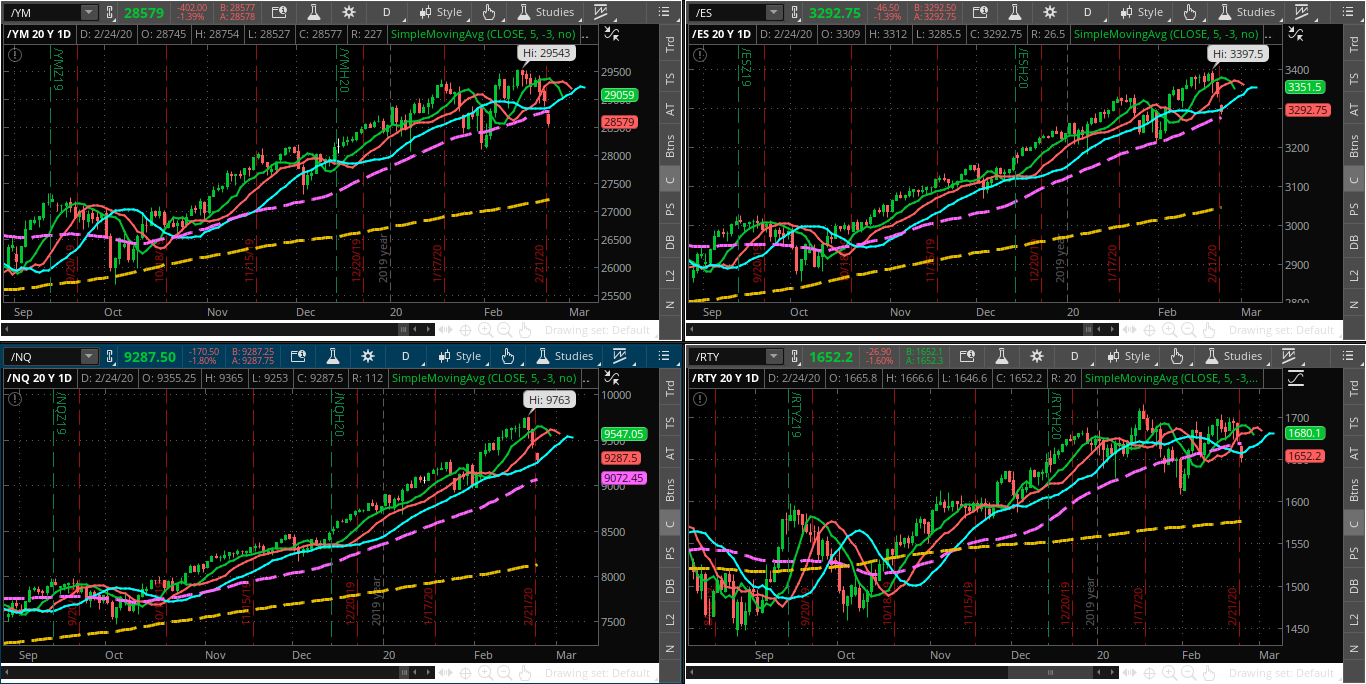

It's around 12:30 am ET on Monday as I begin to write this post. All four U.S. E-mini Futures Indices have gapped down substantially from Friday's close, as shown on the following daily charts of YM, ES, NQ and RTY.

The ES is hovering above its 50-day MA (3279), while the NQ is still well above, and the YM and RTY are below their respective MA.

All of them are trading either within or below a "chaos zone" of a trio of future-offset 5, 8 and 13 moving averages (green, red and blue). Until they all break and hold above this entire zone, I forecast further volatility and/or weakness for U.S. equities. The downturn in these three moving averages is hinting of further weakness.

In fact, the weakest of these E-mini Futures Indices is the YM, inasmuch as the 5 and 8 are about to both cross below the 13 future-offset MA. If that occurs and the crossovers hold, watch for increased volatility and weakness, with the other three indices following suit, in the days ahead.

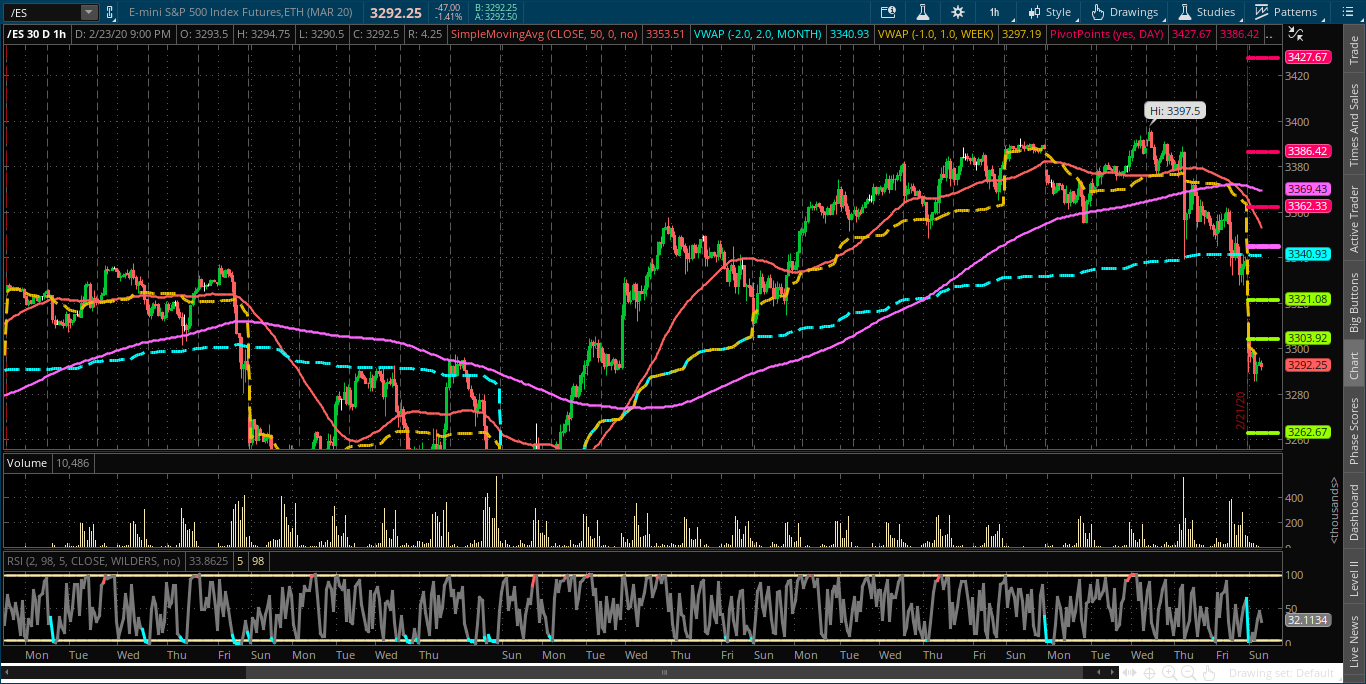

In the very short term, Monday's intraday Pivot Point targets for the ES are (as shown on the following 30-day 60-min chart):

R3 = 3427.67

R2 = 3386.42

R1 = 3362.33

PP = 3345.17

S1 = 3321.08

S2 = 3303.92

S3 = 3262.67

Weekly VWAP = 3297.18

Monthly VWAP = 3340.93

50-hr MA = 3353.53

200-hr MA = 3369.43

All of these levels, as well as the above-noted 50-day MA (3279) represent intraday support and resistance levels (potential targets) for Monday.

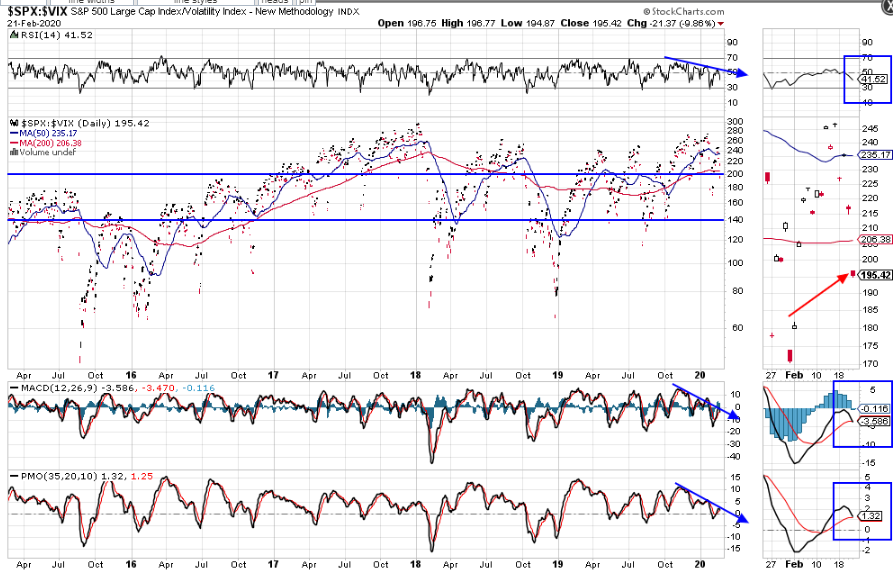

Finally, the following daily ratio chart of the SPX:VIX ratio shows that price gapped down and closed below the 200-day MA around the 200 price support level on Friday.

The RSI, MACD and PMO indicators are in downtrend, and price on this ratio failed to make a new swing high when the SPX hit its all-time high of 3393.52 on February 19. The RSI has dropped below the 50 level, the MACD has formed a bearish crossover, and the PMO is about to form a bearish crossover...all of which are hinting at further weakness ahead for the SPX.

BOTTOM LINE:

Unless we see a sharp snap-back in the above 4 E-mini Futures to new highs soon, together with a new swing high on the SPX:VIX ratio, look for increased volatility and further equity weakness in the near term.