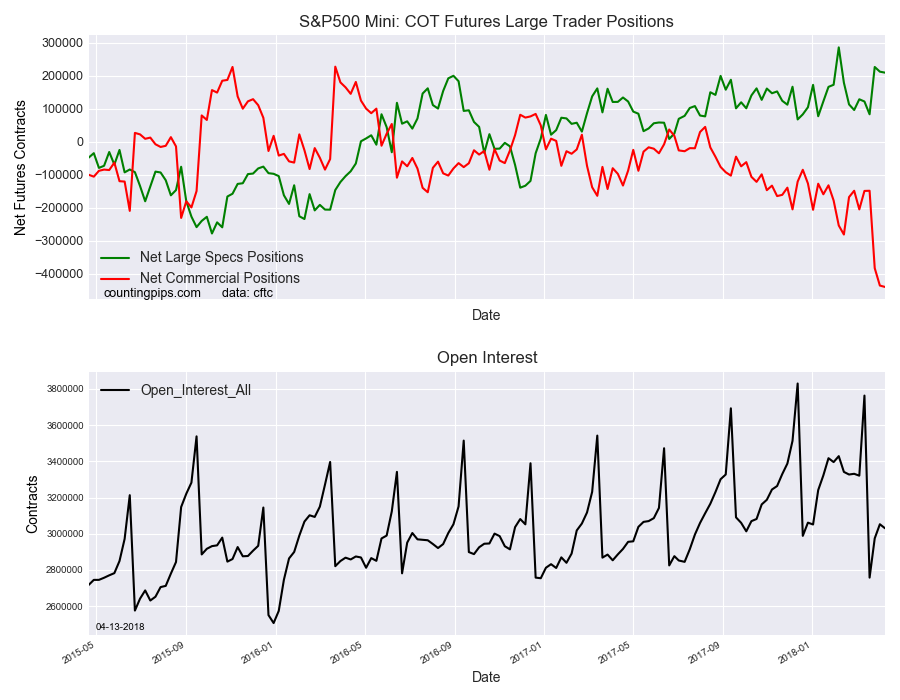

S&P 500 Mini Non-Commercial Speculator Positions:

Large US stock market speculators slightly decreased their bullish net positions in the S&P 500 Mini futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of S&P500 Mini futures, traded by large speculators and hedge funds, totaled a net position of 209,616 contracts in the data reported through Tuesday April 10th. This was a weekly reduction of -2,987 contracts from the previous week which had a total of 212,603 net contracts.

Speculative positions declined for a second straight week but do remain above the +200,000 net contract level for a third week.

S&P500 Mini Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -440,274 contracts on the week. This was a weekly shortfall of -4,238 contracts from the total net of -436,036 contracts reported the previous week.

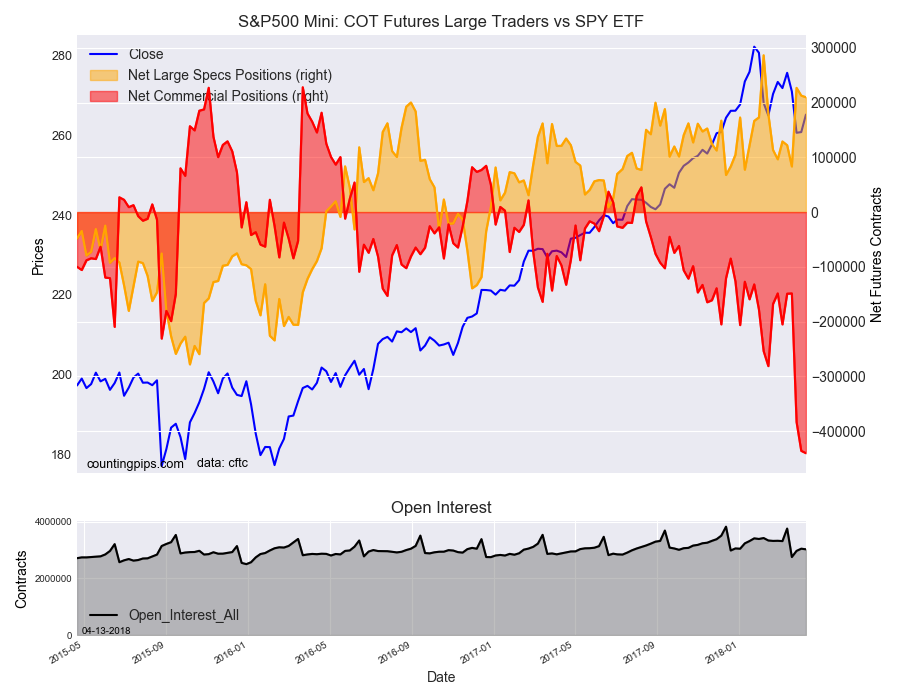

SPY (NYSE:SPY) ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the SPY ETF, which tracks the price of S&P500 Index, closed at approximately $265.15 which was a gain of $4.38 from the previous close of $260.77, according to unofficial market data.