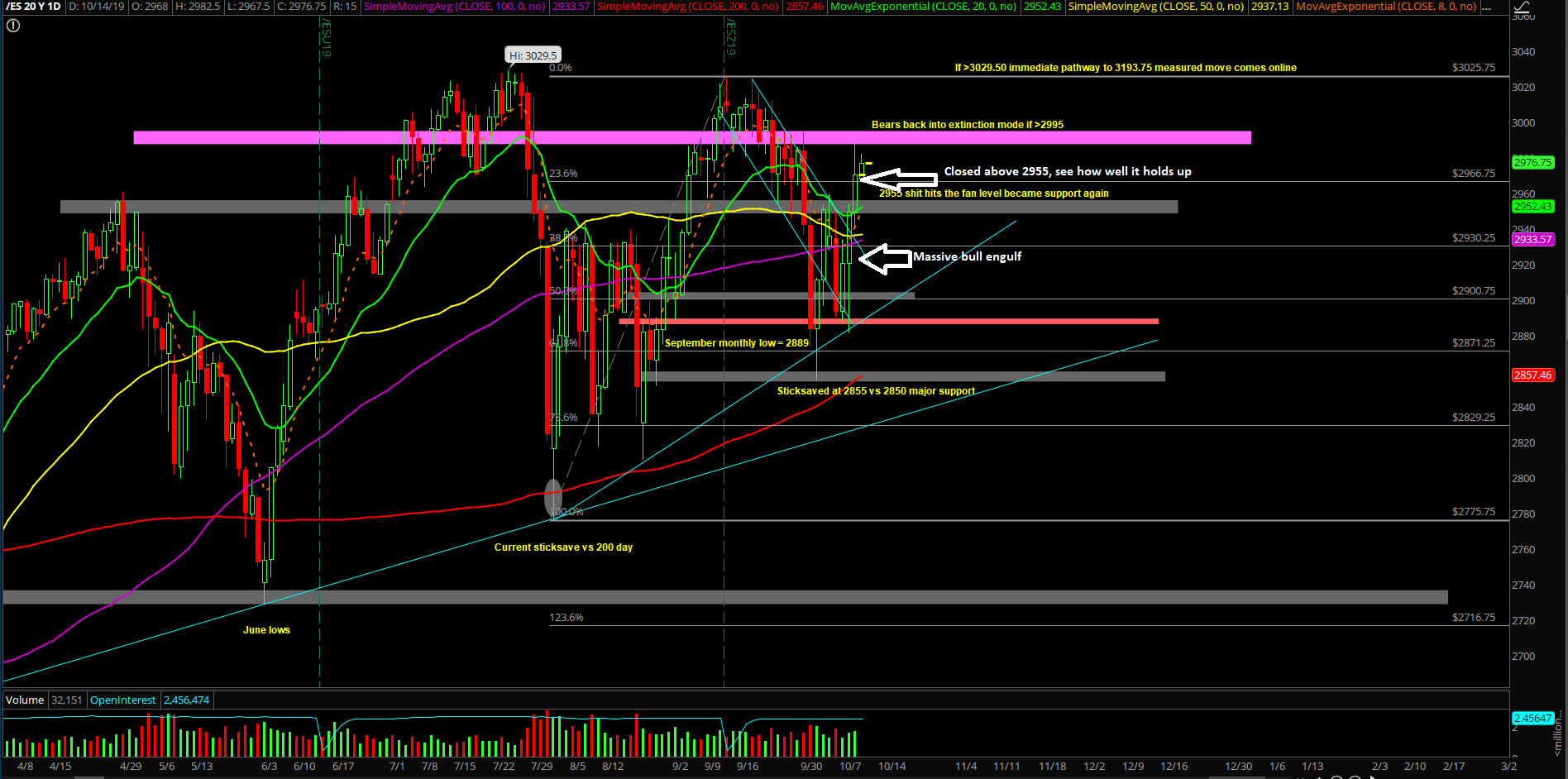

Friday closed at 2970.25 on the ES as a top wick bull bar candlestick. The bulls were unable to close at the dead highs, but they closed above the major 2955 level from these past few months. Heading into this week, when above 2941.75, all dips are buyable on the micro and traders should be focused on buying dips only until price proves otherwise. Below 2941.75 creates another potential double top/lower high setup on the lower timeframes that could extend into the daily/weekly timeframe.

Technically speaking, price action is still trading within an inside week range of 2994.5-2855 overall from the September 30th week, and traders must be aware of this if Monday and the early week in general does not gap up or break above this range. Earnings season is ahead of us, so traders must make sure to manage risk exposure/deltas properly in this environment with the potential of another inside week "shake and bake."

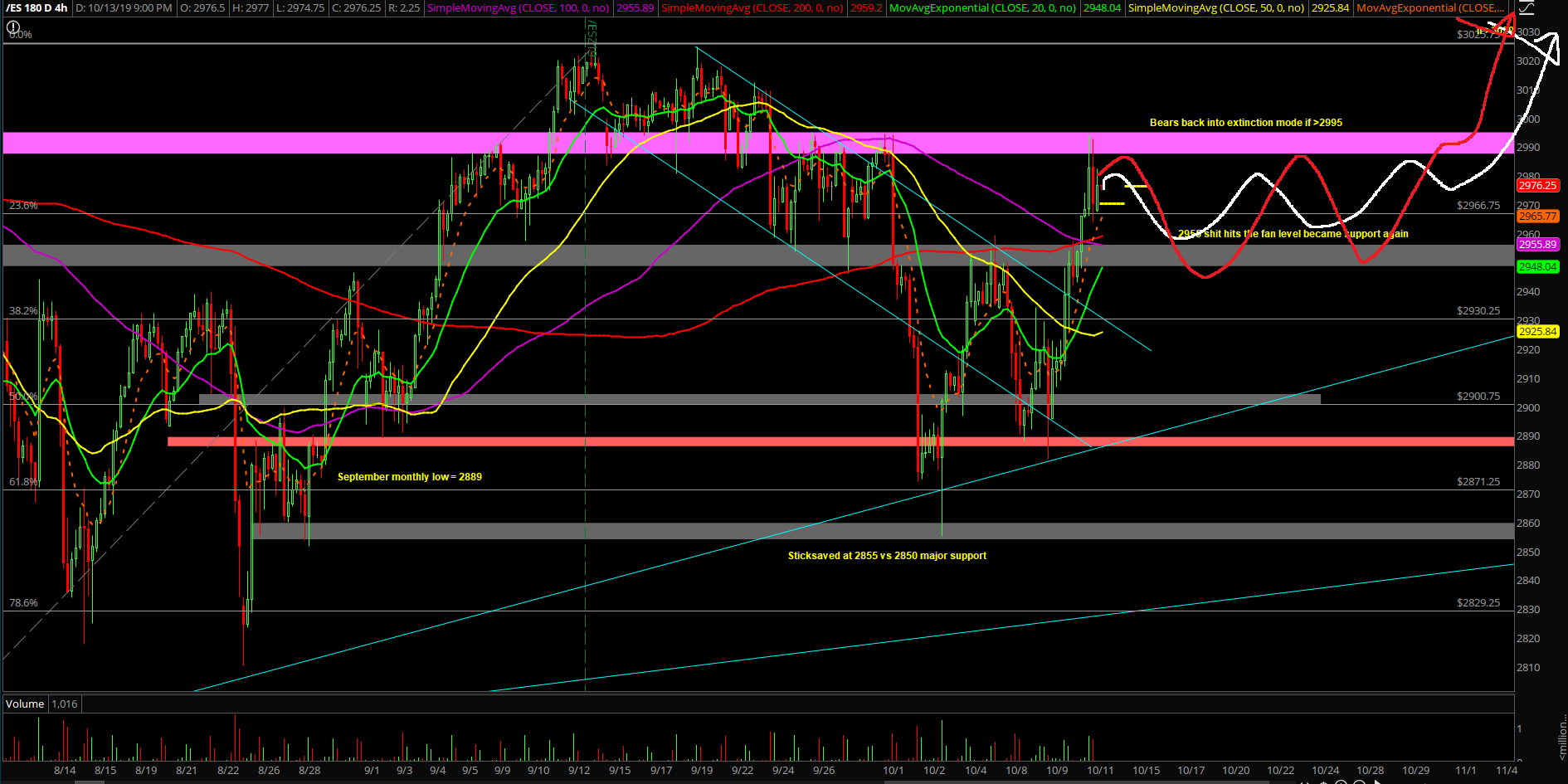

Our 4-hour white line projection is king for now with 4-hour red line projection as alternative. Adapt when price proves otherwise. Also keep in mind that the daily chart could be a W-bottom formation already or one more retracement lower, then a blast off towards 3193.75 macro target.

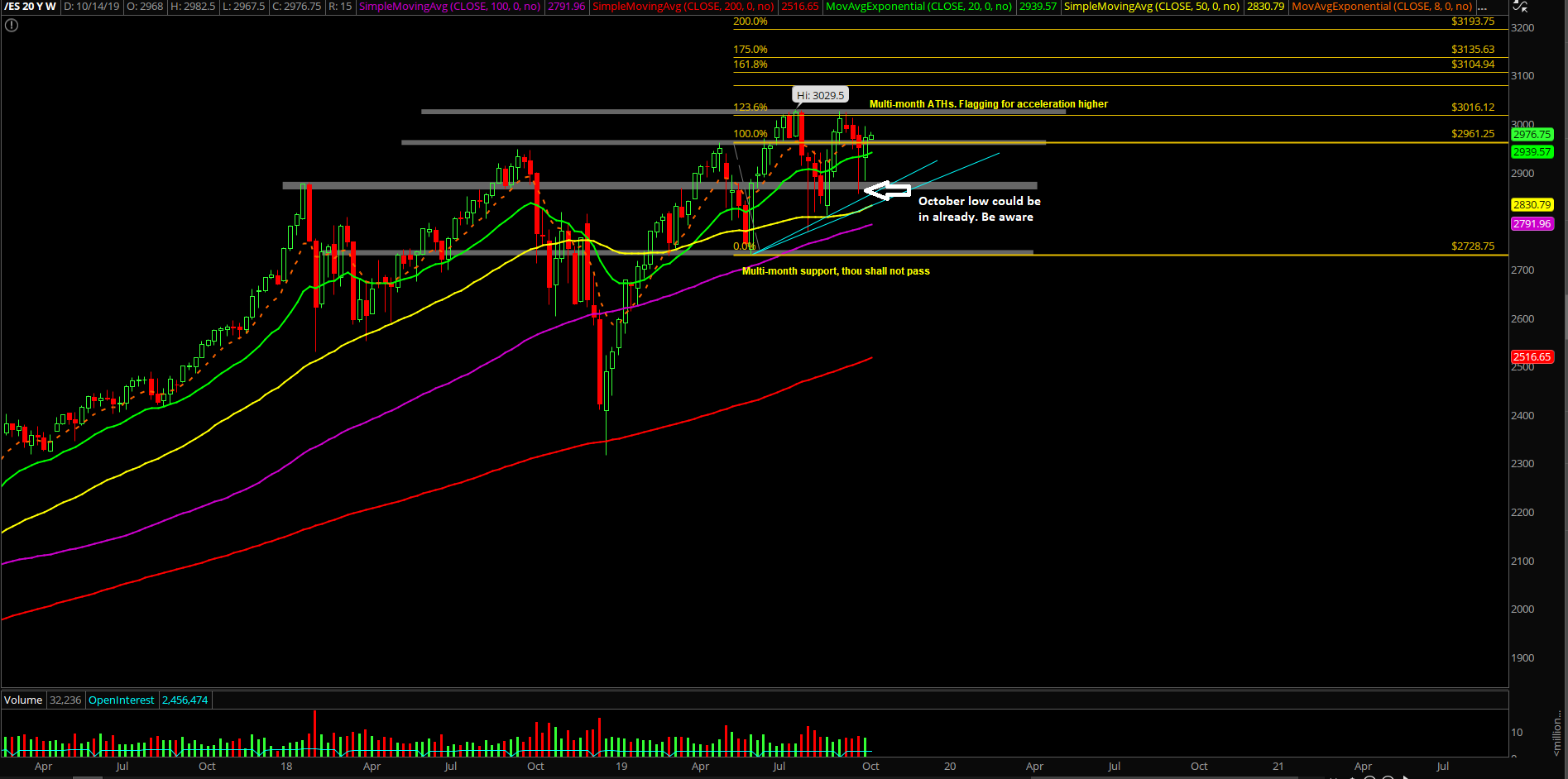

The weekly chart was an inside week full retracement of the Sept 30th bear candlestick, and the higher lows/double bottom setup is fairly clear on this timeframe. At this point, when above 2881.75, the bulls have the ball, and this is especially true when above 2900/2915.

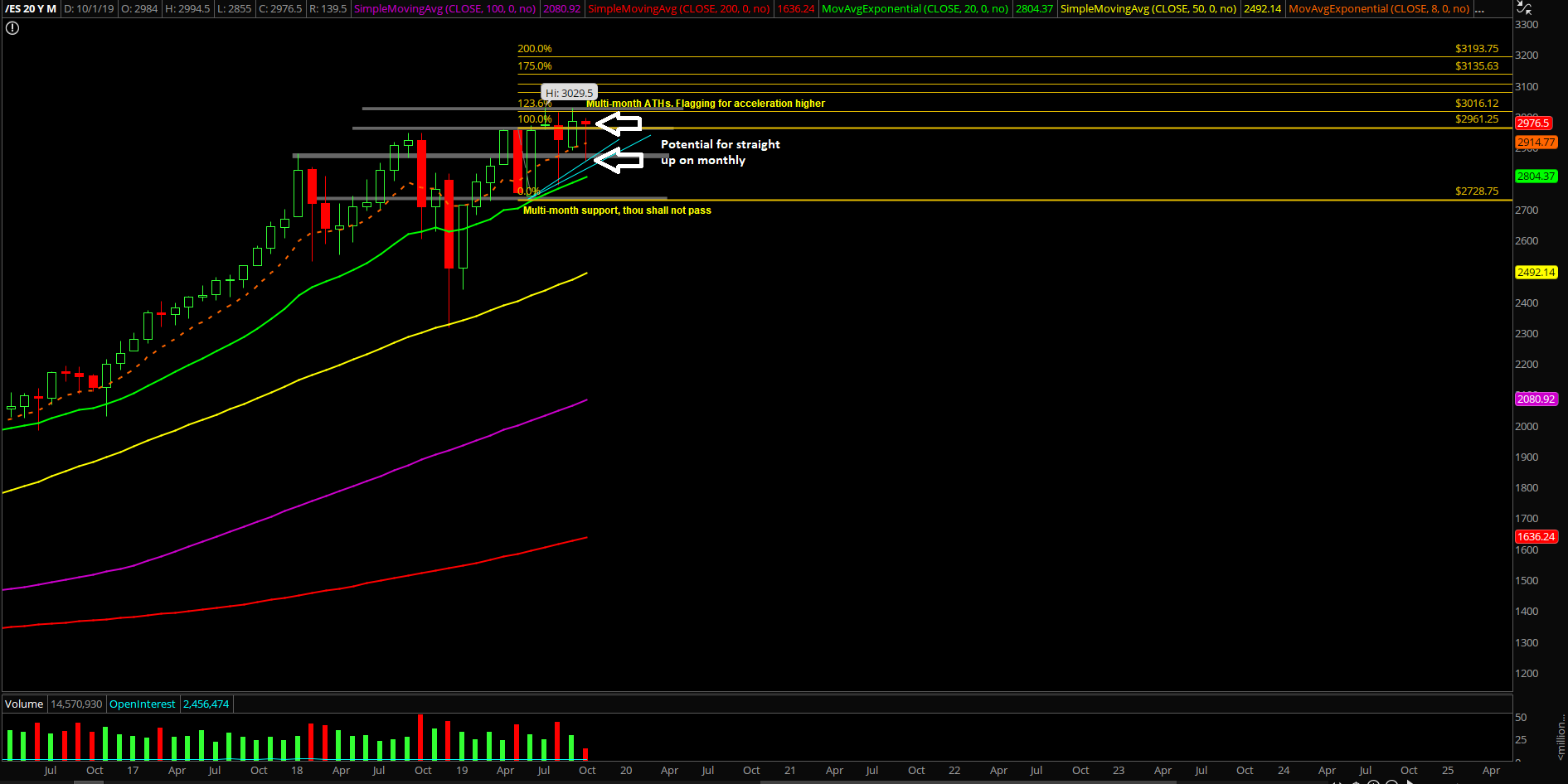

Overall October Bias and Into Year End/Year 2020: