There is a mismatch in the SPDR S&P 500 ETF (N:SPY) option implied volatility right now. This is going into the U.S. unemployment report coming up this Friday.

The out of the money calls, expiring this Friday March 4th, are trading at a tremendous discount to the out of the money puts. This is telling me that the market is expecting a bearish report. I am not one to predict where the unemployment numbers will come in at. Right now the consensus is that the U.S. added about 200,000 jobs in February. I do know that the Fed is looking at the report. The market could go either way, depending on the numbers we get. I think a good trade is to sell the 192 puts expiring on March 4th and buy the 197 calls. The underlying closed at 195.08 on Friday.

The 192 puts have an implied volatility of 21.45%. The 197 calls have an implied volatility of 16.6%. You can probably execute this spread with a zero net cash outlay or a small debit or credit. Considering the calls are less out of the money than the puts, I think that is a good deal.

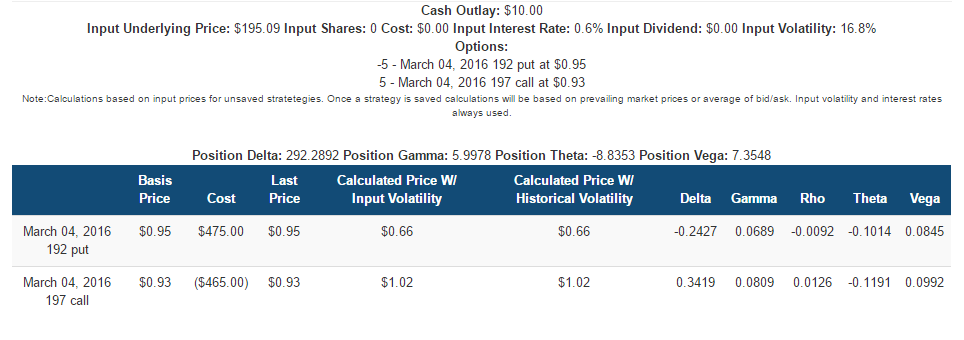

Here is what the details of the trade look like. I am using the closing prices from Friday and an input volatility equal to the one-year historical volatility of the SPDR S&P 500 ETF of 16.8%, buying and selling five contracts each.

You can see that the vega ends up being positive for the position, since the calls are nearer to the strike price than the puts. I think this could work to my advantage if or when volatility ramps up going into the report. The obvious potential downside is that this does not happen. Notice that theta is negative, indicating I will lose out on time decay.

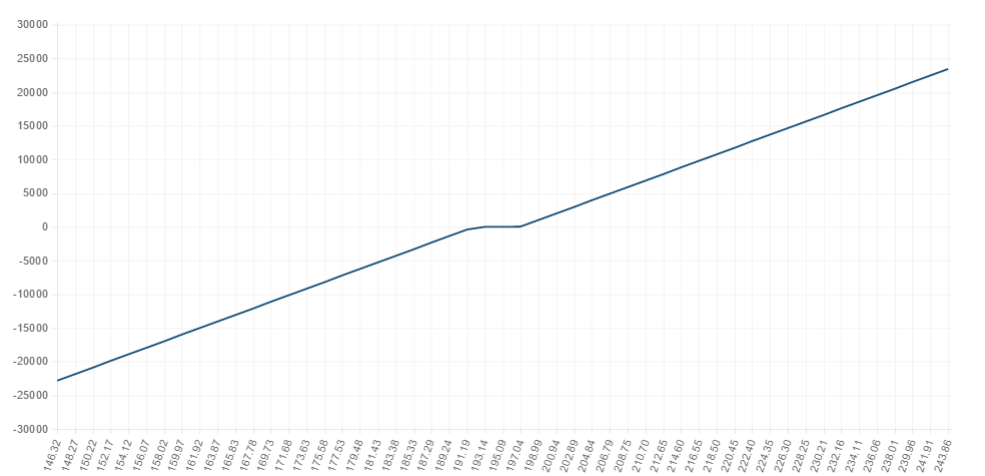

The net position is positive delta. You are virtually long the underlying, with a small range where the gain loss is even. This is best illustrated by looking at the G/L graph at expiration, which I included below.

I am looking to enter the position Monday and sell any spike in implied volatility. If that does not happen before Friday I could hold the position through the Unemployment report, keeping in mind the potential loss from a down move in the SPDR S&P 500 ETF.