Investing.com’s stocks of the week

U.S. Dollar Trading (USD)

Yields on Spanish 10-year debt leapt above 7.3% on Friday in what is being dubbed "Black Friday" in the Spanish Debt Crisis. Risk aversion spread like wildfire throughout the markets with 10-year US debt falling to its lowest yield on record at under 1.5% in stark contrast to the Europeans as bond Investors flooded back to the safe haven of US bonds. Spanish stocks fell near 6% and US stocks fell over 1% and the USD surged higher.

The Euro (EUR)

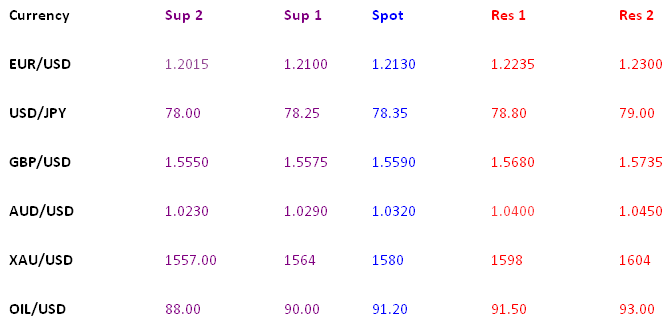

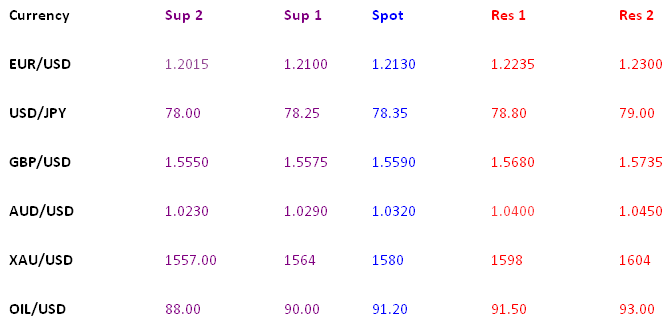

The EUR/USD fell to new lows on Friday under 1.2150 as regions of Spain lined up for bailouts from the pressured Spanish central bank and investors fretted that there was not enough money to completely bailout Spain. Adding to the contagion fears was news that Greece was failing to meet its reform targets and that Germany was not against the idea of them leaving the eurozone as bailout fatigue spreads through the German political establishment.

The Sterling (GBP)

The EUR/GBP continued to fall under 0.7800 and helped to limit the losses the GBP/USD which fell from 1.5700 to 1.5600. The UK is looking like a safer place for investors to store their capital while the slow burning European crisis continues. Looking ahead, focus on the European Debt Crisis and Spanish and Italian Yields will continue.

The Japanese Yen (JPY)

The Yen demand is outstripping even the USD with the yield on US debt falling and EUR/JPY falling to near record lows Friday and Monday morning Asia near Y95. USD/JPY is slipping towards the Y78 level and we expect the intervention talk to ramp up if the markets continue to pressure one direction.

The Australian Dollar (AUD)

The AUD/USD uptrend was damaged on Friday with the market caught long and a reversal being seen back under 1.0400. The selling has intensified on Monday morning Asia with negative Chinese news over the weekend and the mounting global stock market losses further undermining the Australian dollar. The EUR/AUD fell to record lows near 1.1700 but some profit taking has been seen as the AUD is sold aggressively against the yen and USD and this could spark a short covering rally on the EUR/AUD and GBP/AUD. UPDATE Q2 Australian PPI at 0.5% vs. 0.3% forecast.

Oil And Gold (XAU)

Gold was supported on safe haven demand as eurozone bonds collapsed and this countered the USD strength to leave the precious metal roughly unchanged at that $1580 level. OIL/USD large rally last week was reversed from $93 to $91 per barrel as stock losses prompted profit taking.

Pairs To Watch

EUR/USD- Targeting 1.2000 test this week.

AUD/USD - Chance to crash lower if things get worse.

Technical Commentary

Yields on Spanish 10-year debt leapt above 7.3% on Friday in what is being dubbed "Black Friday" in the Spanish Debt Crisis. Risk aversion spread like wildfire throughout the markets with 10-year US debt falling to its lowest yield on record at under 1.5% in stark contrast to the Europeans as bond Investors flooded back to the safe haven of US bonds. Spanish stocks fell near 6% and US stocks fell over 1% and the USD surged higher.

The Euro (EUR)

The EUR/USD fell to new lows on Friday under 1.2150 as regions of Spain lined up for bailouts from the pressured Spanish central bank and investors fretted that there was not enough money to completely bailout Spain. Adding to the contagion fears was news that Greece was failing to meet its reform targets and that Germany was not against the idea of them leaving the eurozone as bailout fatigue spreads through the German political establishment.

The Sterling (GBP)

The EUR/GBP continued to fall under 0.7800 and helped to limit the losses the GBP/USD which fell from 1.5700 to 1.5600. The UK is looking like a safer place for investors to store their capital while the slow burning European crisis continues. Looking ahead, focus on the European Debt Crisis and Spanish and Italian Yields will continue.

The Japanese Yen (JPY)

The Yen demand is outstripping even the USD with the yield on US debt falling and EUR/JPY falling to near record lows Friday and Monday morning Asia near Y95. USD/JPY is slipping towards the Y78 level and we expect the intervention talk to ramp up if the markets continue to pressure one direction.

The Australian Dollar (AUD)

The AUD/USD uptrend was damaged on Friday with the market caught long and a reversal being seen back under 1.0400. The selling has intensified on Monday morning Asia with negative Chinese news over the weekend and the mounting global stock market losses further undermining the Australian dollar. The EUR/AUD fell to record lows near 1.1700 but some profit taking has been seen as the AUD is sold aggressively against the yen and USD and this could spark a short covering rally on the EUR/AUD and GBP/AUD. UPDATE Q2 Australian PPI at 0.5% vs. 0.3% forecast.

Oil And Gold (XAU)

Gold was supported on safe haven demand as eurozone bonds collapsed and this countered the USD strength to leave the precious metal roughly unchanged at that $1580 level. OIL/USD large rally last week was reversed from $93 to $91 per barrel as stock losses prompted profit taking.

Pairs To Watch

EUR/USD- Targeting 1.2000 test this week.

AUD/USD - Chance to crash lower if things get worse.

Technical Commentary