On Sunday, Spanish voters will head to the polls for the fourth time in eight years. A snap vote was called in February because Socialist party (PSOE) leader Sanchez failed to pass the 2019 budget bill with his minority government, after regional parties withdrew their silent support of the government as 12 secessionist leaders from the Catalan independence movement went on trial.

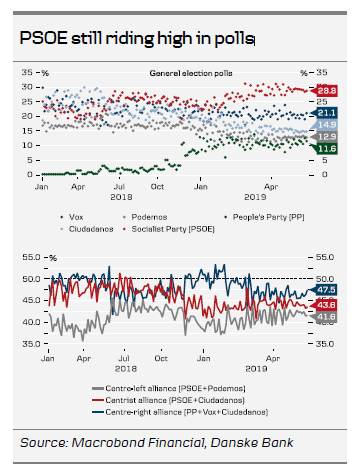

Latest polls point to a clear possibility of a hung parliament resulting from the election, with both the traditional centre-right and centre-left alliances short of an absolute majority. While the PSOE is still riding high among voters, and is on track to add some 50 seats to its current 84 according to the latest polls, the far right Vox party is also showing strong momentum after taking a hard stance towards the Catalan separatists and it might even become the fourth largest party ahead of Podemos. A majority for a centre-left alliance between the PSOE, Podemos and the Catalan and Basque nationalists could be within reach, but its 'shelf-live' might be limited in light of the still unresolved Catalan question. Furthermore, the election campaign has seen parties moving away from the political centre, positioning themselves more clearly at the political left (PSOE) or right (Cuidadanos, PP), which in turn could further complicate the coalition-building process ahead.

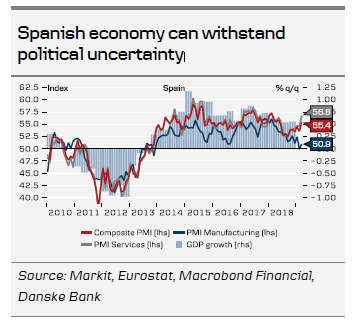

Lately Spain has been one of the bright spots in the general Eurozone slowdown , although the latest data has shown that the manufacturing sector has not been immune to the global slowdown. Although the election might again result in a prolonged period of political uncertainty, the Spanish economy has been fairly resilient to previous such episodes even at the peak of the Catalan crisis in 2017. Hence, irrespective of the election outcome, we still expect the Spanish economy to do well and outperform the euro area in the coming years. However, risks to the outlook still linger, not least from the 22.3% rise in the minimum wage enacted in January 2019. At 13.9%, the unemployment rate remains considerably above the euro area average of 7.8% and the large rise in the minimum wage might adversely affect employment for young, low skilled and temporary workers.

Markets remain complacent despite the possibility of renewed political uncertainty in Spain. The economy remains on a strong footing, the rating outlook is stable with very limited risk of significant fiscal easing, and the risk of a Eurosceptic government is small with the three leading parties all having pro-EU views. Furthermore, periphery fixed income markets continue to see support from the hunt for carry after the ECB set the scene for a 'low-for-longer' interest rate environment at the March meeting. That said, a hung parliament situation could create some market nervousness and trigger some profit-taking in the Spanish government bond market. However, we expect any election uncertainty in the market to be short-lived given the underlying supportive factors mentioned above. Hence, Spain remains our top pick in the periphery . For more on our strategic view on the European Fixed Income market, see our Government Bonds Weekly published on 12 April.