Financial markets have been tough to gauge at the best times, but the recent phenomenon of bad news equalling good news continues to rewrite the rules in modern day macro economic theory. Akin to rewarding a child for misbehaving, lack lustre Spanish services data served to rally EUR yesterday morning, as GBP/EUR dropped 60 odd pips in early morning trading. As we saw in the immediate build up to Draghi’s bond buying plan (a month ago) and the FED’s announcement of QE3, poor economic data (generally seen as bearish) had a bullish reaction in the FX markets as the markets try to anticipate pre-emptive responses.

It has gotten to the point where Spain’s persistent deterioration is now seen as positive as it inevitably will bring about the Government requesting assistance sooner rather than later. The markets can be a cruel mistress indeed. Member state services figures were poor across the board with the Eurozone itself shrinking by its fastest rate in almost 3 years. Retail sales for the month grew by 0.1%. The reaction to Spain saw GBP/EUR fall below 1.25, holding strong this morning in the mid 1.24 range.

UK services confirmed a slight drop off since the Olympics, but reported growth of 52.2 vs August’s 53.7. The figures are in keeping with this week’s earlier construction and industrial figures which paint a flat Q3 GDP picture. The BoE meets this morning but as the tune hasn’t changed from earlier in the week we expect a rather muted session from the Bank this month.

Gains in the US manufacturing index earlier in the week were boosted by the non-manufacturing index yesterday which saw levels climb back to the highs seen last March. The news, although seen as positive, had little lasting effect on the USD push that followed. Any gains enjoyed were soon gobbled up by the close of the US session yester-eve. Cable is virtually unchanged sitting just above 1.61. In order to see any strong USD push, the US will need to see stronger gains in employment

Other snippets from the day include Cyprus refusing to the terms of the IMF austerity plan, saying it won’t follow in the footsteps of Greece. Greek talks with the Troika seem likely to be postponed until after the US elections and Portugal released its austerity plan to reach its 3% deficit target.

We have an interesting morning on the cards with a series of Spanish bond auctions. Although we saw Spanish yields hold steady yesterday in the face of all the school yard bullying, the results will be closely monitored and translated. ECB and BoE rate and policy decisions with jobless claims from the US the best of the rest.

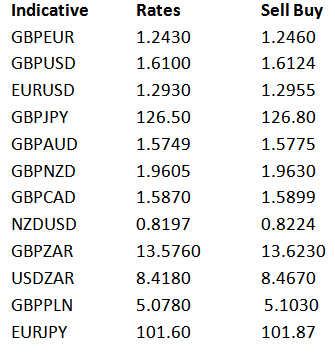

Latest exchange rates at time of writing

It has gotten to the point where Spain’s persistent deterioration is now seen as positive as it inevitably will bring about the Government requesting assistance sooner rather than later. The markets can be a cruel mistress indeed. Member state services figures were poor across the board with the Eurozone itself shrinking by its fastest rate in almost 3 years. Retail sales for the month grew by 0.1%. The reaction to Spain saw GBP/EUR fall below 1.25, holding strong this morning in the mid 1.24 range.

UK services confirmed a slight drop off since the Olympics, but reported growth of 52.2 vs August’s 53.7. The figures are in keeping with this week’s earlier construction and industrial figures which paint a flat Q3 GDP picture. The BoE meets this morning but as the tune hasn’t changed from earlier in the week we expect a rather muted session from the Bank this month.

Gains in the US manufacturing index earlier in the week were boosted by the non-manufacturing index yesterday which saw levels climb back to the highs seen last March. The news, although seen as positive, had little lasting effect on the USD push that followed. Any gains enjoyed were soon gobbled up by the close of the US session yester-eve. Cable is virtually unchanged sitting just above 1.61. In order to see any strong USD push, the US will need to see stronger gains in employment

Other snippets from the day include Cyprus refusing to the terms of the IMF austerity plan, saying it won’t follow in the footsteps of Greece. Greek talks with the Troika seem likely to be postponed until after the US elections and Portugal released its austerity plan to reach its 3% deficit target.

We have an interesting morning on the cards with a series of Spanish bond auctions. Although we saw Spanish yields hold steady yesterday in the face of all the school yard bullying, the results will be closely monitored and translated. ECB and BoE rate and policy decisions with jobless claims from the US the best of the rest.

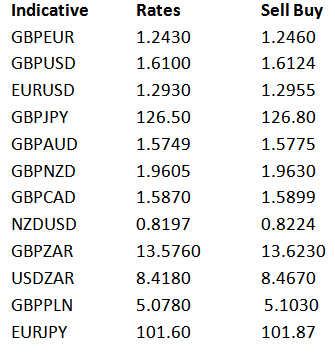

Latest exchange rates at time of writing