S&P Emini pre-open market analysis

Emini daily chart

- The Emini rallied yesterday after the bears formed 6 consecutive bear bars on the daily chart.

- The odds are there are sellers above last Friday’s high, the market is at major support, the 5,000 big round number. This increases the odds of a deep pullback.

- The bears who sell above last Friday’s high must be ready for a deep pullback and willing to scale in higher. Most traders are probably better off waiting to sell after a few legs sideways to up.

- Because the daily chart has been in a tight bull channel since January, the odds favor the current selloff leading to a trading range and not a bear trend.

- The odds favor a second leg down after the two-week selloff. However, the market has been in the middle of the tight bear channel since January. This will increase the risk of a deep pullback, possibly up to the midpoint selloff that ended last Friday.

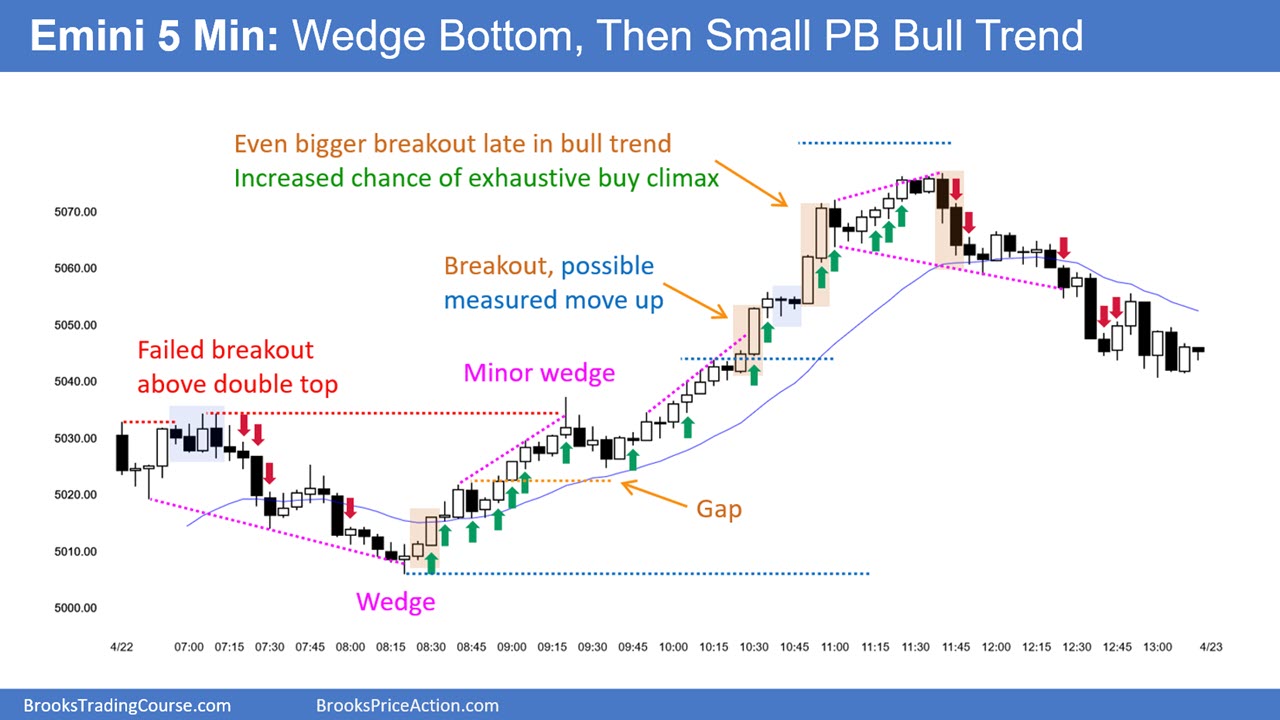

Emini 5-minute chart and what to expect today

- The Globex market was sideways and up for most of the overnight price action.

- The rally last Friday formed a deep pullback, and the odds favored a retest of the highs, which is likely to happen today.

- This means that yesterday’s high will likely act as resistance and lead to profit-taking by the bulls and bear selling to go short.

Yesterday’s Emini setups

Here are reasonable stop entry setups from yesterday. I show each buy entry bar with a green arrow and each sell entry bar with a red arrow. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a near 4-year library of more detailed explanations of swing trade setups (see Online Course/Bitcoin (BTC) Daily Setups). Encyclopedia members get current daily charts added to Encyclopedia.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter. These therefore are swing entries.

It is important to understand that most swing setups do not lead to swing trades. As soon as traders are disappointed, many exit. Those who exit prefer to get out with a small profit (scalp), but often have to exit with a small loss.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.