S&P 500 Futures December found support just 3 points below the buy zone at 5745/35 before surging to both targets of 5755 and 5765. The previous session ranged from a low of 5733 to a high of 5822.

Nasdaq 100 Futures December dipped lower but found strong support at 19900/800, setting the low for the day. Last session's range was 19818 to 20331.

Dow Jones Futures December has been trading sideways for several days. The most recent session ranged from 42251 to 42656.

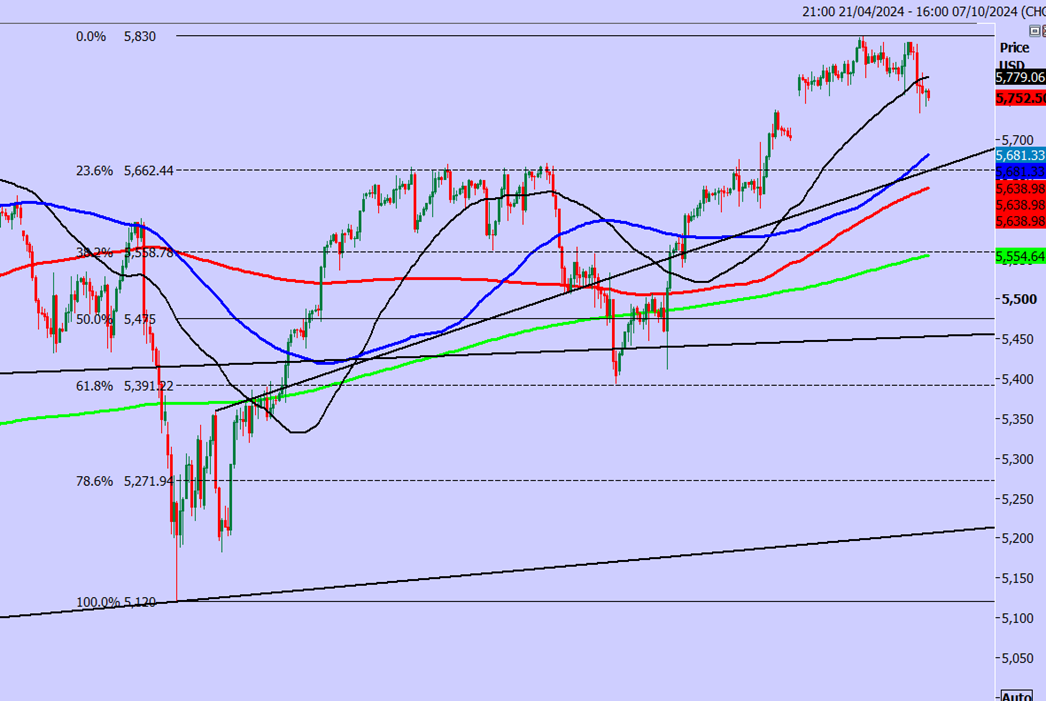

Emini S&P September Futures

Long positions at the key support of 5745/35 worked perfectly, as the market held above 5730 and rallied to 5755 and 5765, extending gains to 5783. If momentum continues, we could see a retest of the all-time high at 5820/30.

For the week ahead, support remains at 5745/35, with stops below 5730. A break below this level could target 5695/90, with further support at 5680/70. Longs at this zone should consider stops below 5660.

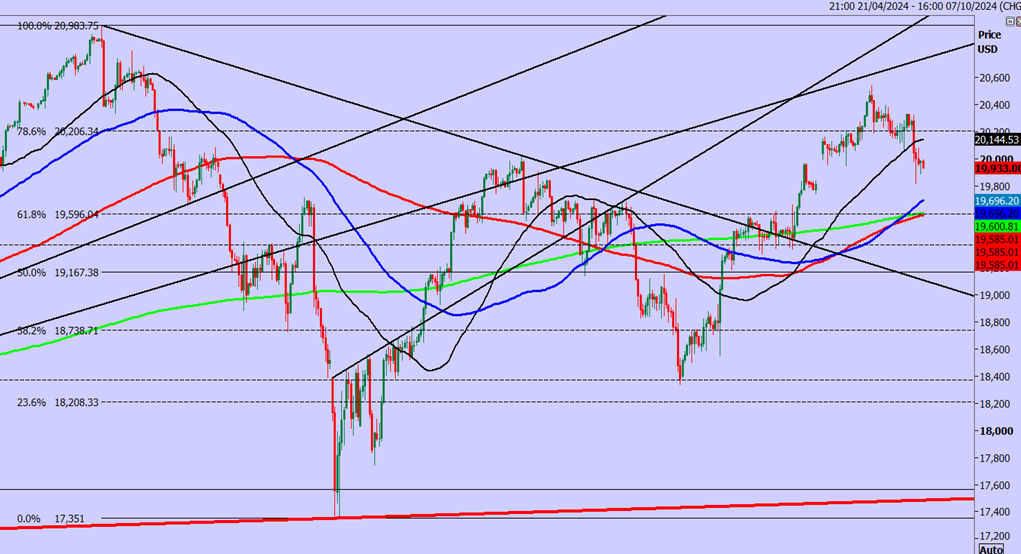

Nasdaq September Futures

We broke support for Emini Nasdaq at 20250/150 to hit my next downside target and very strong support at 19900/800 with a low for the day exactly here.

We then shot higher to 20081.

If we continue higher look for 20150/200, perhaps as far as 20250/290.

Strong support again at 19900/800 - Longs need stops below 19700.

A break lower today however risks a slide to 19550, perhaps as far as strong support at 19400/300.

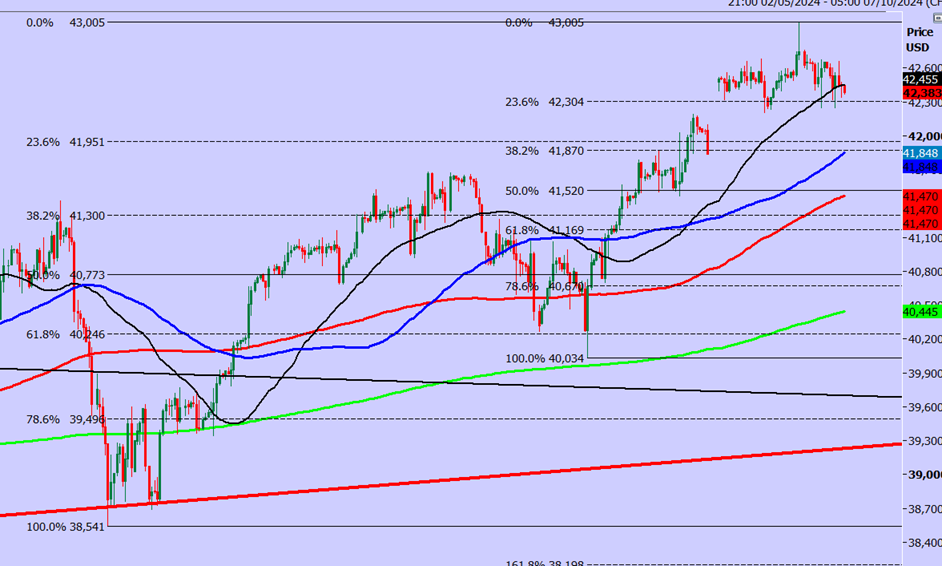

Emini Dow Jones September Futures

We wrote: I think gains in Emini Dow Jones are likely to be limited in severely overbought conditions but there is definitely no sell signal and I will remain a buyer on any profit taking.

We did dip as far as support at 42350/250 as predicted and this did prove to be an excellent buying opportunity again but longs need stops below 42150 on a retest today.

Targets of 42500 and 42650 were hit immediately, meaning we caught the low and high for the day for the second day in a row.

A break lower this week however risks a slide to 42000/41900 and longs need stops below 41800.