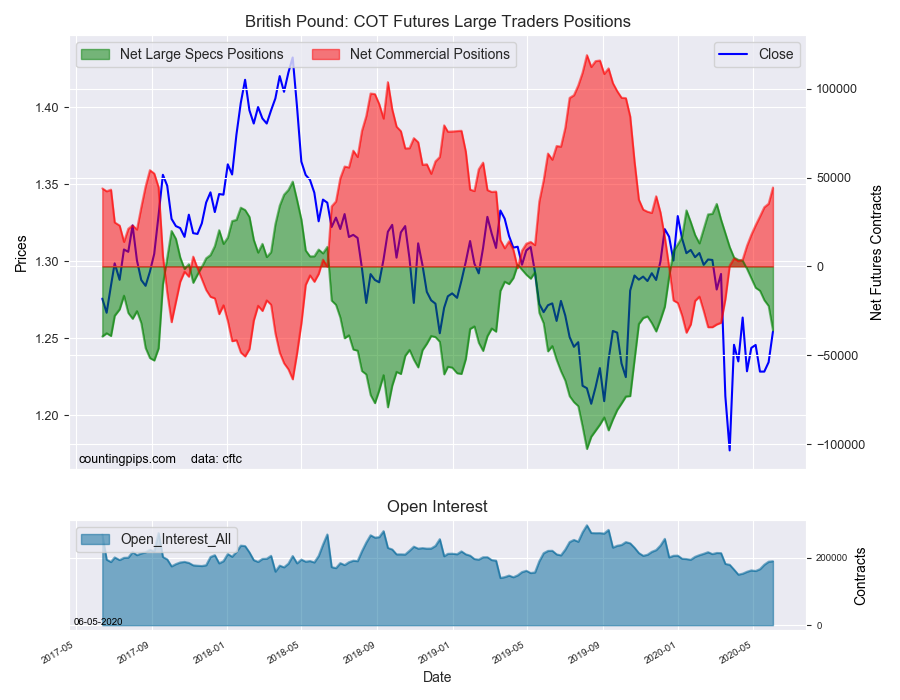

British Pound Sterling:

The large British pound sterling speculator level totaled a net position of -36,044 contracts in the data reported this week. This was a weekly reduction of -13,787 contracts from the previous week which had a total of -22,257 net contracts.

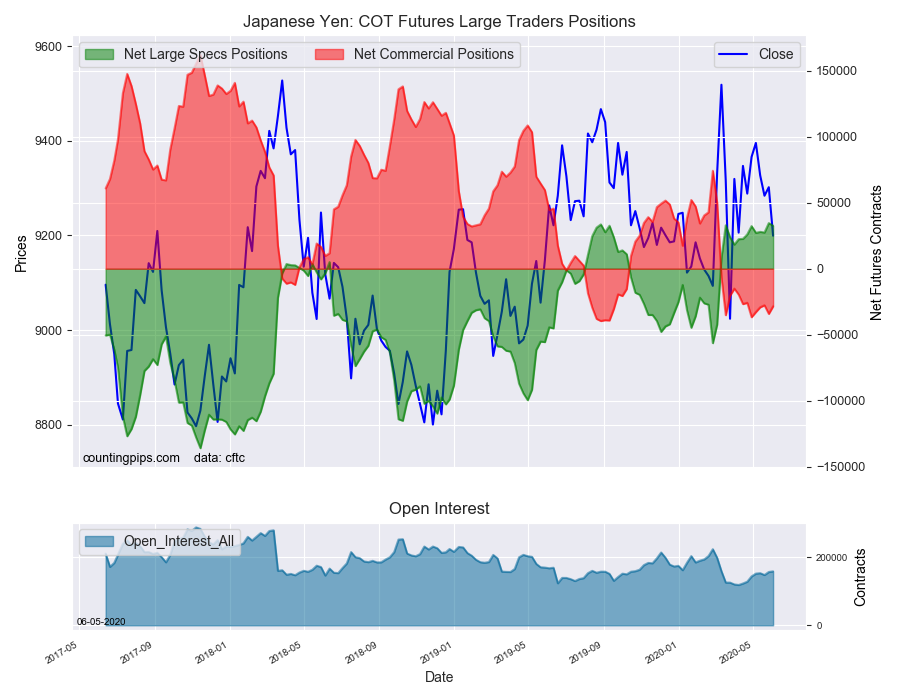

Japanese Yen:

Large Japanese yen speculators resulted in a net position of 32,579 contracts in this week’s data. This was a weekly fall of -2,028 contracts from the previous week which had a total of 34,607 net contracts.

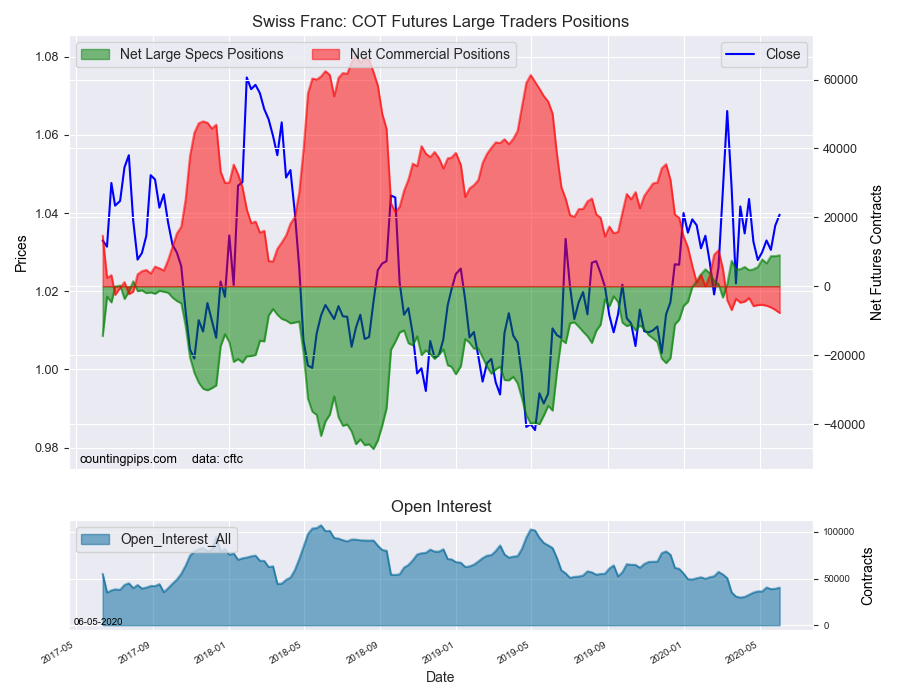

Swiss Franc:

The Swiss franc speculator standing this week totaled a net position of 8,989 contracts in the data through Tuesday. This was a weekly lift of 250 contracts from the previous week which had a total of 8,739 net contracts.

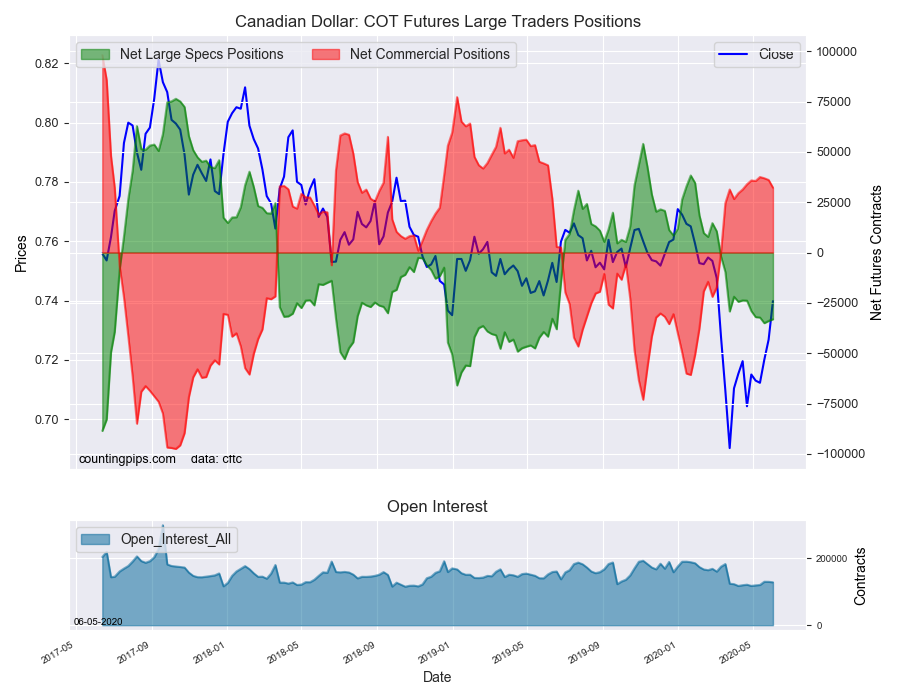

Canadian Dollar:

Canadian dollar speculators equaled a net position of -33,138 contracts this week. This was a boost of 816 contracts from the previous week which had a total of -33,954 net contracts.

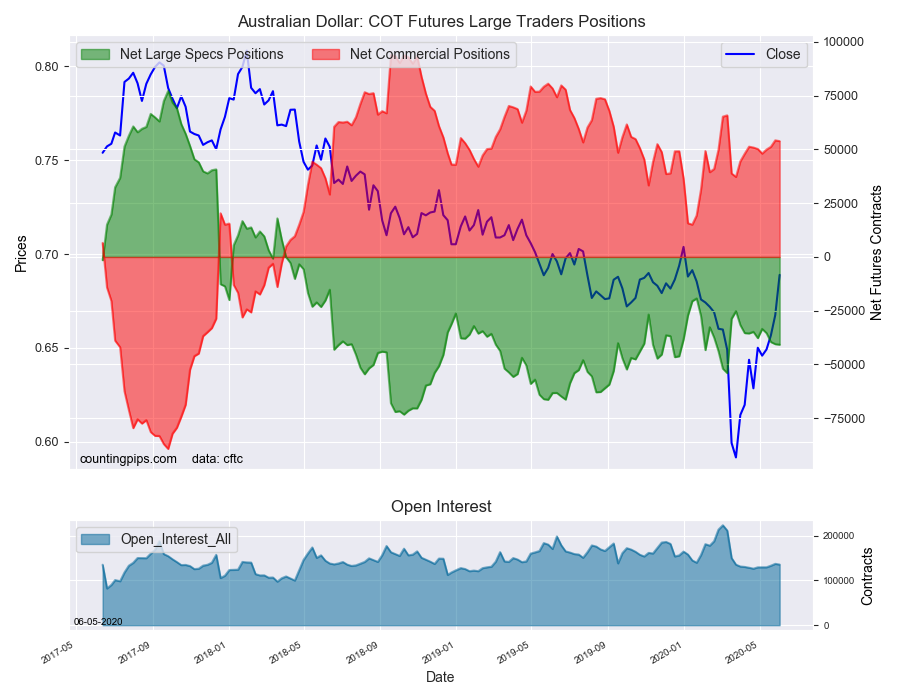

Australian Dollar:

The large speculator positions in Australian dollar futures was a net position of -40,791 contracts this week in the data ending Tuesday. This was a weekly reduction of -253 contracts from the previous week which had a total of -40,538 net contracts.

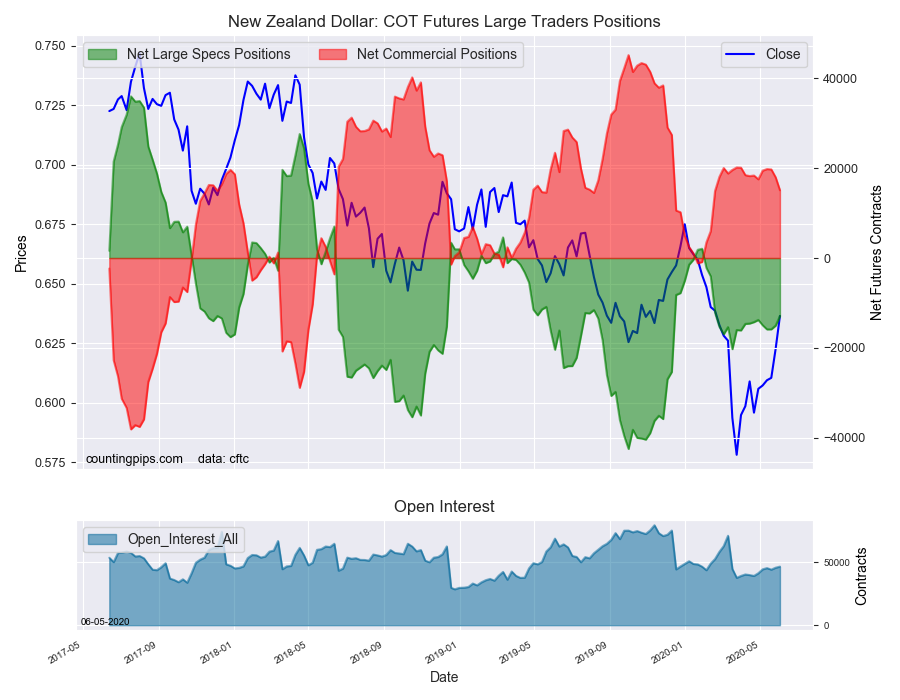

New Zealand Dollar:

The New Zealand dollar speculative standing came in at a net position of -12,923 contracts this week in the latest COT data. This was a weekly lift of 2,120 contracts from the previous week which had a total of -15,043 net contracts.

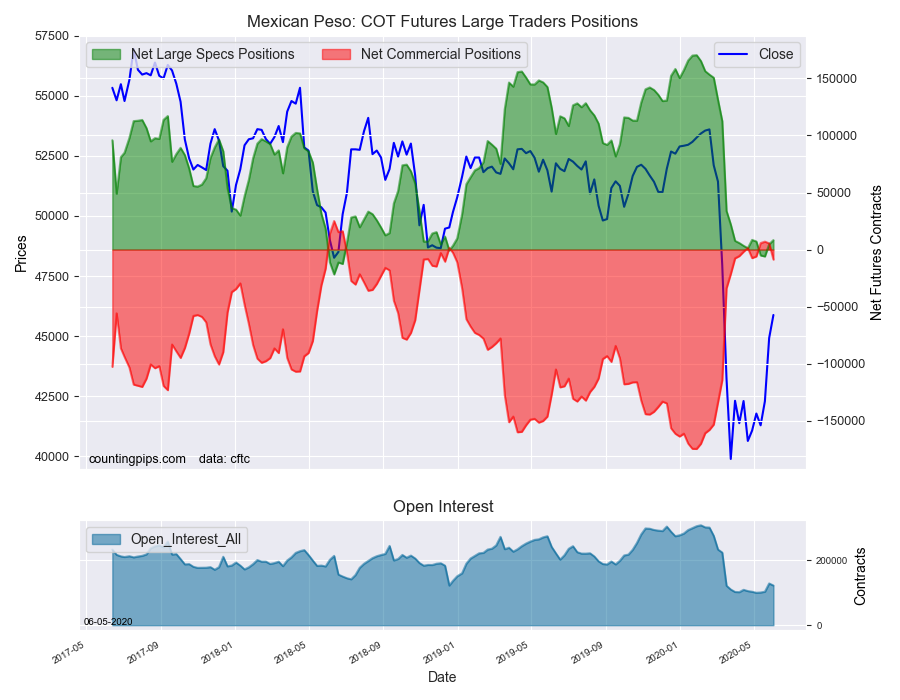

Mexican Peso:

Mexican peso speculators reached a net position of 8,317 contracts this week. This was a weekly advance of 3,626 contracts from the previous week which had a total of 4,691 net contracts.