Gold has been in a sideways consolidation for over four months, with erratic movements making it challenging to predict the next move.

On the daily chart, moving averages are flatlining, and we see a negative divergence with the slow stochastics trending downward, indicating a possible downturn at the start of this week.

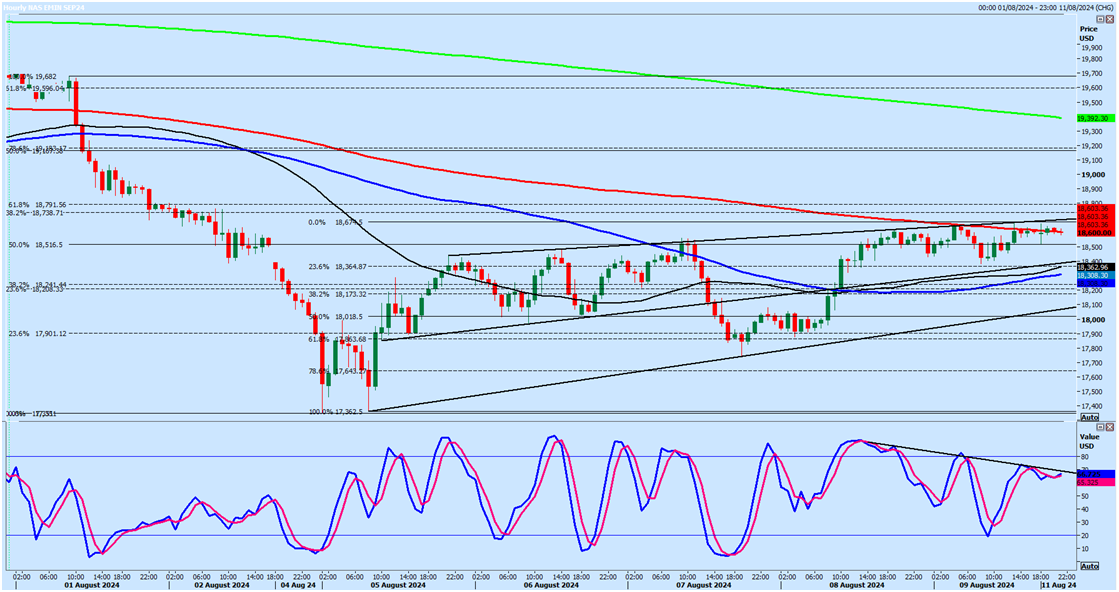

Similarly, the E-Mini S&P futures show an upward price trendline, but again, we have a negative divergence on the slow stochastics.

The market is hovering just above the 100-day moving average—a crucial level that could dictate the direction for the week.

In the Nasdaq, I'm watching a potential bear flag formation within a consolidation channel.

We’re approaching long-term resistance, marked by a two-year-old trendline and Fibonacci levels, suggesting that downside risks are significant.

My bias leans bearish for both the S&P and Nasdaq this week.

E-Mini S&P September Futures

- E-Mini S&P retests strong resistance at 5350/5360 (the US500 contract is about 26 points under this price) but ran as far as 5385 before reversing.

I still think there is a good chance we turn lower today.

Targets: 5320, 5295, 5275

A break above 5385 is a buy signal targeting 5400 and resistance at 5420/30 for profit taking on longs and shorts need stops above 5440.

Nasdaq September Futures

- E-Mini Nasdaq hit resistance at 18630/730 (US100 contract is about 105 points above here) & made a high for the week exactly here.

- Shorts need stops above 18850 & a break higher is a buy signal targeting 19000/19100 for profit taking on longs.

- Targets for the shorts at 18630/730 are 18480 & 18330, perhaps as far as 18200.

Video Analysis: