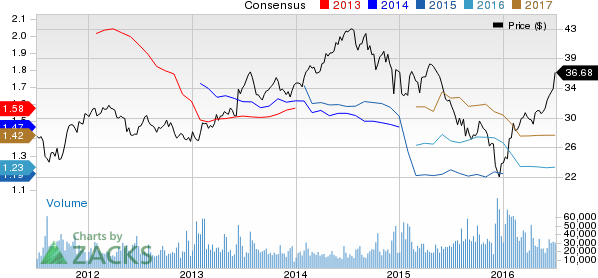

Shares of premier natural gas company, Spectra Energy Corp. (NYSE:SE) hit a 52-week high of $36.88 on Jul 1, 2016. Shares closed at $36.68, reflecting a solid return of 21.9% over the past three months. The average trading volume for the last three months aggregated 4,512,100 shares. The midstream player has a market cap of $25.63 billion. Over the past 52 weeks, the company’s shares have ranged from a low of $21.43 to a high of $36.88.

Spectra's Natural Gas Infrastructure Plays Hold Potential

Spectra Energy is one of North America’s premier natural gas infrastructure plays with a strong presence in growth markets. These positions should lead to value-accretive growth opportunities in the coming years. An above-average dividend yield of 4.52% is an added positive.

The company’s core fee-based businesses of storage, transmission, distribution and Canadian gathering and processing have the potential for solid earnings and cash flow growth in the long run. Going forward, Spectra intends to increase its presence in the oil and refined products pipelines, storage tanks and terminals business. The company plans to invest about $25 billion over the next decade in fee-based gas infrastructure growth projects.

Management remains optimistic on its future performance based on its expansion program, which remains on track. With its market-leading position, diversified asset portfolio and strong investment opportunities, we expect Spectra Energy to sustain the growth momentum.

Spectra Energy currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

A few better-ranked stocks from the broader energy sector are CVR Refining, LP (NYSE:CVRR) , World Fuel Services Corp. (NYSE:INT) and Tallgrass Energy GP, LP (NYSE:TEGP) . Each of these stocks sports a Zacks Rank #1 (Strong Buy).

SPECTRA ENERGY (SE): Free Stock Analysis Report

WORLD FUEL SVCS (INT): Free Stock Analysis Report

TALLGRASS ENRGY (TEGP): Free Stock Analysis Report

CVR REFINING LP (CVRR): Free Stock Analysis Report

Original post

Zacks Investment Research