The market is making minced meat of directional traders, as EUR/USD reverses direction almost daily. The EU debt crisis burns on despite this weekend’s developments as Spain seems to be the new focus.

No real surprises over the weekend relative to expectations, as the Italian lower house approved the new budget measures as expected and as Berlusconi took his leave, with the new technocrat Monti taking his place. Any sense of calm didn’t last for very long, as the euro fell out of bed today. This was after a bizarre sharp USD sell-off and equity market rally unfolding on Friday. That action unfolded as the US bond market was closed for Veteran’s day Friday and today’s strong bond market snapback rally and reversal back to USD strength suggested there wasn’t any real conviction in Friday’s move, though any chartist is having a hard time finding conviction in any move of late, considering the number of reversals we seen. We await a close either back below 1.3600 or above 1.3800 for attempting to get the next bit of visibility. The upside is a very tough argument, but there is so much downside fear in the market already that the pair seems to be stuck in limbo for the moment.

EU debt spreads wider again

The Italian 5-year bond auction went off relatively well, though the yield was over 6% and the amount was a paltry EUR 3 billion. Spreads against bunds widened back out some 20+ bps. Italy will have to auction off some EUR 200 billion in debt in 2012, as the “two Monti’s”, new Prime Minister Monti and Finance Minister Tremonti, certainly have their work cut out for them. More worrisome, the spreads on Spanish and Belgian bonds widened to new record levels for the cycle today.

Interest rate spreads

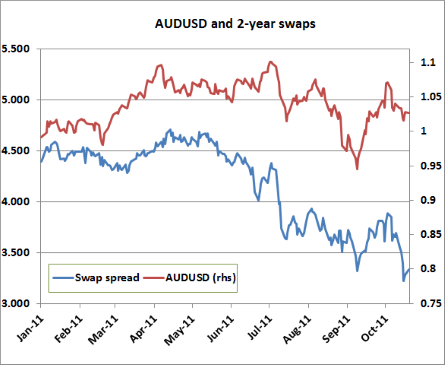

If we have a glance over at our interest rate spreads, the USD is finding far less support than spreads would suggest it should – an on-going divergence that requires a good explanation very soon if it continues much longer. Below we show the spread between 2-yr. AUD and USD swaps and AUDUSD. Likewise, the spread between EUR and USD swaps has dropped to a new low for the cycle as well. Shouldn’t these spreads and the negative implications for carry trades matter more than we are seeing at present?

Chart: AUD/USD vs. 2-year swap spreads

Looking ahead – Evans the dove

Tomorrow we will have a speech from President Evans of the Chicago Fed, who will give a speech on the “Discussion of the Fed’s Dual Mandate Responsibilities.” Evans has been a clear and consistent dove among the voting FOMC members, though he loses his voting status at the end of this year. He gave two very aggressive speeches on the need for the Fed to act further in September and October of this year to bring down unemployment according to the Fed’s dual mandate, without worrying about inflation (to a degree). He also dissented from the last FOMC monetary policy statement. There were no specifics in that statement other than that he favoured “additional policy accommodation at this time.” We’ll see more details next week with the release of the minutes of that meeting. Mr. Evans will also appear on CNBC tomorrow, which suggests he is doing his utmost to generate positive PR for his views – an interesting move. The key policy initiative buzzword that Mr. Evans has also mentioned favourably in his speeches is NGDP – nominal GDP targeting, which would represent a whole new league of money printing. The prospects for a Fed move toward an NGDP policy may be one of the reasons behind the continued positive sentiment in equity markets and the inability of the USD to get consistent upside tracking on the negative EU news flow.

Odds and ends

Remember that we have Spanish elections this coming weekend, and a Spanish 10-year bond auction is set for this Thursday after Spanish spreads have gone to record wide levels today. Tomorrow is the busiest day of the week on the US data calendar with the Oct. PPI, Oct. Advance Retail Sales, and Nov. Empire Manufacturing on tap. The data surprises out of the US have pushed Citigroup’s Economic Surprise Index to its highest level since April. How much longer will the positive data surprises continue?

Economic Data Highlights

- Switzerland Producer and Import Prices out at -0.2% MoM and -1.8% YoY vs. -0.3%/-1.9% expected, respectively and vs. -2.0% YoY in Sep.

- Euro Zone Sep. Industrial Production out at -2.0% MoM and +2.2% YoY vs. -2.3%/+3.5% expected, respectively and vs. +6.0% YoY in Aug.