S&P 500 Mini Non-Commercial Speculator Positions:

Large stock market speculators added to their bearish net positions in the S&P 500 Mini futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday. The latest COT data is now up to date after delays in previous weeks due to the government shutdown.

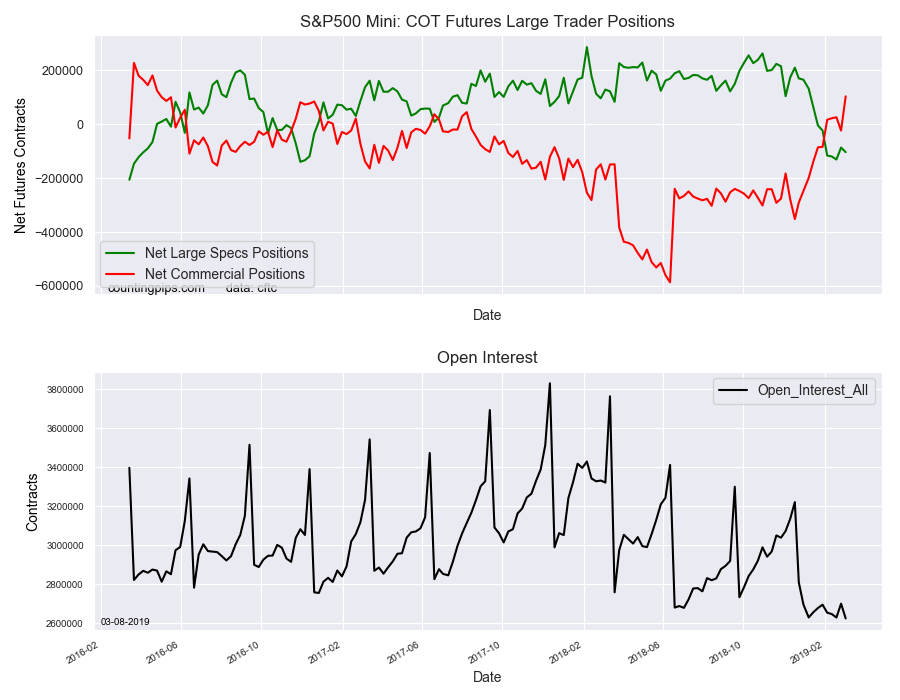

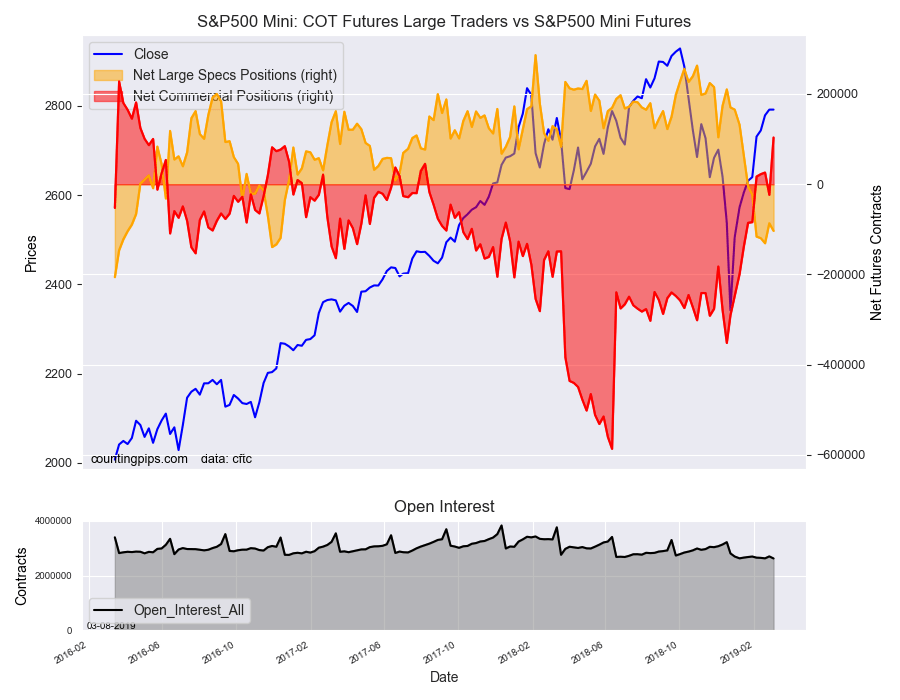

The non-commercial futures contracts of S&P 500 Mini futures traded by large speculators and hedge funds, totaled a net position of -103,387 contracts in the data reported through Tuesday, March 5th. This was a weekly change of -16,882 net contracts from the previous week which had a total of -86,505 net contracts.

The week’s net position was the result of the gross bullish position (longs) declining by -13,514 contracts to a weekly total of 328,775 contracts combined with the gross bearish position (shorts) which saw a gain by 3,368 contracts for the week to a total of 432,162 contracts.

The net speculative position has now decreased for ten out of the past eleven weeks through March 5th. The overall net position standing is back above the -100,000 contract level for the fourth time out of the past five weeks.

The S&P 500-Mini spec contracts have seen quite a fast turn in sentiment in a short time period. The speculator level has gone from +131,833 contracts on January 8th to -103,387 contracts this week, a reversal of over -200,000 contracts in just eight weeks.

S&P 500 Mini Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 103,605 contracts on the week. This was a weekly gain of 127,054 contracts from the total net of -23,449 contracts reported the previous week.

S&P 500 Mini Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the S&P 500 Mini Futures (Front Month) closed at approximately $2791.50 which was virtually no change from the previous week, according to unofficial market data.