A decade ago I was seemingly always on the lookout for a crash. It’s not a profitable long-term strategy. In recent years I literally found myself resisting the urge to participate in crash “theology”. In most cases I would find if I paused, those moments would likely mark important bottoms.

The curious thing that happens mentally when you make that transition over a period of years, is that as I resist the urge to participate in a move that is getting away to the downside I begin to recognize more clearly when I’m out of step with the market. I experienced that on Friday. The market had many good reasons to continue bouncing higher but it didn’t. Friday’s break of key support I imagine caught a lot of people off guard. This is the environment where crashes are possible.

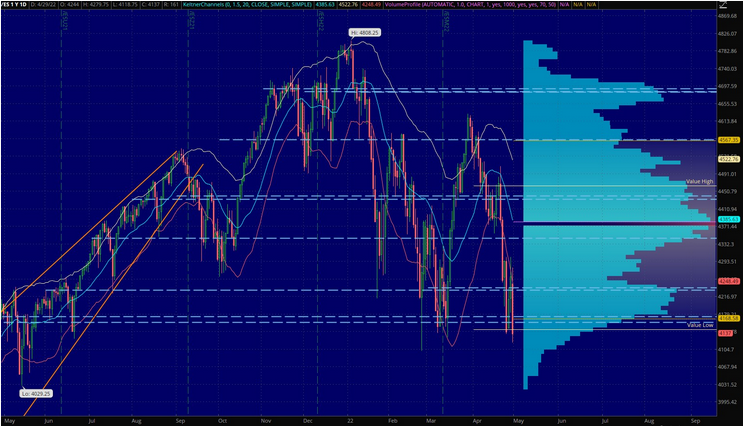

Above is the daily chart of /ES. You can see that Friday’s action broke under what has been key support, the cluster of two POCs at 4161 – 4174. If we continue to hold under these POCs on Monday, I would expect this to be a key change in the market’s direction. The problem (for bulls) is that due to the speed of the rise off the COVID low where there is very little support under this area.

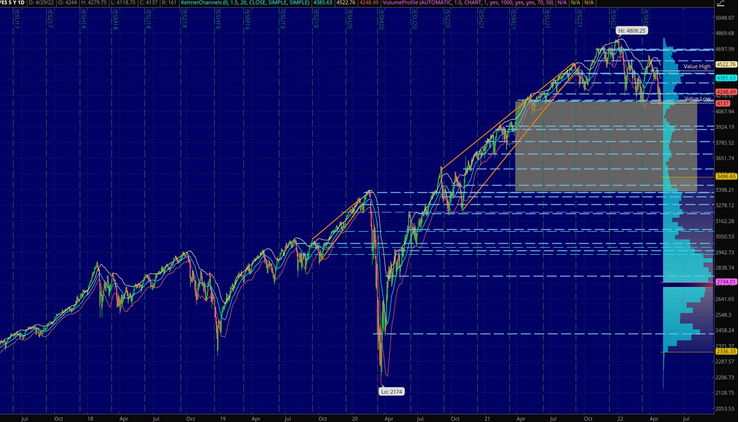

On the five year chart below I have highlighted the area I would consider at risk. You can see there are primarily only single line POCs, no clusters in this area. This is representative of little support being offered. I would think that the pre-COVID highs around 3300 should offer support if the downtrend continues on in earnest.

I’ve gotten asked multiple times over the years why I’ve been around Slope for the past 15 years. The answer is simple: I value the bearish perspective. I think it is largely missing as a form of analysis for most investors. The result? Ignorance.

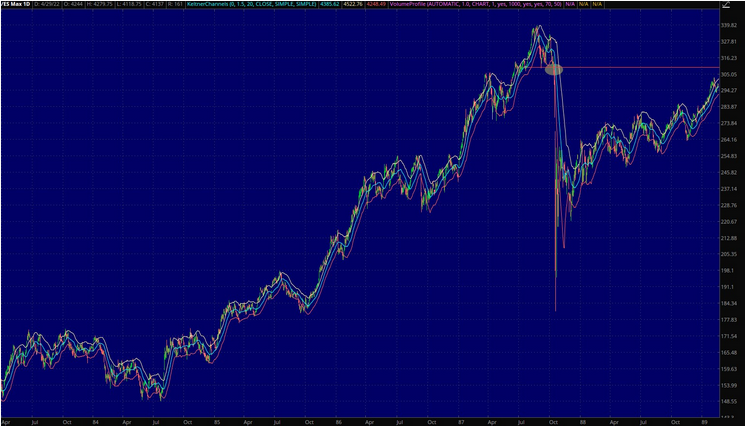

One direction my study in the bearish dark arts took was to study the history of crashes in markets. Below is chart of the 1987 crash. It wasn’t the end of the world. The market was in the midst of a rapid advance, and needed a pullback to consolidate. Investors got overly giddy, and the below crash was the result. I would call your attention though to the structure preceding the crash. An initial move down from the highs to support, a bounce to put in a lower high, then a break of key support which never stopped.

We find ourselves this weekend in a similar position with /ES. We’ve broken key support, and the Fed isn’t coming to save it. The Fed seemingly is what “should” have given traders pause on Friday, as the lead up to next week’s Fed meeting “should” have led to a respite from our current oversold condition.

That didn’t happen on Friday. As we head into Monday morning the key level for me to watch will be the level that changed my mind today…. The POC at 4161. “Buyers higher, sellers lower.”