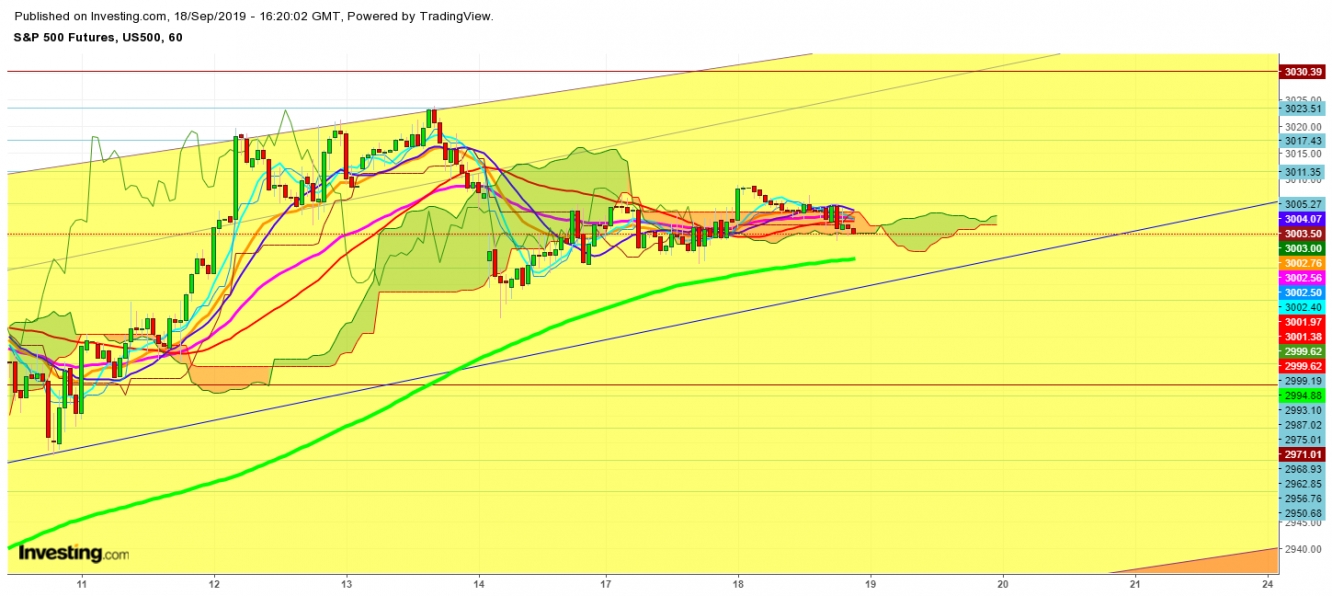

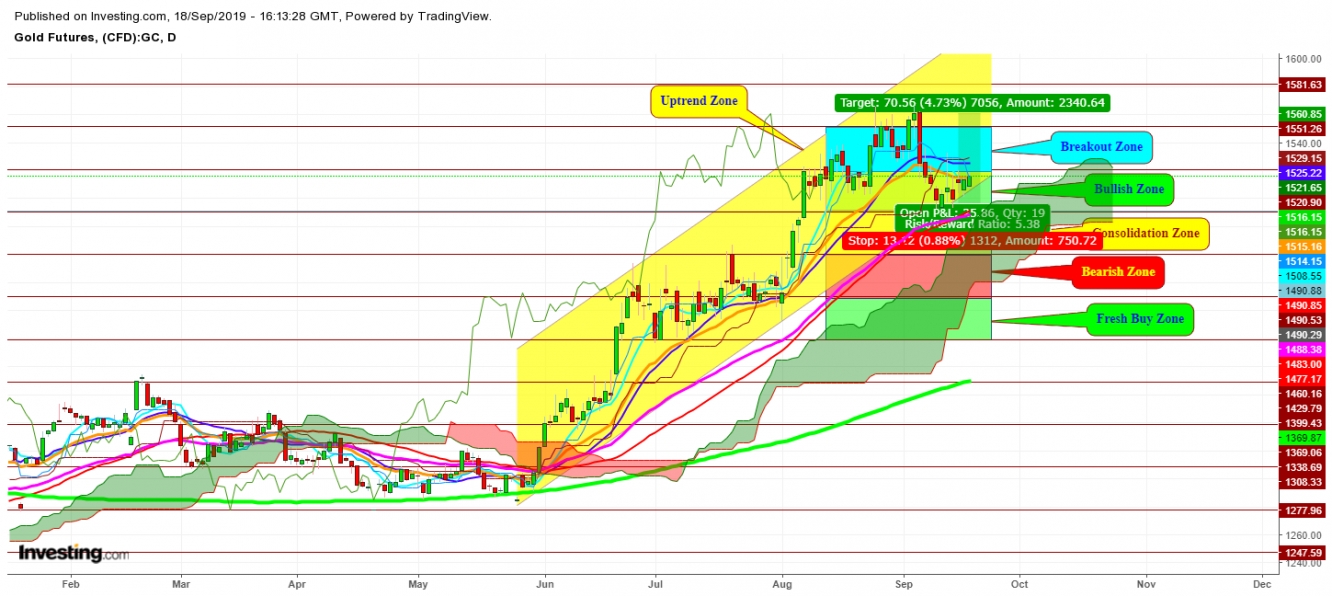

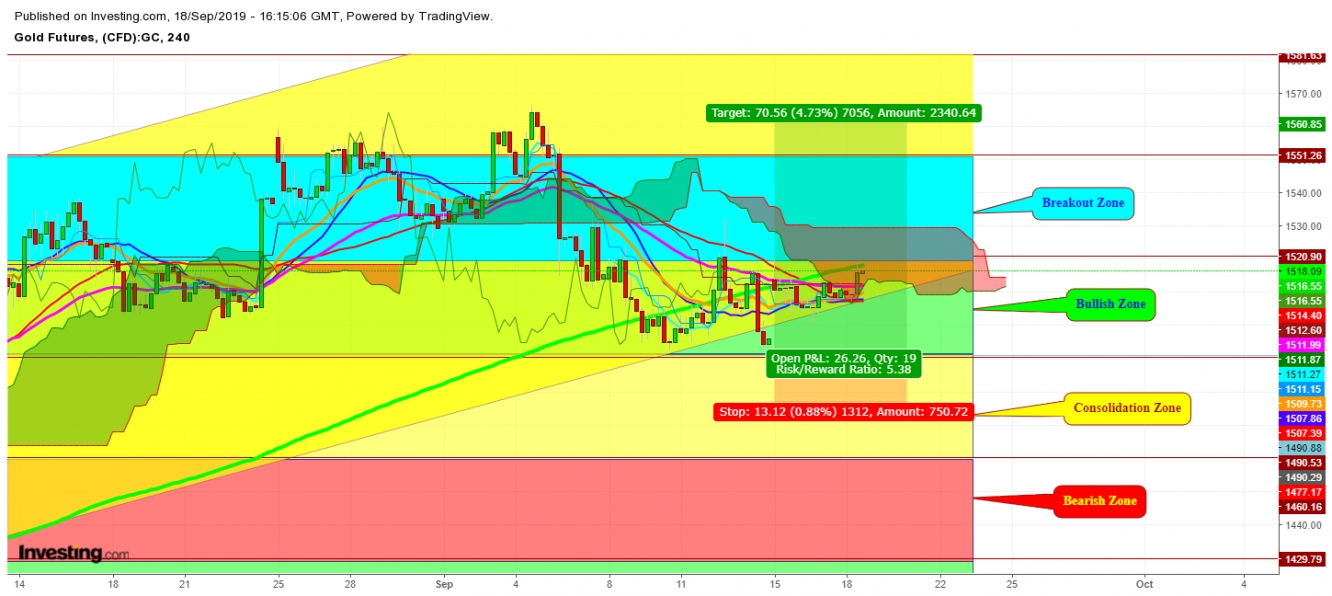

On analysis of the movements of S&P 500 Futures, in different time frames, I find that S&P 500 Futures look ready to repeat steep downward move; what they did on August 23, 2019. On the other hand, Gold Futures look to take a steep upward move; what they took on the same day. No doubt that all eyes are now on the FOMC (Federal Open Market Committee) and the gold market has been pretty sensitive to FOMC and Fed policy this year, so the expectations of a rate cut are supportive for gold. Gold futures have been constantly maintaining strong position on Wednesday, currently trading at $1517.45; and look ready to test $1529 after the announcement of Fed’s decision on Interest rate cut.

I find that the growing uncertainty due to grave geo-political situation, from Sino-U.S. tariff tussle to attack on Saudis oil fields, has extended the fear of global economic slowdown manifolds during the last few weeks; all eyes look to stick over Fed’s decision; which is due at 2 p.m. (1800 GMT) with investors largely pricing in a quarter-point cut, with focus on forward guidance as the central bank policymakers are deeply divided on the need for further easing as U.S. economic data improves.

Finally, I find that the current strength of Gold futures look evident enough for an eruptive move after the Fed’s decision. On the other hand, S&P 500 futures look too weak to sustain at the current level; what they have been holding amid growing volatility. For watching my upcoming videos on Gold and S&P 500 Futures, subscribe my YouTube channel ‘SS Analysis’.

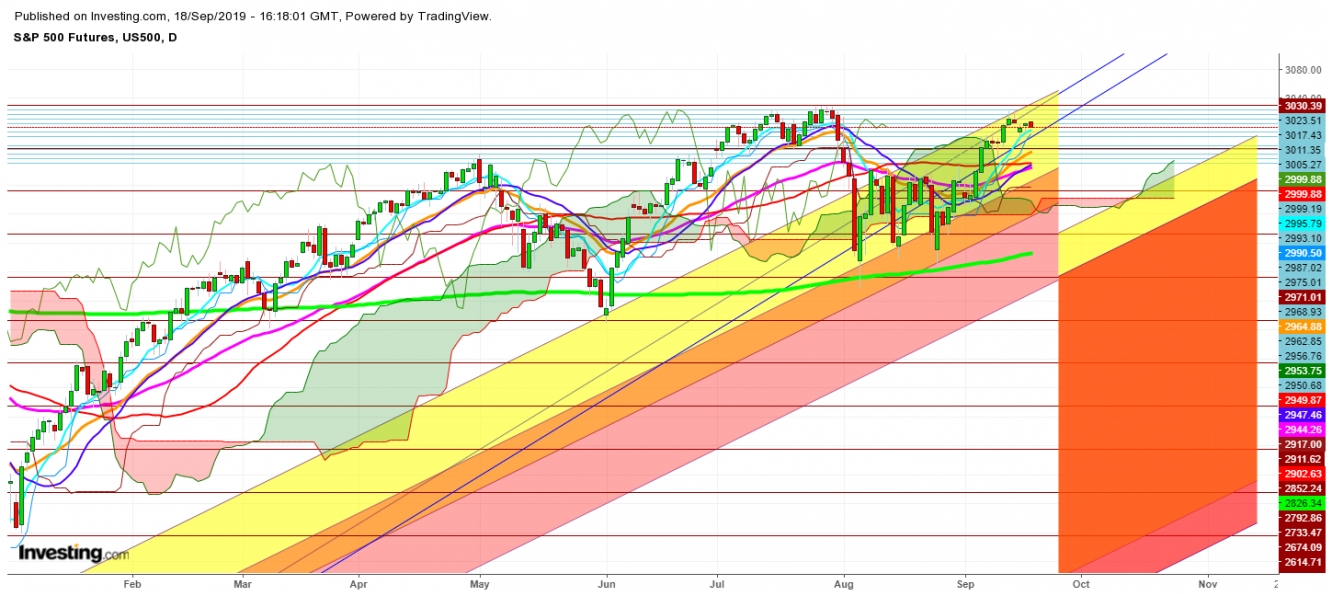

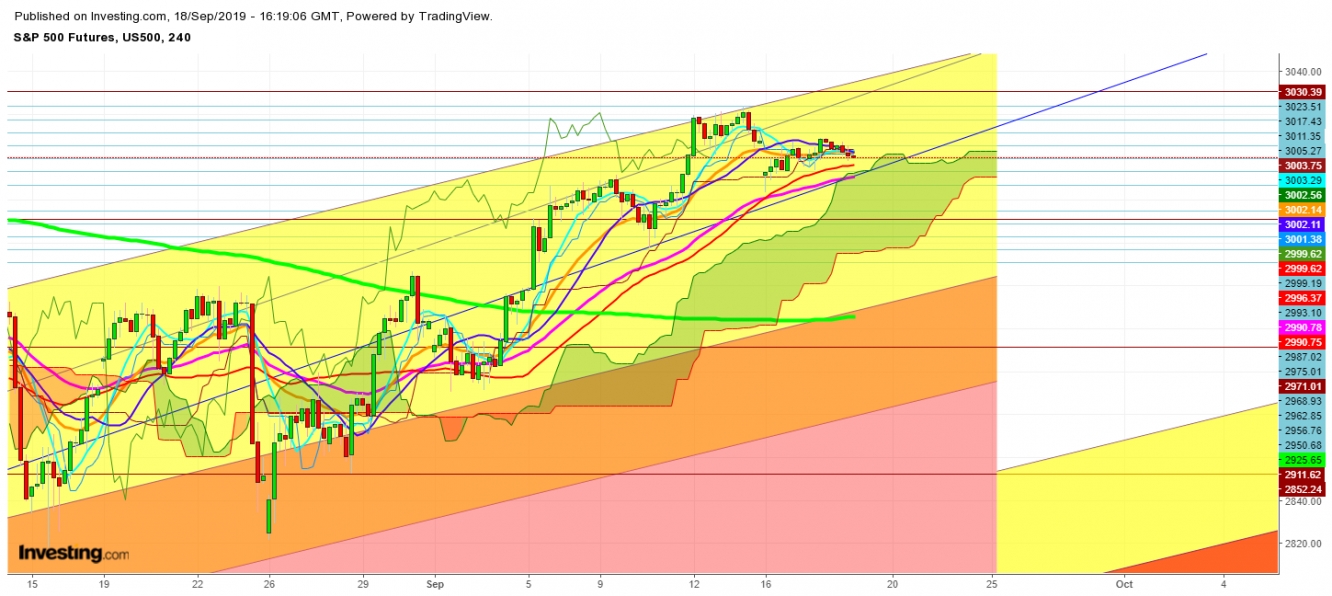

S&P 500 Futures

On analysis of the movements of S&P 500, in different time frames, I find that despite good boost, provided on Thursday after trade concessions between Beijing and Washington gave hope that the two largest economies in the world would soon settle their differences; House Asks Tech Giants for Documents in Antitrust Probe https://www.investing.com/news/stock-market-news/newsbreak-house-asks-tech-giants-for-documents-in-antitrust-probe-1977504 , S&P 500 has been constantly showing exhaustion.

I find that the trade conflict has taken a toll on U.S. manufacturing and tempered global growth, with the International Monetary Fund forecasting that the tit-for-tat tariffs between the United States and China could reduce global GDP in 2020 by 0.8%. On the other hand, Investors are now expecting the U.S. Federal Reserve to cut rates at its policy meeting next week for a decision on interest rate cuts, especially after the European Central Bank announced a sweeping stimulus drive on Thursday to prop up the euro zone economy.

No doubt that the U.S. equity indices gained the bullish sentiments as the Commerce Department data showed that retail sales rose 0.4% in August, lifted by spending on cars, building materials, healthcare and hobbies. Economists polled by Reuters had forecast an increase of 0.2%.; but the U.S. President Donald Trump calmed markets on Thursday after saying he was potentially open to an interim trade deal with China, although he preferred a comprehensive agreement. I find that this interim trade deal seems to be delayed as far as up to 2020 elections, which may keep the uncertainty in global equity markets at the same pitch; as the steady gold futures look evident enough to define the current uncertainty for a long time. For watching my upcoming video on S&P 500, subscribe to my YouTube channel “SS Analysis” https://www.youtube.com/channel/UCnsjgic3owWKZtx1wbTbKLQ

Gold Futures

Disclaimer

1. This content is for information and educational purposes only and should not be considered as an investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.