Yesterday’s relatively quiet day had an eerie feel of “the calm before the storm” about it. Considering the tumultuous day we saw on Friday the 13th, with all the major global indices finishing way down, Monday’s session was suspiciously non-eventful.

Sterling range was low throughout the day with the trading bands on the GBPEUR and the GBPUSD not really tested or pushed at any point during the session, having said that we did see GBPEUR hit a 19 month high at 7am before European markets opened, reaching 1.2175.Spanish yields flirted briefly above the 6% level before retreating back by the close of business.

This proverbial storm may very well come in the form of the Spanish debt auctions this week. With Spain looking to raise 5.5bn this week, it’s very much sink or swim time for the Spanish Armada.As it stands, Spain is unable to finance itself at current levels of short term financing. Further LTRO cash injections only serve to reduce yields in the short term and increase the exposure of the banking system to higher volumes Spanish debt. Financial assistance isn’t what is needed but fiscal assistance and structural reform.

The only way to solve this is to reduce debt as a percentage of GDP and implement more cuts. The fundamental problem is that the Spanish economy can’t handle any more public sector cuts as they would more than likely push the economy even further in recession. The likelihood of cuts coming from the private sector in the near future are not realistic. It’s very much a “Catch 22” situation for the Spanish PM. So for the time being Spain has to keep ticking over and It’s imperative that they raise the full levels of debt required.

Other snippets from Europe saw a successful French bond auction this morning, selling the full 7.9bn of short-term debt. Fitch, the ratings agency, assured that it had no plan to downgrade Italian debt.

US markets opened the week well, following better than expected US retail figures out earlier in the morning. European markets which had a much quieter day, made gains on the back of this positive data.

Today’s schedule will see the IMF meetings commence which will run throughout the week. UK inflation figures are released and the first of two eagerly anticipated Spanish bond auctions begin this week.

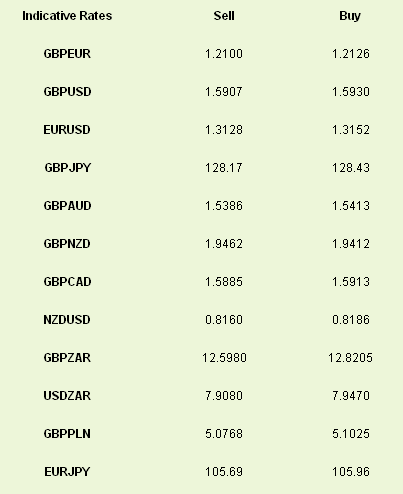

Latest exchange rates at time of writing

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Spanish Bond Auction Needs European Support

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.