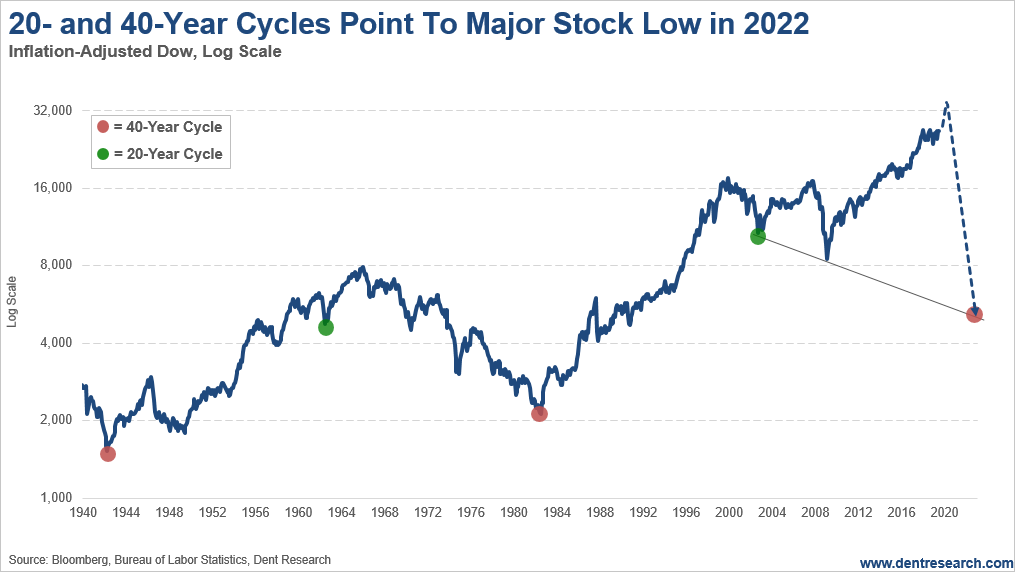

I noticed this cycle in the early 1980s: Substantial stock-market bottoms have come every 20 years and major ones every 40.

That 40-year cycle would correspond to the generation waves of spending that have actually peaked 39 years apart – in 1929, 1968 and 2007.

Twenty years would be half of that cycle and double the average recession cycle that occurs roughly every 10 years and corresponds with sunspots. Cycles tend to be more powerful on alternating swings, as Market Timing Report’s Andy Pancholi taught me. So, we actually have 10-, 20- and 40-year cycles hitting just ahead.

Look at this chart back to 1929 showing these two cycles. Major lows occurred in May 1942 and August 1982 for stocks. Minor lows occurred in late 1962 and 2002.

Reasons For A Crash

The next major low on both cycles would be targeted for mid-to-late 2022.

I have been quoting this scenario for decades, which shows just how consistent the two cycles have been.

There are other reasons I am looking for the “crash of a lifetime” to start sometime in 2020 and the “sale of a lifetime” on financial assets by late 2022+.

The 45-year and double 90-year Super Bubble/Great Reset Cycle also bottoms around 2022, following previous major bottoms right on cue in 1932 and 1942.

My Generational Spending Wave forms a 3-year bottom between 2020 and 2023.

I know that governments have and will continue to throw the kitchen sink at this bubble to keep it going… especially President Trump. But you simply can’t keep a bubble going forever.

If there is any time that this bubble will burst, it is in the extreme danger zone between 2020-2022.

A normal 2-3-year crash would have to start sometime in 2020, preferably early 2020, as has been my best forecast. It could well be later in the year if Trump starts sending money directly to people in order to get re-elected, as in his suggested payroll tax cut.

If it doesn’t happen by then, we have finally died and gone to heaven – a land of endless happiness with no cycles.