Using the Elliott Wave Principle (EWP), I have been tracking how the ongoing correction in the S&P 500 Futures market (ES_F) should unfold starting April 13 (see here).

As I already warned on April 7, trouble was brewing. Based on the available price data, I found that the index would see:

“a final decrease to SPX4015+/-25. Now we can let the market do its thing and see how it will fill this anticipated path and make minor changes if necessary[...] All we can do is anticipate, monitor, and adjust.”

As more price data became available, that downside target was revised slightly to SPX3960-4025. Ultimately, the index bottomed last week at SPX3855 because the final (green) minor-5 wave extended.

Such extensions can always happen but are impossible to know beforehand. Regardless, my bottom call on April 13 was only off by 3.4%, which is well within the margin of error.

As I always say:

“Please remember, my work is ~70% reliable and ~95% accurate. I am not a prophet. Thus, be realistic and do not expect perfection and zero bad calls in a dynamic, stochastic, probabilistic environment.”

Now that this leg of the five-waves decline has ended, it is time to assess what is most likely coming next.

After Five Waves Lower, Expect At Least Three Waves Back Up

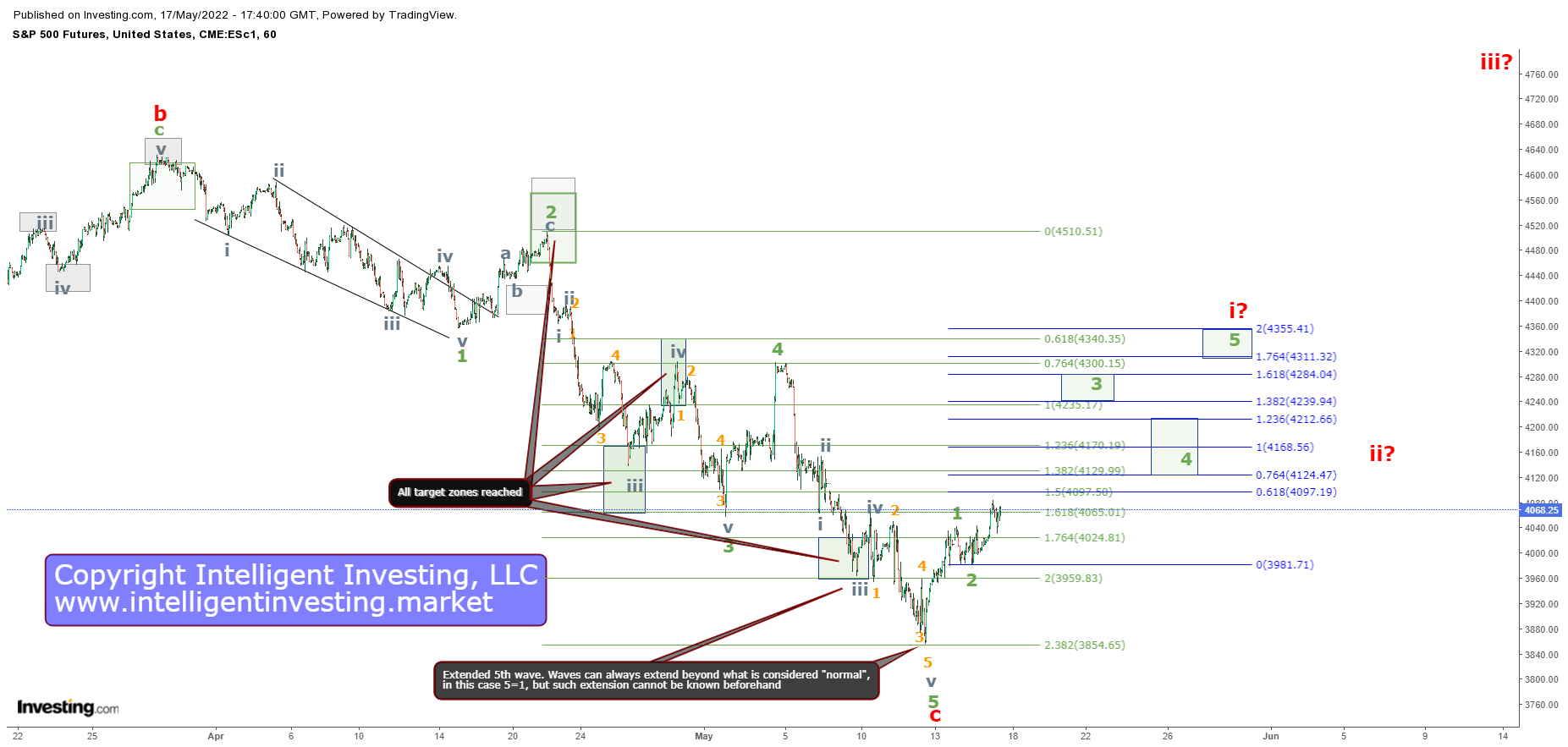

Allow me to explain. Now that the Futures have rallied over 5% and overlapped with the (green) minor-3 low made on May 2, the index is most likely either working on a more significant bounce (Figure 1) or has started its final rally to ES_F5500+ (Figure 2).

Once five waves have been completed, in this case to the downside, one must expect at least three waves back up. Why? Because one is never sure if the correction continues, i.e., subdivides or not.

Figure 1 shows how the market can try to morph the current correction into what is called a double zigzag in EWP terms. It would essentially mirror the leg lower from the January all-time-high (ATH) into the February 24 Ukrainian invasion low.

The grey and blue arrows show the anticipated path (proportionate in price, not time). Assuming there is symmetry, the current rally is part of a larger b-wave to ideally the (blue) 62% retrace at ~ES_F4335+/-25. From that level, a final c-wave lower will then complete the correction at around ES_F3750+/-25.

Figure 2 shows the ES_F has completed its 4th wave correction as, so far, the entire decline from the January ATH was only made up of three larger waves, not five (Only red (intermediate waves b and c are shown).

Corrections are always at least three waves. Thus, the YTD price action can be considered complete. In that case, I anticipate a standard impulse pattern as shown using the green and red labels. With only a few days of price data available since last week’s low, it is still too early to have high confidence in the impulse path. As shown, the index should move forward around these lines.

But, remember, what was said on April 13 applies now as well:

”Now we can let the market do its thing, see how it will fill in this anticipated path, and make minor changes if necessary. Or, as I always say, “All we can do is anticipate, monitor, and adjust.”

Bottom Line

Last week, the ES_F bottomed 3% below my ideal target zone set forth a month prior. Well, one can bank on within my ~95% accuracy level. With the recent rally off that low, it is time to look higher. Either a more significant bounce to ideally ~ES_F4335+/-25 from where I expect a final c-wave lower to complete the correction at ~ES_F3750+/-25. Or the correction is over.

In that case, the index is working on an impulse to around ES_F4325+/-25, and I expect a wave-ii decline to around SPX4125+/-50 before the wave-iii to new ATHs kicks in. I will have to revise my current POV on a drop below last week’s low.