While still trading in a tight range, stock bulls are making steady progress on a daily basis. The slow grind higher just goes on, regardless of a daily weakening in the advance-decline line or advance-decline volume, or the VIX attempting to rise yesterday. The bulls better tread with a tight stop-loss regardless of the credit market signs, though.

The analyses in the coming few days will be briefer than you're used to from me, but rest assured that behind the scenes, I am looking at the very same broad set of charts that power my trading decisions. For business reasons related to your Stock Trading Alerts, I want to thank you for your patience before the number of charts presented comes roaring back later this week.

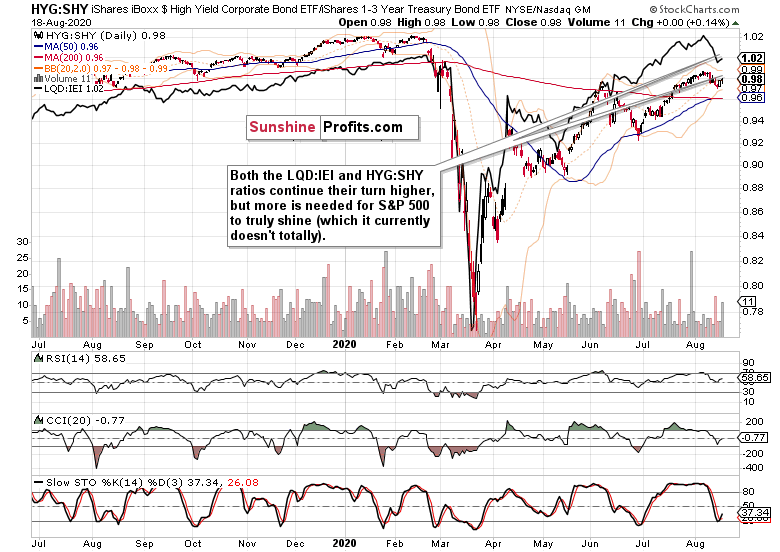

These are the two charts I picked as key for today:

S&P 500 in the Short-Run

First, it's the daily chart perspective (charts courtesy of http://stockcharts.com ):

The caption says it all – it's one thing to be building a base, and lacking the strength to break higher with resounding force. Judged by this chart alone, things could go both ways. Considering the many charts on my radar screen, a move higher is still the favored direction to go next.

The Credit Markets' Point of View

Both leading credit market ratios – high-yield corporate bonds to short-term Treasuries (HYG:SHY) and investment-grade corporate bonds to longer-dated Treasuries (LQD:IEI) - have again risen yesterday. So far, the turnaround has been relatively modest, yet it took a little pressure off the sizable relative extension in stocks vs. the HYG:SHY ratio.

When I look at long-term Treasuries (TLT ETF), odds are that corporate bonds have likewise stabilized in the short run. The corporate junk bonds to all corporate bonds (PHB:$DJCB) are also clinging near their Monday's highs, yet have run into headwinds yesterday. In short, the renewed upswing in corporate bonds is still relatively fragile, as also the JNK ETF (NYSE:JNK) chart illustrates.

Hence, the call to be still cautious, and cautiously bullish at the same time.

Summary

Summing up, the S&P 500 upswing still has higher odds of continuing than not, and the reasons go beyond the nascent turnaround in the credit markets. Smallcaps and emerging markets aren't painting a picture of caution (they're broadly in line with the S&P 500 short-term move), yet I am keeping a close eye on the dollar. Is its break below the July and August lows for real? If not, we can look for a return of risk-off sentiment that wouldn't leave stocks unscathed.

But the key move yesterday happened in copper as it broke higher from its flag formation. That's a vote in favor of both the economic recovery and the stock upswing to continue, whatever its birthing troubles of the moment.