S&P 500 Futures Emini market analysis

Emini daily chart

- Emini tested up to the December 6th high yesterday and after Wednesday's rally.

- While the rally was good for the bears, it is a disappointing bar due to the tail above it. This increases the odds of the market going sideways to down over the next several weeks.

- The odds favored sellers back at the December 6th high due to disappointed bulls selling out of longs and bears looking to establish shorts.

- The bears, at a minimum, need to add to the selling pressure and make the market go sideways.

- The bears hope this is the start of a strong reversal below the moving average.

- Because the channel up has been tight, the odds favor sideways trading and not a strong reversal today or tomorrow.

- Overall, the bull channel forms a wedge top and will likely be corrected soon. This increases the risk of a test to the November 19th low over the next several weeks. It is important to realize that the market can go sideways for a long time before the bears get the test down.

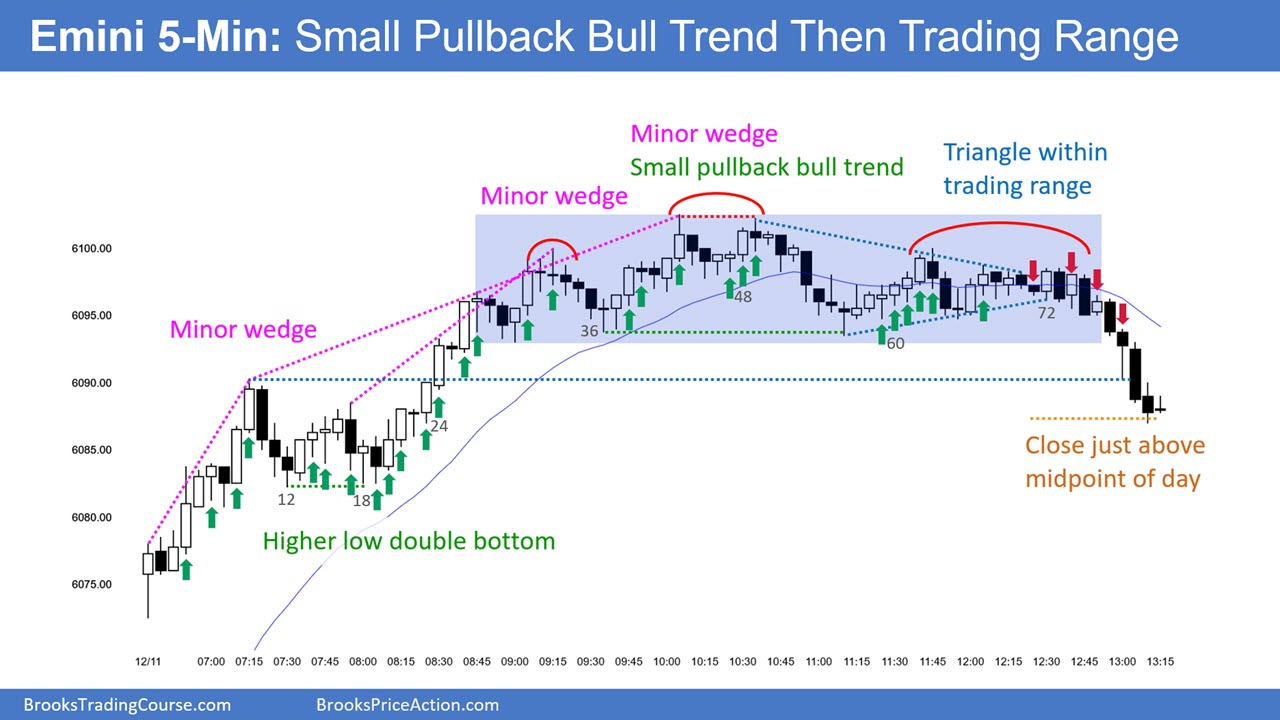

Emini 5-minute chart and what to expect today

- The Emini gapped down on the open and is testing yesterday’s low.

- Because of yesterday’s rally’s strength, the odds favor a trading range today, not a strong bear trend day.

- This means traders will probably look to buy and attempt to go below yesterday’s low.

- The bulls see the selloff that began at yesterday’s high as a pullback following the large bull breakout. Next (LON:NXT), the bulls want a rally and test of yesterday’s high.

Yesterday’s Emini setups

S