In a similar fashion to last week, the week in waiting is geared towards the ECB meeting this coming Thursday. These meetings of late have been all bark and no bite as we rarely see evasive action when we expect it. Bernanke disappointed on Friday in Jackson Hole keeping the FED chequebook in his jacket pocket. He did give what seemed to be a monetary report, justifying the past use and benefits of QE. In other words he has made it clear that from his arsenal of monetary tools, QE is the weapon of choice, but the timing isn’t quite right. USD movement was non-existent almost as if the market anticipated the FED sitting on their hands. It does set the stage for the FED Sept meeting where we do expect this broken record… I mean QE announcement to happen.

Eurozone unemployment held tight at 11.3% with Inflation coming in a little higher than expected, but wholly inside its allocated range, considering the rise in commodity prices of late. In view of the shaky German figures just previously, the modestly sideways stepping Eurozone data was taken as positive news. GBP/EUR fell to 1.2570 briefly before news from Spain sent it north of the 1.26 mark.

Spain took a positive step in the right direction on Friday, announcing the plan for the formation of a bad bank for the banking system. Similarly to the situation in Ireland, this bad bank will absorb all the bad debt from the struggling banks to alleviate the contagion risk from holding toxic assets on the balance sheet. This move puts an end in sight for the banking crisis as it means a bottom line can hopefully now be calculated to recapitalise the Spanish banking sector. There are still details that will need to be ironed out but the fact that it’s now happening is the key point of note here. It’s no co-incidence that it happened the same day that Bankia asked for further recapitalisation. The government took a controlling stake in the bank a few months ago and it would appear that the government thought it necessary to produce a more long term plan, before it could pump more cash in the ailing bank.

The US are celebrating Labour day today so we expect a quiet day on all fronts. Nothing significant from Europe data wise as we build up to the climatic ECB meeting on Thursday. We can expect the Spanish banking crisis to be the main talking point of the week as the proposal comes together.

World First is going to Tanzania to build a school with Childreach and we’re currently raising funds for the building materials required. We’d really appreciate any donation you might be able to make. We’ll keep you updated on our efforts once we return! You can make a donation via this link here: https://mydonate.bt.com/fundraisers/worldfirst?

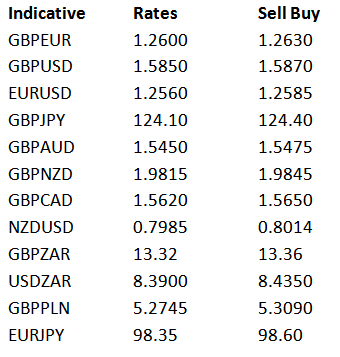

Latest exchange rates at time of writing:

Eurozone unemployment held tight at 11.3% with Inflation coming in a little higher than expected, but wholly inside its allocated range, considering the rise in commodity prices of late. In view of the shaky German figures just previously, the modestly sideways stepping Eurozone data was taken as positive news. GBP/EUR fell to 1.2570 briefly before news from Spain sent it north of the 1.26 mark.

Spain took a positive step in the right direction on Friday, announcing the plan for the formation of a bad bank for the banking system. Similarly to the situation in Ireland, this bad bank will absorb all the bad debt from the struggling banks to alleviate the contagion risk from holding toxic assets on the balance sheet. This move puts an end in sight for the banking crisis as it means a bottom line can hopefully now be calculated to recapitalise the Spanish banking sector. There are still details that will need to be ironed out but the fact that it’s now happening is the key point of note here. It’s no co-incidence that it happened the same day that Bankia asked for further recapitalisation. The government took a controlling stake in the bank a few months ago and it would appear that the government thought it necessary to produce a more long term plan, before it could pump more cash in the ailing bank.

The US are celebrating Labour day today so we expect a quiet day on all fronts. Nothing significant from Europe data wise as we build up to the climatic ECB meeting on Thursday. We can expect the Spanish banking crisis to be the main talking point of the week as the proposal comes together.

World First is going to Tanzania to build a school with Childreach and we’re currently raising funds for the building materials required. We’d really appreciate any donation you might be able to make. We’ll keep you updated on our efforts once we return! You can make a donation via this link here: https://mydonate.bt.com/fundraisers/worldfirst?

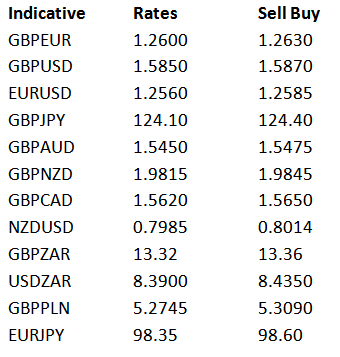

Latest exchange rates at time of writing: