Equities

Asian markets tumbled on Monday as fear over Spanish debt spiked. The Nikkei sank 1.9% to 8508, the Kospi shed 1.8% to 1789, and the ASX 200 declined 1.7% to 4129. The Hang Seng was the worst-hit, plunging 3% as heavyweight HSBC plummeted 5.7%. The Shanghai Composite fell 1.3% to 2141.

Selling intensified in Europe, led by the DAX’s steep 3.2% drop. The CAC40 sank 2.9% and the FTSE dropped 2.1%. Spain banned short selling on all Spanish equities for 3 months, which raised fear that the situation may be even worse than anticipated.

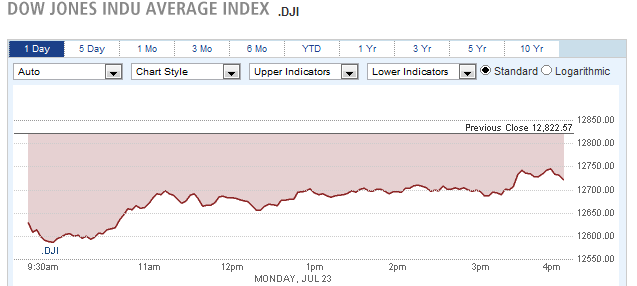

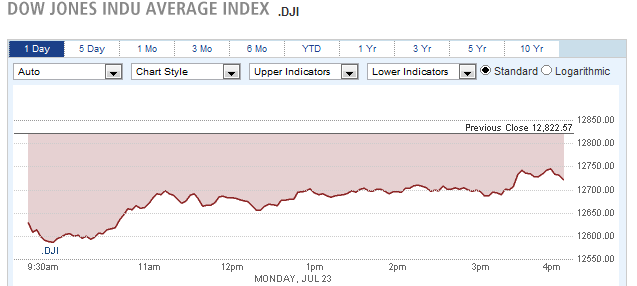

US stocks fared better as a recovery rally trimmed the morning’s losses. The Dow fell for its 8th straight day, and closed down 101 points to 12727 after falling as much as 240 points earlier in the day. The Nasdaq shed 1.2% to 2890, and the S&P 500 fell .9% to 1351.

Currencies

Global currencies plunged on Monday against the dollar, gapping down over the weekend. The euro dropped 1.3% to 1.2123, after dropping as low as 1.2070 earlier in the day. The pound tumbled 1.3% to 1.5514, and the Swiss franc fell 1.2% to .9906. The Australian dollar skidded 1.5% to 1.0263, and the Canadian dollar fell 1% to 1.0182. The yen rose .3% to 78.38, also benefiting from the flight to safety.

Economic Outlook

Tuesday’s reports will include Flash manufacturing PMI data for the US and Euro zone. Also due in the US are the Richmond manufacturing index, and the FHFA’s home price index.

Asian markets tumbled on Monday as fear over Spanish debt spiked. The Nikkei sank 1.9% to 8508, the Kospi shed 1.8% to 1789, and the ASX 200 declined 1.7% to 4129. The Hang Seng was the worst-hit, plunging 3% as heavyweight HSBC plummeted 5.7%. The Shanghai Composite fell 1.3% to 2141.

Selling intensified in Europe, led by the DAX’s steep 3.2% drop. The CAC40 sank 2.9% and the FTSE dropped 2.1%. Spain banned short selling on all Spanish equities for 3 months, which raised fear that the situation may be even worse than anticipated.

US stocks fared better as a recovery rally trimmed the morning’s losses. The Dow fell for its 8th straight day, and closed down 101 points to 12727 after falling as much as 240 points earlier in the day. The Nasdaq shed 1.2% to 2890, and the S&P 500 fell .9% to 1351.

Currencies

Global currencies plunged on Monday against the dollar, gapping down over the weekend. The euro dropped 1.3% to 1.2123, after dropping as low as 1.2070 earlier in the day. The pound tumbled 1.3% to 1.5514, and the Swiss franc fell 1.2% to .9906. The Australian dollar skidded 1.5% to 1.0263, and the Canadian dollar fell 1% to 1.0182. The yen rose .3% to 78.38, also benefiting from the flight to safety.

Economic Outlook

Tuesday’s reports will include Flash manufacturing PMI data for the US and Euro zone. Also due in the US are the Richmond manufacturing index, and the FHFA’s home price index.