S&P500 Mini Non-Commercial Speculator Positions:

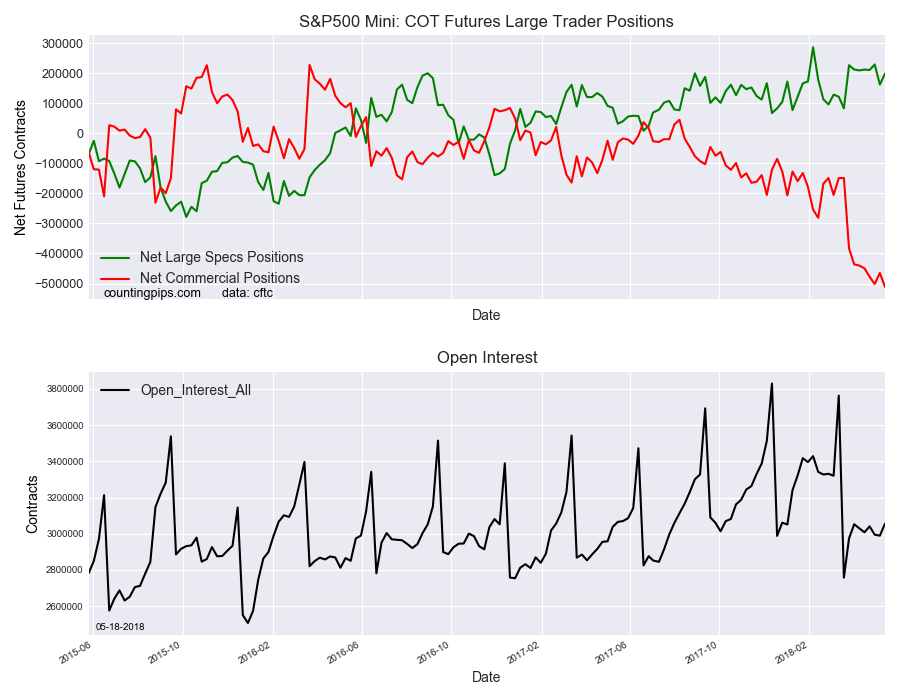

Large stock market speculators sharply raised their bullish net positions in the S&P500 Mini futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of S&P500 Mini futures, traded by large speculators and hedge funds, totaled a net position of 198,805 contracts in the data reported through Tuesday May 15th. This was a weekly increase of 36,450 contracts from the previous week which had a total of 162,355 net contracts.

Speculative positions rebounded this week after falling by -66,878 contracts in the previous week. The overall net position remains under the +200,000 contracts for the second week in a row after six weeks above that threshold.

S&P500 Mini Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -511,373 contracts on the week. This was a weekly decline of -46,369 contracts from the total net of -465,004 contracts reported the previous week.

The commercials bearish positions have increased for seven out of the past eight weeks and are now at the largest bearish level since 1997.

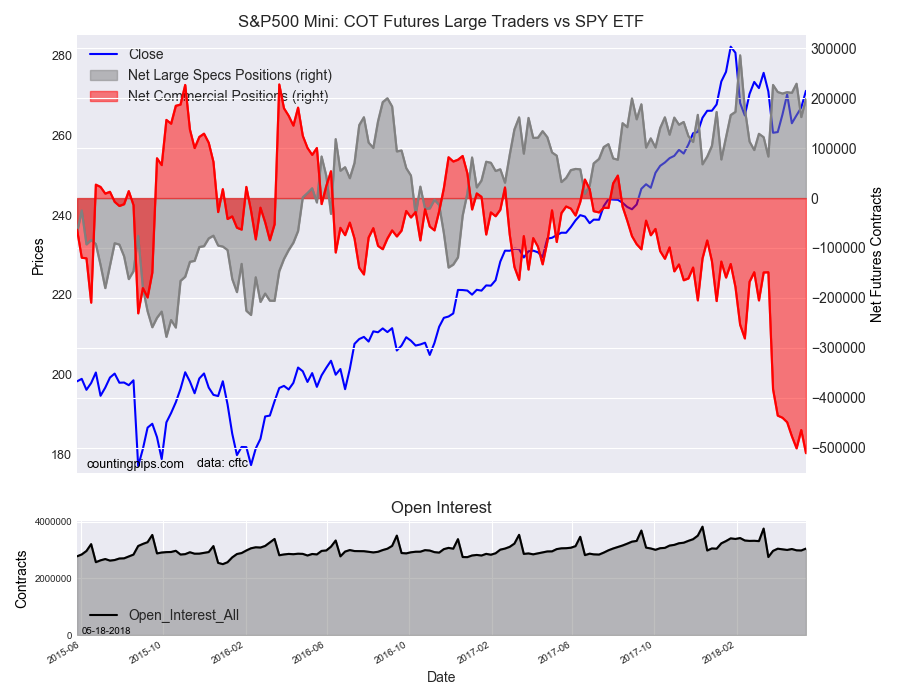

SPY (NYSE:SPY) ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the SPY ETF, which tracks the price of S&P500 Index, closed at approximately $271.1 which was a gain of $4.18 from the previous close of $266.92, according to unofficial market data.