Equities

Asian markets skidded on Friday as investors focused once again on the European debt crisis. The Nikkei slumped 1.4% to 8670, as financials dropped more than 3%. The ASX 200 eased .2% to 4199, and the Shanghai Composite sank .7% to 2169. Bucking the trend, the Hang Seng rose .4% to 19641, as China Unicom surged 7.2% thanks to strong subscriber growth. The Kospi ended flat at 1823, as tech shares offset losses in other sectors.

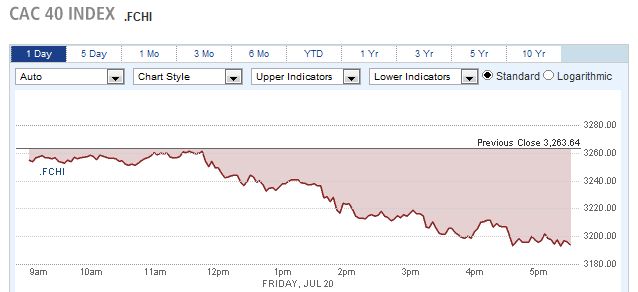

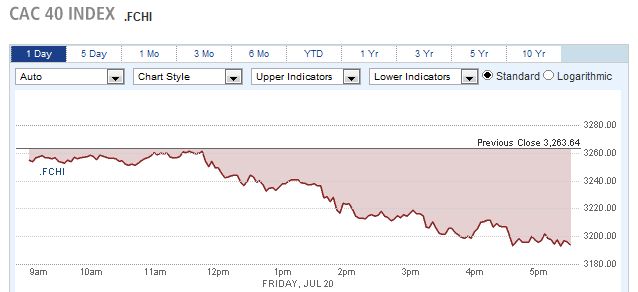

Spanish bonds-yields continued to rise past 7%, sending the region’s indexes sharply lower. The CAC40 tanked 2.1% to 3194, the DAX tumbled 1.9% to 6630, and the FTSE dropped 1.1% to 5652. Nokia shares plunged 7.6%, reversing Thursday’s gains, as investors continued to digest the company’s recent earnings announcement.

US stocks skidded as well, succumbing to pressure from Europe. The Dow lost 121 points to 12823, the S&P 500 lost 1% to 1363, and the Nasdaq fell 1.4% to 2925.

Microsoft shares shed 1.8% to 30.11 after reporting its first loss since the company went public in 1986, although earnings were above analyst forecasts.

AMD shares tumbled 13.2% on weak revenue forecasts, and Chipotle tanked 21.5% after warning of weak sales growth.

Currencies

The euro came under pressure on Friday, sinking 1% against the dollar to 1.2156. The EUR/JPY fell 1.1% to a record low of 95.35, before settling at 95.42. The Swiss franc kept pace with the euro’s losses, dropping 1% to .9879, and the pound sank .6% to 1.5620. The Canadian dollar slipped .4% to .7782, and the Australian dollar declined .2% to 1.0400.

Economic Outlook

No major economic news is due on Monday. Earnings are expected from Baidu, Crane, Halliburton, Hasbro, McDonald’s, Texas Instruments, Taro, and Zions.

Asian markets skidded on Friday as investors focused once again on the European debt crisis. The Nikkei slumped 1.4% to 8670, as financials dropped more than 3%. The ASX 200 eased .2% to 4199, and the Shanghai Composite sank .7% to 2169. Bucking the trend, the Hang Seng rose .4% to 19641, as China Unicom surged 7.2% thanks to strong subscriber growth. The Kospi ended flat at 1823, as tech shares offset losses in other sectors.

Spanish bonds-yields continued to rise past 7%, sending the region’s indexes sharply lower. The CAC40 tanked 2.1% to 3194, the DAX tumbled 1.9% to 6630, and the FTSE dropped 1.1% to 5652. Nokia shares plunged 7.6%, reversing Thursday’s gains, as investors continued to digest the company’s recent earnings announcement.

US stocks skidded as well, succumbing to pressure from Europe. The Dow lost 121 points to 12823, the S&P 500 lost 1% to 1363, and the Nasdaq fell 1.4% to 2925.

Microsoft shares shed 1.8% to 30.11 after reporting its first loss since the company went public in 1986, although earnings were above analyst forecasts.

AMD shares tumbled 13.2% on weak revenue forecasts, and Chipotle tanked 21.5% after warning of weak sales growth.

Currencies

The euro came under pressure on Friday, sinking 1% against the dollar to 1.2156. The EUR/JPY fell 1.1% to a record low of 95.35, before settling at 95.42. The Swiss franc kept pace with the euro’s losses, dropping 1% to .9879, and the pound sank .6% to 1.5620. The Canadian dollar slipped .4% to .7782, and the Australian dollar declined .2% to 1.0400.

Economic Outlook

No major economic news is due on Monday. Earnings are expected from Baidu, Crane, Halliburton, Hasbro, McDonald’s, Texas Instruments, Taro, and Zions.