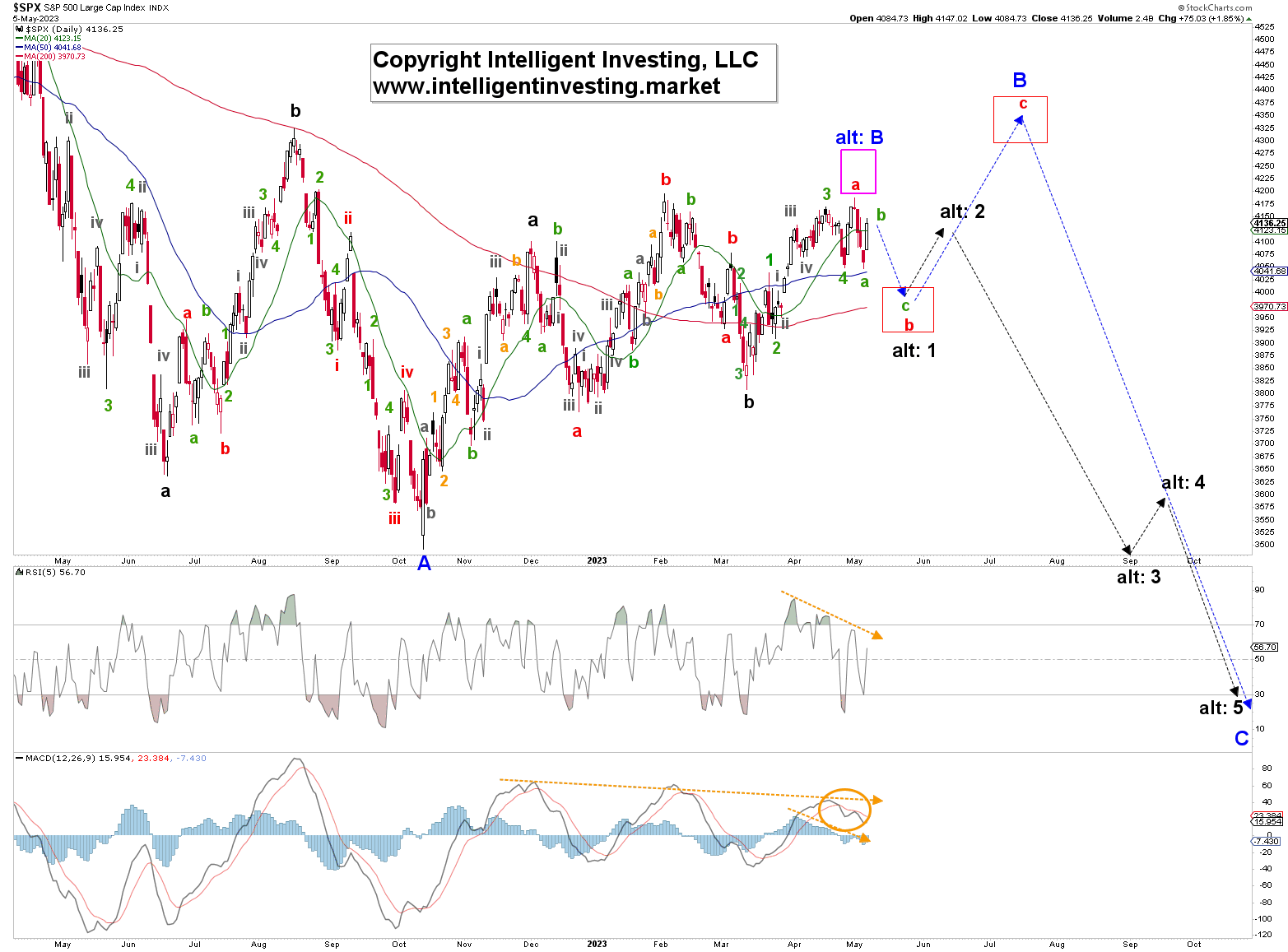

Last week, see here, we warned using the Elliott Wave Principle (EWP) that the S&P 500 (SPX) was approaching a larger top once, ideally, $4200-4285 would be reached.

The index reached $4187 the same day our article was posted. Similarly to the previous top, which also did not reach the ideal (red) W-iii upper target zone, see Figure 1 below, the SPX topped 13p shy of the lower end of the perfect target zone. Or, as they say,

“The markets do not owe us anything, and in Bear Markets Upside Disappoints.”

Regardless, we don’t sweat the small stuff as we have been forecasting last week’s highs and lows every step of the way, see here, and the general path we have been sharing with you since April 12 appears still on track.

After topping on May 1, the index dropped almost 140p (3.3%) in just three days, only to rally 75p on the last day of the week to ease some pain. This price action leaves us in a bit of a precarious spot.

Namely, last week we found,

“Once the red W-v tops, we should prepare for the blue W-C, which will subdivide into the five black waves 1, 2, 3, 4, and 5: black dotted path (exemplary only; not accurate in price nor time). The alternative options will be the red “alt: b, alt: c”: blue dotted path.”

Given the decline from last week’s high to last week’s low was only three waves, i.e., corrective, we now switch between our preferred and alternative EWP counts. The preferred option is the green W-a, -b, -c for red W-b, followed by the red W-c: blue path. The alternate is the black path, where the black “alt: 1” will have to morph into an overlapping leading diagonal.

The preferred path is looking for possibly a bit higher early in the week, ideally around SPX4155+/-5 for green W-b, before green W-c takes hold, bringing the index down to ideally $3925-4000. This downside target zone will be updated as more price data becomes available. A break below SPX4049 will confirm this option with a severe warning for the Bulls below $4090. The Bulls will have to push the S&P 500 over $4200 on a daily closing basis to tell us the rally to $4300+ is most likely happening more directly.

However, please do not forget the (pre-election year) seasonality we have shared before. It peaks significantly in early May, followed by a decline into late May and a rally into the Summer. See Figure 2 below. Besides, the 10-year lag between Crude Oil and the Dow Jones Industrial Average, which we have also shared with you before, has a significant top due later this year too.

Thus as long as these relationships hold, we continue to give them our attention. As such, the current preferred EWP count we have in front of us continues to match these patterns well.