Market Overview: S&P 500 Emini Futures

The market formed a weekly Emini micro wedge. The bears need to create a strong entry bar with follow-through selling to convince traders that they are at least temporarily back in control. If the market trades lower, the bulls want the pullback to form a higher low or a double-bottom bull flag with the May 31 or the April 19 low.

S&P 500 Emini Futures

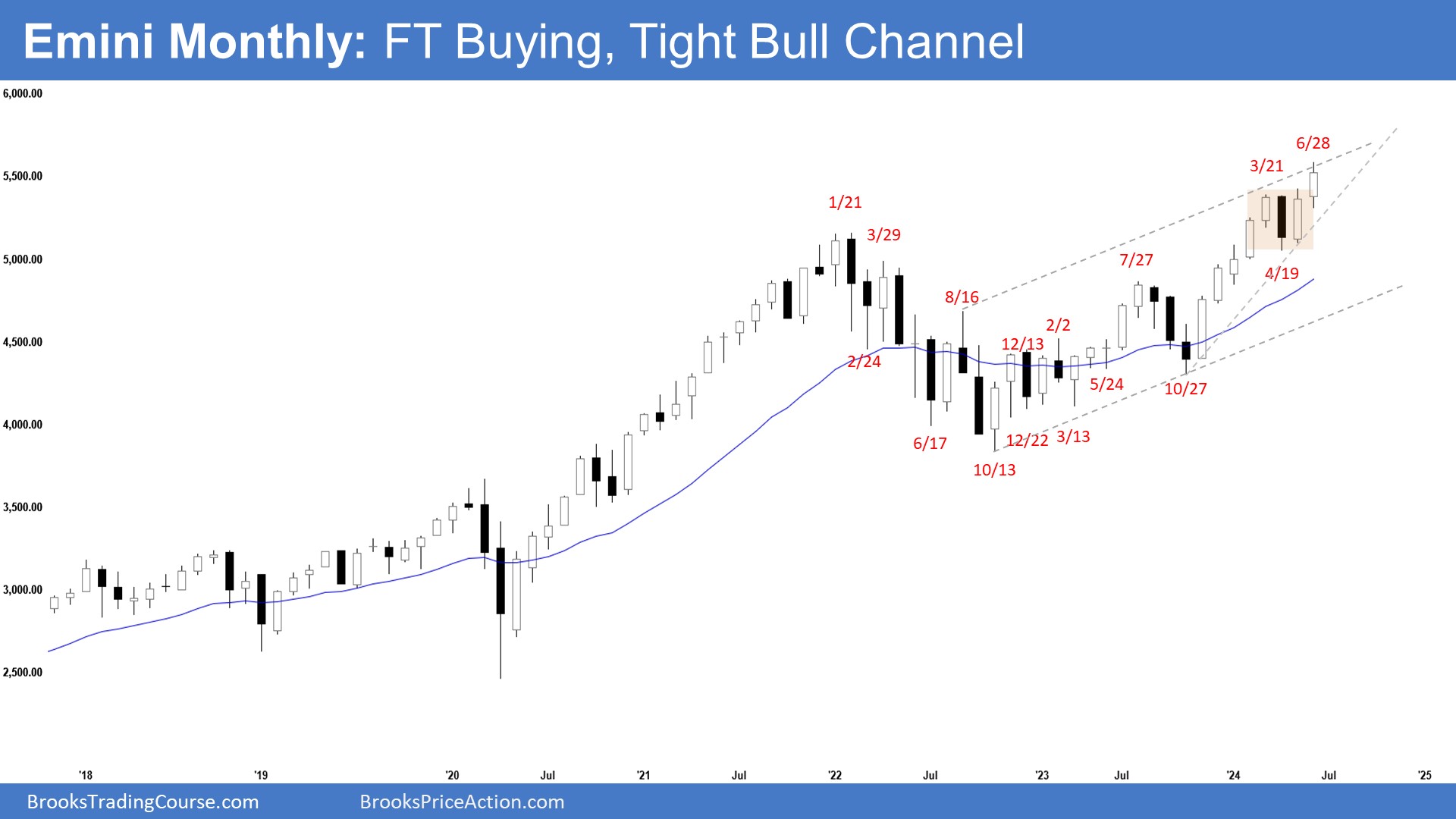

The Monthly Emini Chart

- The June monthly S&P 500 Emini candlestick was a bull bar closing in its upper half with a prominent tail above.

- Last month, we said that the odds slightly favor the market to trade at least a little higher. Traders will see if the bulls can create another breakout into new all-time high territory or will the market trade slightly higher but stall around the prior all-time high area.

- The bulls got a strong rally starting in October in the form of a tight bull channel.

- They hope that the market has entered a broad bull channel phase which will last for many months.

- They want another strong leg up completing the wedge pattern with the first two legs being July 27 and March 21. The third leg up is currently underway.

- If there is a pullback, the bulls want it to be sideways and shallow (filled with weak bear bars, bull bars, doji(s) and overlapping candlesticks).

- They want the pullback to form a higher low or a double-bottom bull flag with the April 19 low.

- They want the 20-month EMA or the bull trend line to act as support.

- The bears want a reversal from a higher high major trend reversal and a large wedge pattern (July 27, March 21, and June 28).

- They see the last 3 sideways candlesticks (Mar, Apr, and May) as forming a possible final flag of an extended rally.

- They see a possible blow-off top forming and hope to get a deep pullback within a few months.

- The problem with the bear’s case is that they have not yet been able to create credible bear bars (strong bear bars with follow-through selling).

- They will need a strong reversal bar or a micro double top before they would be willing to think to sell aggressively.

- Since June was a bull bar closing in its upper half, it is a buy signal bar for July. It is not a strong sell signal bar.

- Traders will see if the bulls can create another breakout into new all-time high territory in July or will the market start to stall around the current levels and begin the pullback phase?

- The rally has lasted a long time and is slightly climactic.

- Traders are looking for signs of profit-taking in the months ahead.

- The bears need to create strong bear bars to indicate that they are at least temporarily back in control. They haven’t been able to do so yet.

- Odds favor any pullback to be minor.

The Weekly S&P 500 Emini Chart

- This week’s Emini candlestick was a bear doji closing near its low with a long tail above.

- Last week, we said that traders will see if the bulls can continue to create follow-through buying or will the market start to stall around the current levels and the bears start to get some bear bars.

- The market was sideways for most of the week but rallied on Friday making a new high. However, the market reversed to close the week with a bear body.

- The bulls hope that the rally will lead to months of sideways to up trading (broad bull channel). They hope that the broad bull channel phase has begun.

- They want to get another strong leg up completing the wedge pattern with the first two legs being July 27 and March 21. The third leg up is currently underway.

- If the market trades lower, they want the pullback to form a higher low or a double-bottom bull flag with the May 31 or the April 19 low.

- They want the 20-week EMA or the bull trend line to act as support.

- The bears want a reversal from a higher high major trend reversal, a wedge pattern (Jul 27, Mar 21, and Jun 28), and a trend channel line overshoot.

- They also see a micro wedge (Jun 12, Jun 21, and Jun 28) and a micro double top (Jun 21 and Jun 28). The odds of a minor pullback are increasing.

- They see the sideways trading range in the last 3 weeks of May as a possible final flag of the rally.

- They want a TBTL (Ten Bars, Two Legs) pullback trading far below the 20-week EMA.

- At the very least, they want a retest of the April 19 low, even if it forms a higher low.

- They need to create a strong entry bar next week with follow-through selling to begin the pullback phase.

- Since this week’s candlestick is a bear doji closing near its low, it is a sell signal bar for next week.

- The bears need to create a strong entry bar with follow-through selling to convince traders that they are at least temporarily back in control.

- Traders will see if the bears can create a strong entry bar or will the market trade slightly lower but lack follow-through selling.

- For now, any pullback is likely to be minor and not immediately lead to a bear trend.

- The move is becoming slightly climactic and overbought. Traders are looking for reasons to take profits off the table.

- If the bears can create a strong entry bar with subsequent follow-through selling, we may start to see a deeper pullback form towards the April 19 low or the 20-week EMA.

- Moving forward, if the market has entered a broad bull channel or a trading range phase, traders should expect more two-sided trading.