Over the last almost four weeks, I have kept you up-to-date on how the current ongoing correction in the S&P 500 futures Market (ES_F) should unfold using the Elliott Wave Principle (EWP).

On April 13th, I found:

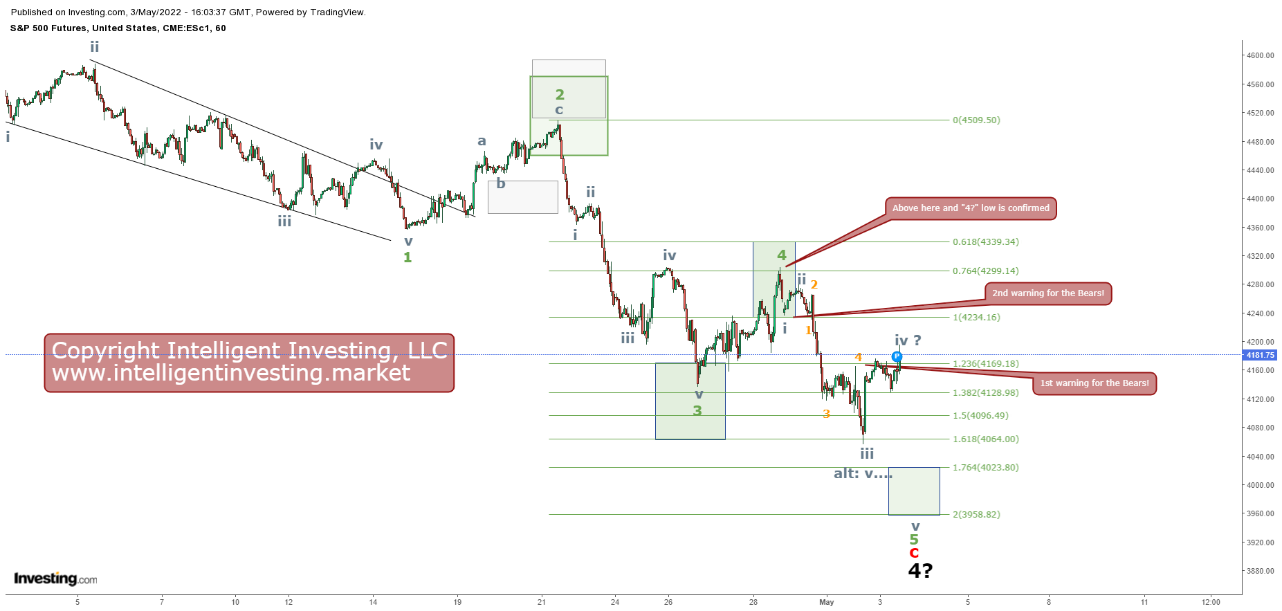

“I expect a bounce to 4500+/-25 soon from where the subsequent decline to ideally 4115+/-25 can start (green c/3). Once that target zone is reached, the index should bounce again to 4285+/-25 (4?), followed by a final decrease to 4015+/-25 (5?, c, 4).“

Let’s see what happened using Figure 1 below.

The index topped at $4509 (green wave-2), dropped to $4136 (green wave-3), rallied to $4303 and (green wave-4), and bottomed yesterday at $4056 (grey wave-iii/alt: v). Thus, using the EWP, I have been able to forecast each low and high, so far, weeks ahead of time.

That raises the question: do news and other externalities drive the markets, or does the stock market marches to the beat of its drum?

Impulse lower unfolded as it should. Is it complete?

I determined the bulls had fumbled on April 13th, and the index has since followed a standard Fibonacci-based impulse pattern to the downside. Although it does not work this beautifully all the time, it does mean that a sustainable bottom is most likely in or very close.

Namely, one last stab lower (a final 5th of a 5th wave, i.e., grey wave-v of 5 of c of 4) deeper in the ideal Fibonacci-based target zone of ES_F3959-4024 can not yet be excluded. But it is not necessary; there are enough waves in place, and all the target zones set forth several weeks ago have been reached.

Or, as they say:

“Do not bank on the fifth of fifth waves.”

Bottom Line

Now that the ES_F got very close to my ideal target zone of SPX $4015+/-25 set forth several weeks ago, it is time to start paying attention to the possibility of a sustainable bottom in place. A move above ES_F $4303 will be an excellent first sign, with confirmation above ES_F $4509. If the index reaches those two levels over the next few days and weeks, the anticipated rally to 5500+ has most likely begun.

But as always, I will continue to monitor the price action to see if the market may have one more trick up its sleeve as that final stab lower cannot be excluded just yet.