Market movers today

Markets will continue to digest yesterday's Spanish election result (see below).

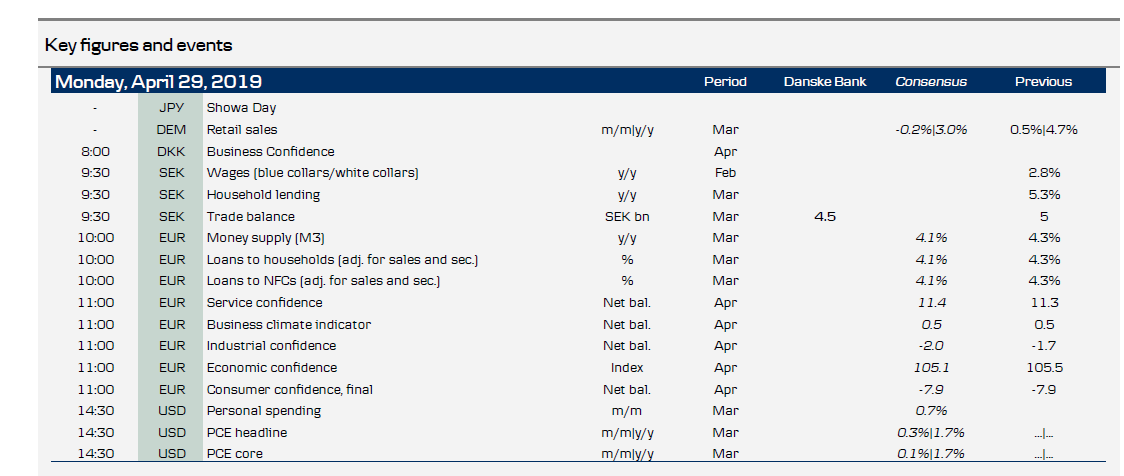

In the euro area the economic confidence indicator for April is due out and it shall be interesting to see if it also points to a lacklustre start to Q2, in line with the latest PMIs. Loan growth data for March will also be released, which markets will keep an eye on to gauge how favourable the ECB will design its new liquidity operation (TLTRO3) when details are announced in June.

In the US, focus today reverts to the inflation front with the PCE figures for March. The Fed's communication recently has put more weight on the inflation dynamics and therefore it will be interesting to see whether the PCE core rate shows a further decline from 1.8% in February.

In Sweden, we get trade balance figures for March and in Denmark focus is on business confidence data.

Later this week, Q1 GDP data out of the euro area, Chinese PMIs as well as the Fed meeting and US job report will be in focus.

Selected market news

In the Spanish general election yesterday the Socialist Workers' Party (PSOE) emerged, as expected, as the election's winners by gaining 29 per cent of the popular vote, and thus obtaining some 123 seats (out of a total of 350). The result sees the number of PSOE seats increase by 38 on the 2016 elections and most importantly gives the PSOE options to form a government possibly without the need of Catalan separatist parties, whose place in a Spanish government would be highly problematic given the still unresolved Catalan question, and result in a higher probability of a hung parliament. Instead the PSOE's leader and sitting Prime Minister, Pedro Sánchez, could be able to form a majority government together with either left-wing party Unidas Podemos, whose election result at 14.3% (42 seats) was less bad than expected (2016 result: 21.1%, expected: 13%), the Basque nationalists and more moderate regional parties, or look across the centre towards Ciudadanos (low probability) or even govern a minority government. The far-right nationalist Vox, who is taking a hard stance against Catalan independence, gained 10% (24 seats) although mostly at the cost of the centre-right PP (16.7%, 2016 result: 33%) losing more than half its seats, leaving the Spanish right wing more fragmented than ever. Given the options of the PSOE the election outcome should be marginally positive for markets. In any case Spain has shown some resilience towards political uncertainty as of late and we remain positive on the Spanish economy.

Oil prices plunged on Friday after US president Trump was out saying he had called on OPEC to reduce crude prices. On Thursday, current waivers on Iran sanctions expire and the oil market could suffer a supply shortage if OPEC does not follow Trump's call. This comes on top of last week's increased uncertainty regarding Libyan oil exports following attacks on Tripoli by Libyan opposition, with fighting continuing this weekend.

Scandi markets

Sweden. Among today’s Swedish data we particularly want to stress the March trade balance. Over the latest several years, the trade balance has gradually deteriorated and in fact in 2017-2018 Sweden had a deficit in goods trade for the first time in more than two decades. This development has had (at least) two effects. First, net goods exports have been a drag on GDP and secondly, we believe that a shrinking trade surplus has been weighing on the krona. The two first months this year have been better though with relatively robust surpluses. For March we expect a surplus of 4.5bn.

Fixed income markets

Italy maintained its BBB-rating and unchanged outlook from S&P on Friday. We expect that Italy will rally significantly, since the S&P states in its comments that it would require a significant worsening of the Italian budget deficit and growth outlook for the Italian economy or a significant worsening of the funding costs for both the Italian government and the Italian banks, for a possible downgrade. Hence, we expect a positive opening on the Italian government bonds this morning with spreads tightening to core- and semi-core EU.

The main event of the week is the FOMC meeting on Wednesday. The consensus view is that the Federal Reserve will remain on hold, and thus the “wording” will be important. On Friday we published our Government Bond Weekly (GBW). Here we take a closer look at France and the possible impact, if Moody’s remove its positive outlook. See more here.

FX markets

This week, we’ll see a host of events that in part centre on oil supply, but importantly on global liquidity conditions and cyclical demand. In order, watch Chinese PMIs & US ISM (Tuesday), FOMC (Wednesday), US sanctions on Iran & European CPI (Thursday) and non-farm payrolls (Friday). To us, a dovish Fed, sideways China PMIs and possibly hints of oil supply increases from Saudi Arabia and others to mitigate impact of Iran sanctions sounds like the right recipe to reboot risk appetite. Put together, this should favour commodity currencies (AUD, NZD, CAD and NOK) vs JPY. It could also pave the way for a rebound in EUR/USD towards 1.13.

More specifically on the NOK, EUR/NOK moved to the high end of the 9.60s at the end of last week. Primarily two drivers were behind the move: first a dovish Riksbank and secondly the Trump induced oil price drop on Friday. Historically, SEK induced spikes in EUR/NOK have been profitable to sell and indeed the near-term Norges Bank policy impact of the Riksbank message is marginal. The coming months will be decisive of whether Norges Bank will hike rates in June (our call) and with markets pricing less than 50% probability of this materialising we expect relative rates to turn increasingly supportive of the NOK, see Reading the Markets Norway for more colour here. In terms of oil markets it is trickier amid Iran waiver uncertainty and possible strategic petroleum reserve selling. That said we think Trump’s overall influence on oil markets is overstated, see tweet history, and supply story driven oil price volatility has less impact on NOK FX than demand related volatility. In sum, we still expect a stronger NOK and see value in buying USD/NOK 3M (NYSE:MMM) volatility, which valuation-wise seems cheap as we enter decisive months for spot drivers.