S&P500 Mini Non-Commercial Speculator Positions:

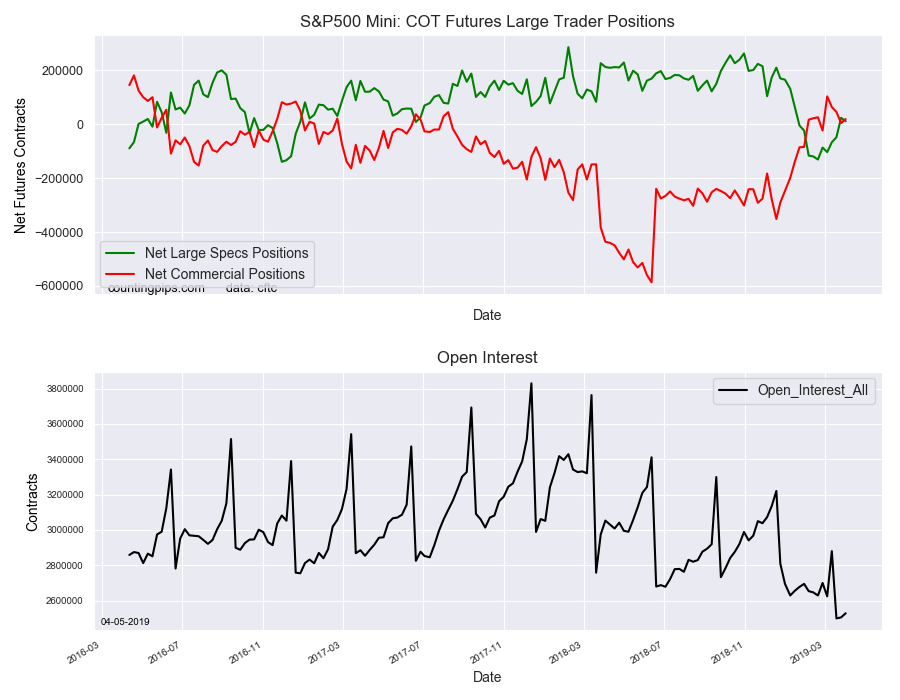

Large stock market speculators reduced their bullish net positions in the S&P 500 Mini Futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of S&P500 Mini futures, traded by large speculators and hedge funds, totaled a net position of 11,335 contracts in the data reported through Tuesday April 2nd. This was a weekly decline of -12,799 net contracts from the previous week which had a total of 24,134 net contracts.

The week’s net position was the result of the gross bullish position (longs) increasing by 7,504 contracts to a weekly total of 367,417 contracts but that was overtaken by the gross bearish position (shorts) which saw an increase by 20,303 contracts for the week to a total of 356,082 contracts.

The net speculative position had gained for three straight weeks and by a total of +127,521 contracts in that three-week period before this week’s pull back. The current standing remains in bullish territory for a second straight week after having spent the previous nine weeks in a bearish position.

S&P500 Mini Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 19,222 contracts on the week. This was a weekly gain of 14,875 contracts from the total net of 4,347 contracts reported the previous week.

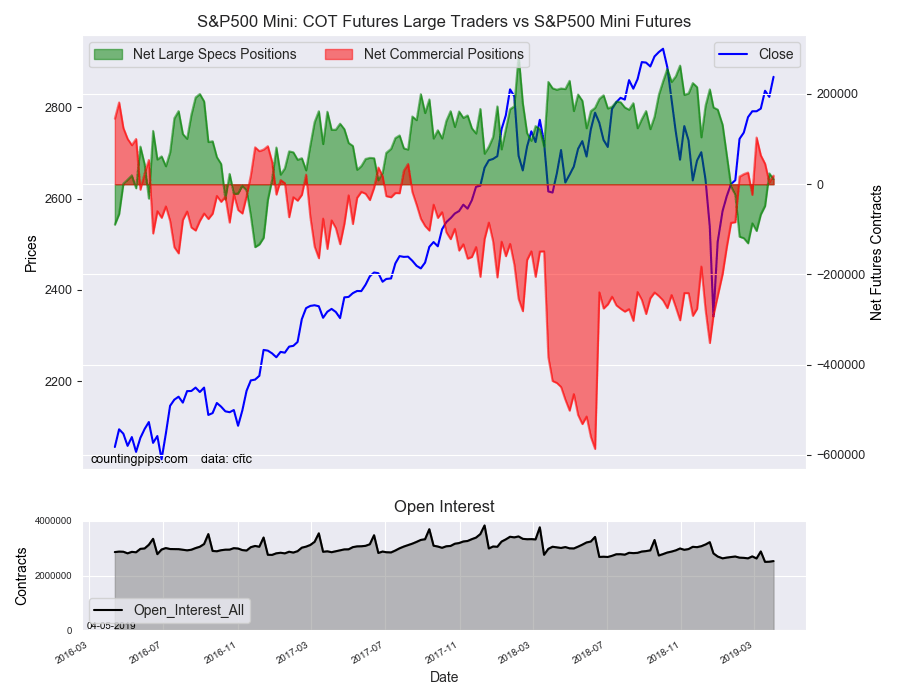

S&P500 Mini Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the S&P500 Mini Futures (Front Month) closed at approximately $2867.00 which was an advance of $44.00 from the previous close of $2823.00, according to unofficial market data.