Since early August, I used the Elliott Wave Principle (EWP) to forecast the S&P 500 (SPX) reaching SPX 4550-4600 before a 200-300p correction should start. My latest update can be seen here.

One day after my last update, the index topped at SPX 4546. It has since moved lower every trading day. Assuming the index closes red today, it would mark the fifth consecutive down day, which has not been experienced since June 18. The last string of five down days in a row ended Feb. 22. Thus, the current down week, therefore, appears to be significant as it signals a trend change. Allow me to explain below.

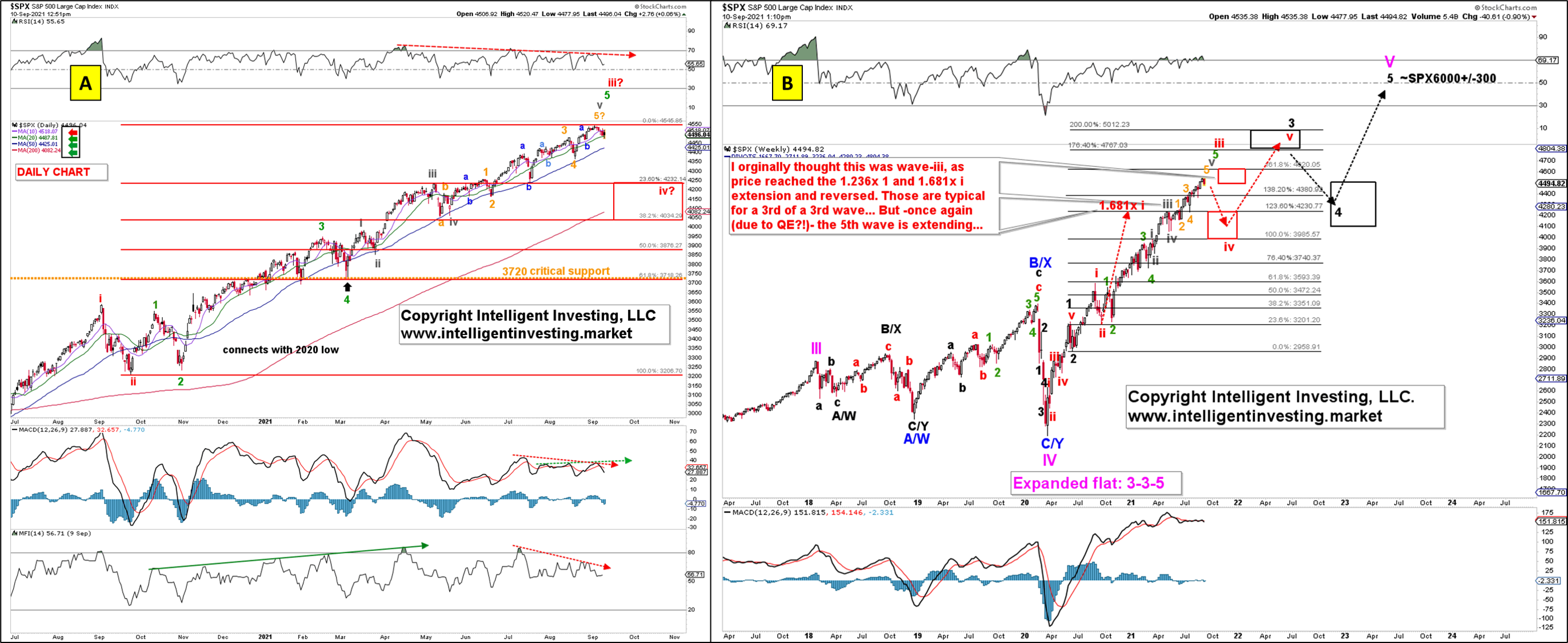

Figure 1: S&P500 daily and weekly charts with detailed EWP count and technical indicators.

With a high of SPX 4546, the index came close enough to the ideal SPX 4550-4600 target zone I had in mind, and well within the narrowed-down SPX 4535-4595 target zone first identified in early August. (See here.) Although a break below SPX 4465 is needed, followed by a move below SPX 4365 to confirm, there are now enough waves in place to call the entire overlapping rally since the May low complete. See Figure 1A above.

Moreover, there’s now also negative divergence on the technical indicators (red dotted arrows) to slow the current (red) intermediate wave-iii of (black) major wave-3 of (blue) primary wave-V uptrend down. Although divergence is only divergence until it is not, it must be noted.

In addition, the preferred bullish EWP count suggests the index is about to complete the most vital part of its rally: the 3rd of a 3rd wave, and the pending correction is thus another buying opportunity.

The weekly chart in Figure 1B shows what to expect next as this wave-iii of 3 extended. A (red) intermediate wave-iv pullback to SPX 3985-4230 should be in the cards, with the upper end preferred (downside disappoints and upside surprises in bull markets). From there, I expect the 5th wave rally to complete (black) major wave-3 around SPX 4767-5012 before an even larger correction starts (major wave-4), with a last-gasp rally to around SPX 6000 to finish the entire bull market that started after the 1929 crash.

Conversely, the index will have to break back above SPX 4546 to try for SPX 4600 one more time.

Bottom line: Watch for a break below SPX 4465 and especially SPX 4365 to signal an intermediate-term pullback is under way, which should be an excellent buying opportunity for another run higher to SPX 4800-5000.