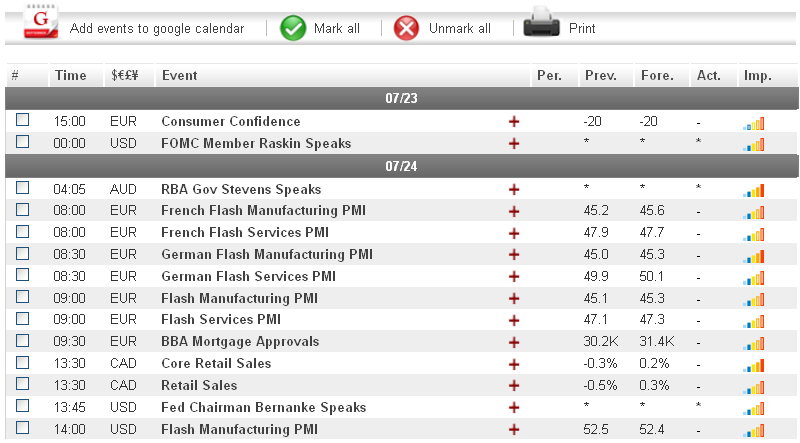

Renewed concerns regarding the debt situation in Spain sent the euro plunging to fresh lows against several of its main currency rivals, including the US and Australian dollars and the Japanese yen on Friday. Investors are now worried that Spain will have to seek a full scale international bailout to rescue its ailing banking sector. This week, the common-currency is likely to see additional volatility, as a batch of eurozone news is set to be released. Tuesday in particular may be a busy day in the markets, as both France and Germany are scheduled to release manufacturing data. Should any of the indicators come in below their expected levels, the euro could extend its downtrend.

Economic News

USD - Dollar Extends Gains Vs. EUR And CHFInvestors sought out safe-haven assets on Friday following renewed Spanish debt fears. The news sent the US dollar significantly higher against several of its main currency rivals, including the Swiss franc and euro. The USD/CHF gained close to 100 pips during European trading, eventually peaking at 0.9885 before staging a minor correction to close out the week at 0.9875. Against the euro, the USD was able to reach a fresh two-year high after investors became concerned that Spain would soon need to request an international bailout. The EUR/USD sank as low as 1.2143 before finishing the week at 1.2158.

This week, dollar traders will want to pay attention to several potentially significant news events. On Tuesday, a speech from Fed Chairman Bernanke could lead to volatility if he hints at a new round of quantitative easing to boost the US economy. In addition, home sale data on Wednesday, followed by Thursday's Core Durable Goods Orders and Friday's Advance GDP figure mean that the greenback is likely to see plenty of movement in the coming days.

EUR - EUR Continues To Fall Against Main Rivals

The euro dropped to a record low against both the Australian and Canadian dollars on Friday, while the EUR/JPY hit an 11-year low. Fears that Spain, the EU's fourth largest economy, will soon require a bailout were blamed for the euro's downtrend. The EUR/AUD fell close to 70 pips during European trading, while the EUR/CAD dropped close to 60 pips. The pairs respectively finished out the week at 1.1707 and 1.2309. Against the yen, the euro tumbled over 100 pips before closing the week at 95.43.

This week, analysts are warning that given the current fears that the euro-zone debt crisis is spreading to other countries in the region, combined with the ongoing concerns regarding Spain, the euro could potentially fall further against its main rivals. In addition to any announcements out of the EU regarding the Spanish debt situation, traders will also want to pay attention to manufacturing and services data out of Germany and France, scheduled to be released on Tuesday. Should any of the news fail to come in as expected, the euro may extend its recent losses.

Gold - Gold Stabilizes Following Russian News

Risk aversion due to eurozone news sent the price of gold tumbling close to $13 an ounce during the first half of the day on Friday. The precious metal eventually reached $1573.26 before correcting itself after Russia announced that it had boosted its gold reserves. Gold eventually closed out the week at $1584.25 an ounce.

This week, gold traders will want to pay attention to news out of the EU and US. While the eurozone debt crisis has resulted in prices falling in recent days, gold has the potential to see gains following a speech from Fed Chairman Bernanke on Tuesday. Should the Fed Chairman hint at a new round of quantitative easing in the US, the precious metal may turn bullish as a result.

Crude Oil - EU Worries Cause Crude Oil To Resume Bearishness

After hitting an eight-week high earlier in the week, crude oil resumed its bearish trend on Friday as eurozone news caused investors to shift their funds to safe-haven assets. The price of oil fell by well over $1 a barrel over the course of the day, eventually reaching as low as $90.90 before recovering to close out the week at $91.51.

This week, oil traders will want to monitor any developments in the Middle East. The military-conflict in Syria combined with the ongoing dispute over Iran's nuclear program were the main reasons behind oil's bullish movement last week. Any escalation in either conflict may lead to supply side fears among investors which could result in oil resuming its upward trend.

Technical News

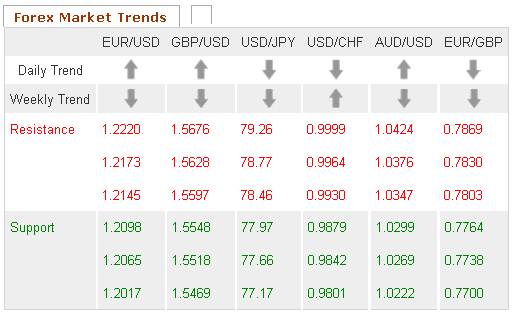

EUR/USDThe weekly chart's Slow Stochastic appears to be forming a bullish cross, indicating that this pair could see an upward correction in the coming days. Furthermore, the same chart's Williams Percent Range has crossed over into oversold territory. Traders may want to open long positions for this pair.

GBP/USD

Long-term technical indicators indicate that this pair is range trading, meaning that no defined trend can be determined at this time. Traders may want to take a wait and see approach, as a clearer picture is likely to present itself in the near future.

USD/JPY

The daily chart's Relative Strength Index has crossed into oversold territory, signaling possible upward movement for this pair in the near future. In addition, the Slow Stochastic on the same chart appears to be forming a bullish cross. Going long may be the wise choice for this pair.

USD/CHF

The weekly chart's Williams Percent Range is currently well into overbought territory, signaling that downward movement could occur in the coming days. Furthermore, the Relative Strength Index on the same chart is currently at the 70 level. Opening short positions may be the wise choice for this pair.

The Wild Card

EUR/SEKThe Slow Stochastic on the daily chart is forming a bullish cross, signaling that this pair could see upward movement in the near future. This theory is supported by the Relative Strength Index on the same chart, which has crossed into oversold territory. Opening long positions may be the wise choice for forex traders today.