S&P 500 Mini Non-Commercial Speculator Positions:

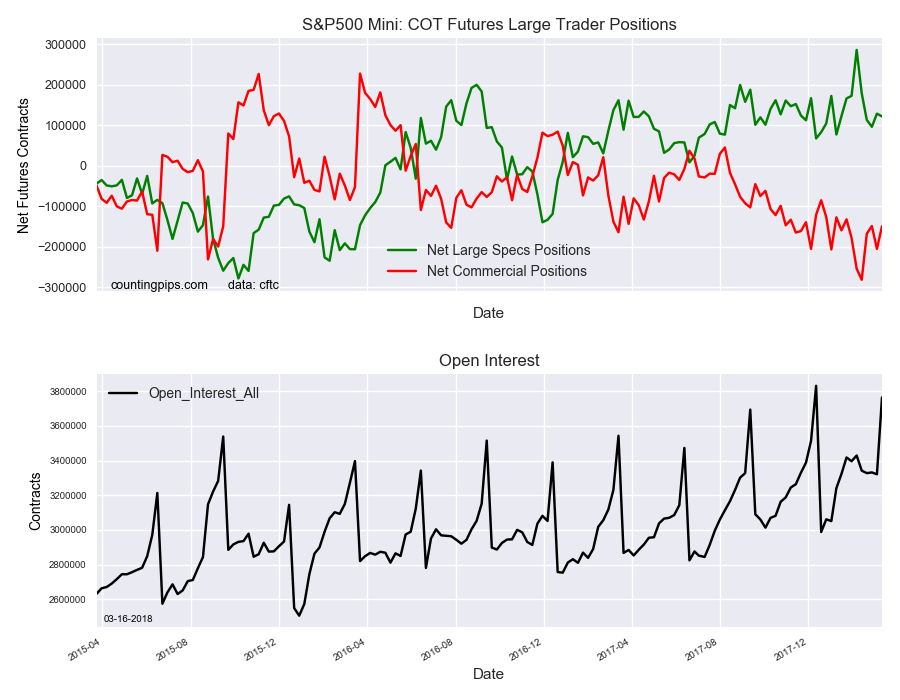

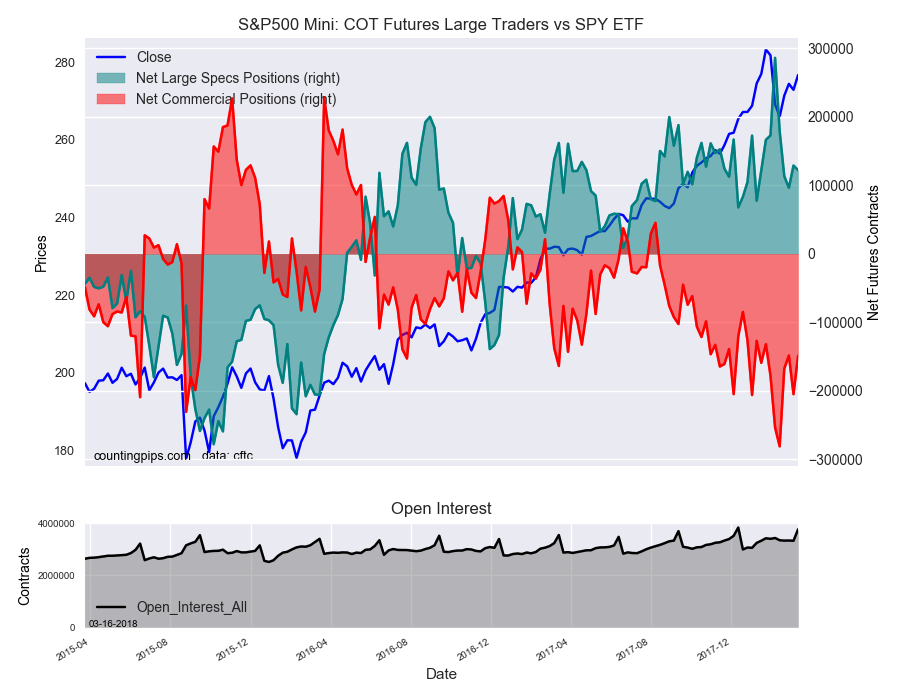

Large stock market speculators reduced their bullish net positions in the S&P 500 Mini futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of S&P500 Mini futures, traded by large speculators and hedge funds, totaled a net position of 122,106 contracts in the data reported through Tuesday March 13th. This was a weekly reduction of -6,768 contracts from the previous week which had a total of 128,874 net contracts.

Speculative positions have declined for three out of the past four weeks although the overall net position remains above the +120,000 contract level for a second straight week. The speculator bets had fallen below the +100,000 contract threshold on February 27th before surging back above that level last week.

S&P500 Mini Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -149,105 contracts on the week. This was a weekly increase of 56,004 contracts from the total net of -205,109 contracts reported the previous week.

SPY (NYSE:SPY) ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the SPY ETF, which tracks the price of S&P500 Index, closed at approximately $276.72 which was a rise of $3.84 from the previous close of $272.88, according to unofficial market data.