A Tuesday selloff through multiple supports including 2896.75 down to 2888.25, but to then rebound from here to hold onto upside forces from Monday’s rally that built on Friday’s strong recovery through key 2950.5 (that shifted the intermediate-term outlook back to a neutral range), just keeping the bias higher Wednesday.

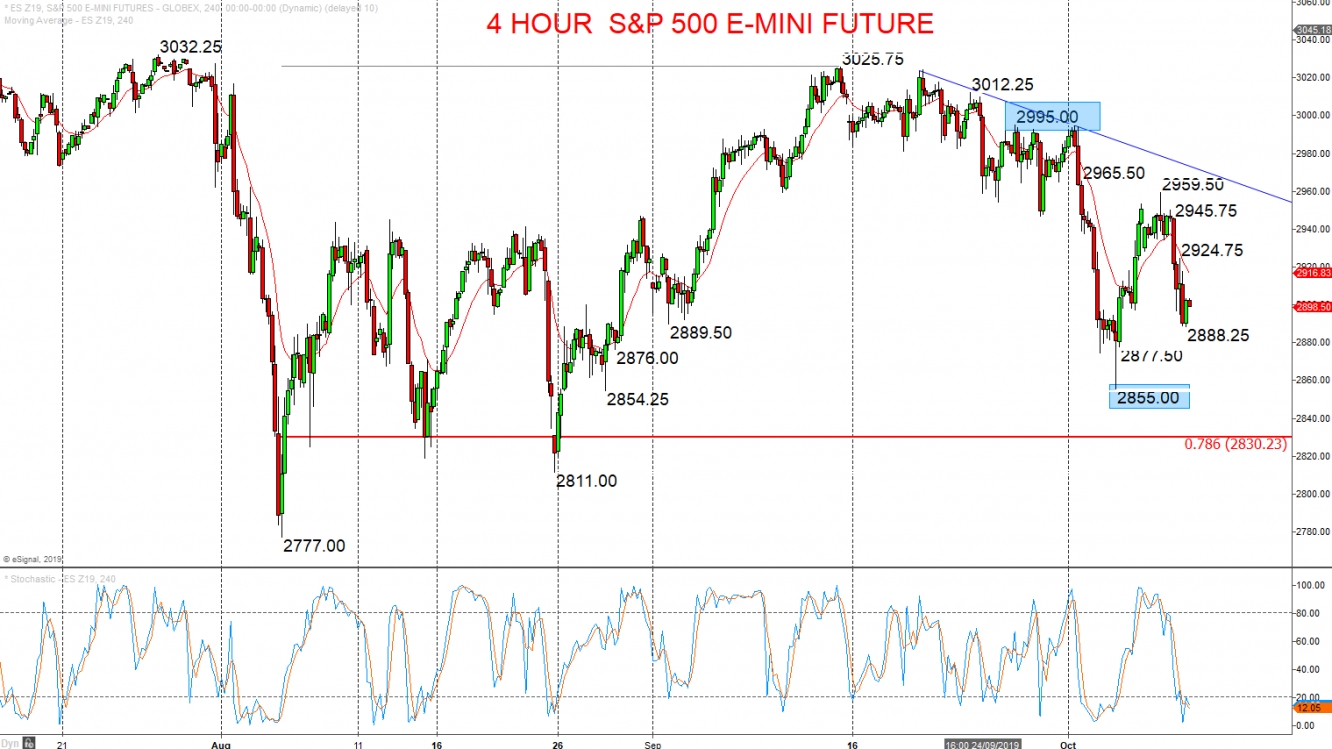

The early October strong recovery shifted the intermediate-term outlook back to a broader range, we see as 2995.0 to 2855.0.

For Today:

· We see an upside bias for 2909/0 and 2924.75; break here aims for 2945.75, then maybe towards 2959.5.

· But below 2888.25 opens risk down to 2877.5 and 2864/63, maybe key 2855.0.

Intermediate-term Range Breakout Parameters: Range seen as 2995.0 to 2855.0.

· Upside Risks: Above 2995.0 sets an intermediate-term bull trend to aim for 3025.75/3032.35, 3050.0 and 3095.5.

· Downside Risks: Below 2855.0 sees an intermediate-term bear trend to target 2811.0 and 2777.0.